This post was originally published on this site

Rules of thumb in investing appear to no longer apply in the carnage of 2022 in financial markets.

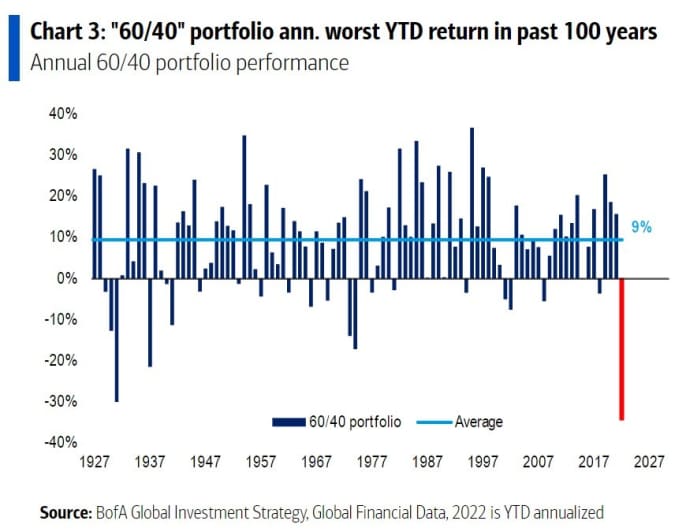

Advocates for the 60/40 portfolio split, designed to capture the upside of stocks, but offer investors downside protection in bonds, have seen the classic investment strategy collapse this year in striking fashion.

Rather than producing its 9% average return, the strategy instead has delivered a thundering minus 30% return on the year-to-date (see chart), marking its worst stretch in about a century, according to BofA Global.

The 60/40 strategy’s collapse of 2022 is worst in roughly 100 years

BofA Global

That makes roughly the worst return for the 60/40 strategy since the aftermath of 1929, according to BofA Global.

Financial markets have convulsed this year as the Federal Reserve has worked to dramatically raise rates to fight inflation that’s been stuck near a 40-year high for longer than expected.

A hot reading on inflation on Thursday led to a dramatic day of upheaval, what Rick Rieder, chief investment officer for global fixed income at BlackRock Inc.,

BLK,

called one of the “craziest” days in financial markets, in an interview with MarketWatch’s Christine Idzelis.

Rieder also said the classic 60/40 portfolio allocation, with the biggest slice in stocks and a smaller share in bonds, no longer makes sense. Given today’s higher bond yields, particularly with the 2-year Treasury yield

TMUBMUSD02Y,

at 4.5% he thinks the 60% allocation should go to bonds instead.

The sharp rise in the 10-year Treasury rate

TMUBMUSD10Y,

this year to about 4% has hammered returns in the bond market and ratched up borrowing costs for households and corporations already reeling from high inflation.

Stocks were losing further ground on Friday, with the S&P 500

SPX,

down about 1.7% at last check, but off roughly 24% on the year-to-date. The Dow Jones Industrial Average

DJIA,

was off 250 points, but down roughly 18% on the year and the Nasdaq Composite Index

COMP,

was trading 2.3% lower Friday and down 33.5% for the year.

Also read: Why the 60/40 model suddenly has life again