This post was originally published on this site

The S&P 500 index has declined by 21% year to date, but strategists at Goldman Sachs think it’s still too expensive.

The large-cap index started the year with a price-to-earnings (P/E) ratio of 21, a 91st percentile valuation since 1980, Goldman Sachs’ strategists led by David Kostin, chief U.S. equity strategist, wrote in a note dated Oct. 14. While the P/E ratio has since dropped to 15.8, it still stands at the 66th percentile.

“Despite elevated recession risk, geopolitical tension, and a generally murky macro outlook, the earnings yield gap — a common proxy for the equity risk premium — trades close to the tightest levels in 15 years,” the strategist team wrote. “Relative to both real 10-year Treasury yields

TMUBMUSD10Y,

and investment-grade corporate bonds, the S&P 500

SPX,

index valuation ranks above the 75th percentile since 1980.”

However, Goldman’s strategists still see opportunities in four areas of the U.S. equity market where investors can look for bargains.

Value and short duration stocks

Compared with long duration stocks, which are particularly sensitive to shifting interest rates, value and short duration stocks look more attractive, said Kostin and the team. “Provided that interest rates remain elevated, we expect long duration stocks will continue to face stronger valuation and performance headwinds than their short duration peers,” they wrote.

Both valuations and the current macro environment also tend to favor value stocks over growth stocks, as the gap in valuation between the most and least expensive stocks in the S&P 500 remains “extraordinarily wide,” according to Kostin.

Profitable growth stocks

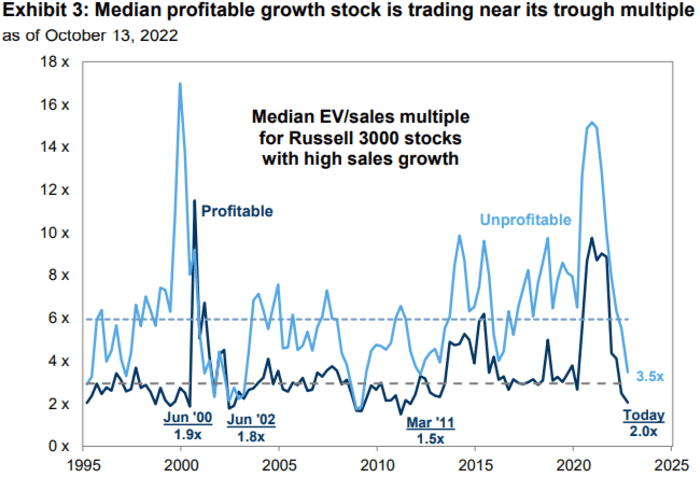

However, the sharp selloff has created opportunities for some profitable growth stocks, which are now trading only slightly above the EV/sales valuation levels that have marked troughs in the last 30 years (see chart below).

“While higher rates and the risk of recession pose headwinds to growth stocks in the near term, the low valuations of some growth stocks could represent an opportunity for stock pickers with sufficiently long investment horizons,” wrote Goldman’s strategists.

SOURCE: GOLDMAN SACHS GLOBAL INVESTMENT RESEARCH

Cyclinals

Some stocks in cyclical sectors are trading at depressed valuations even in the event of a recession, per Goldman’s analysis.

“If recession risk continues to rise and earnings estimates continue to fall, then cyclicals will likely continue to lag,” said strategists. “However, substantial valuation dispersion exists among cyclicals. Investor fears of recession have weighed on the multiples of certain cyclical stocks meaning the distribution of risks is becoming favorable even despite the elevated risk of economic downturn.”

Small-cap stocks

Small-cap stocks trade at much more attractive valuations than large-caps, said Kostin and the team. For example, the S&P Small Cap 600

SML,

traded at a P/E ratio of 10.8, the cheapest level in nearly 30 years, according to Dow Jones Market Data.

However, the multiple, which is 32% lower than the main index, reflects concern about small-cap earnings, which are “extremely elevated compared with pre-COVID profitability and could face more downside in recession than their larger-cap peers,” the strategists wrote.

U.S. stocks rallied on Tuesday as investors weighed another round of corporate earnings reports after a volatile week of trading. The S&P 500 climbed 2.3%, while the Dow Jones Industrial Average

DJIA,

was up 2% and the Nasdaq Composite advanced 2.8%.