This post was originally published on this site

When a key part of the U.S. bond market starts shrugging off new Federal Reserve interest rate hikes or tough talk on inflation, it’s probably time to buy stocks, according to James Paulsen, the Leuthold Group’s chief investment strategist.

To inform his call, Paulsen looked at the relationship between the 10-year Treasury yield

TMUBMUSD10Y,

and the S&P 500 index

SPX,

in several past Fed tightening cycles. He found five periods, since the mid-1980s, when the benchmark 10-year yield peaked, signaling bond investors “blinked,” before the Fed stopped raising its policy interest rate.

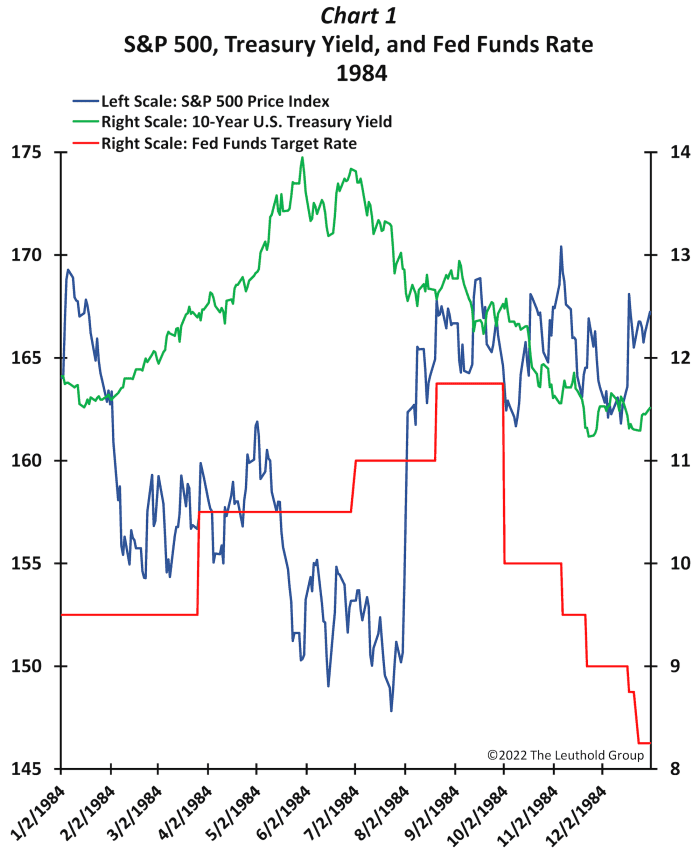

In 1984, once the 10-year yield topped out near 14% in June (see chart), it then took only a few more weeks for the S&P 500 index to bottom. The S&P 500 then surged in August, even before the central bank ended its tightening cycle with the fed-funds rate near 11.5%.

Bond investors blinked in 1984 months before the Fed stopped raising rates and stocks surged higher.

Leuthold Group

A similar patterned emerged in the tightening cycles of 1988-1990, 1994-1995 and it 2018-2019, with a peak 10-year yield signaling the Fed’s eventual end of rate hikes.

“Everyone wants to know when the Fed will stop raising the funds rate,” Paulsen wrote, in a Tuesday client note. “However, as these historical examples demonstrate, perhaps the more appropriate question for stock investors is: When will the 10-year Treasury yield blink?”

The benchmark 10-year yield matters to financial markets because it informs prices for everything from mortgages to corporate debt. Higher borrowing costs can slam the brakes on economic activity, even provoking a recession.

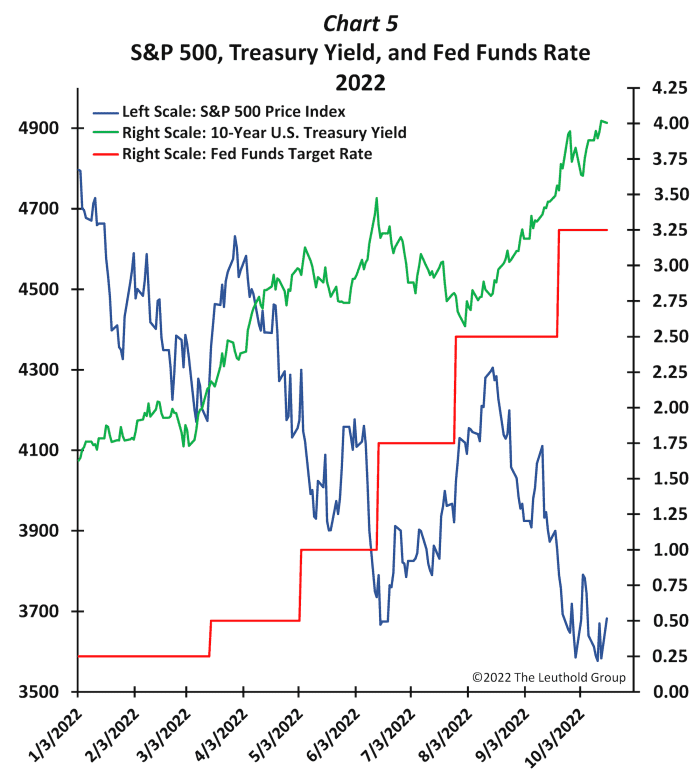

Despite the 10-year’s surge in 2022 (see below), it has kept climbing in each of the past 11 weeks, hitting 4% earlier this week, or its highest since 2008, according to Dow Jones Market Data.

The 10-year Treasury rate hasn’t blinked yet

Leuthold Group

“The Fed may soon attempt to raise the funds rate to 4%, 4.5%, or even 5%,” Paulsen warned. “Most importantly for investors, the stock market typically bottoms not once the Fed stops raising rates but when the bond market blinks.”

Stocks closed higher Tuesday following a batch of strong corporate earnings, with the Dow Jones Industrial Average

DJIA,

up more than 300 points, the S&P 500 advancing 1.1% and the Nasdaq Composite Index

COMP,

ending 0.9% higher, according to FactSet.

Read: Snapchat is about to play the canary in social media’s coal mine

Related: How high will rates go? This chart shows expectations for central bank policy rates.