This post was originally published on this site

Investors have been battered by China’s economic slowdown, due in large part to a stubborn strain of COVID-19 that has rippled through the country this year which forced hundreds of millions of people into lockdowns, coupled with a debt-laden property sector, and a restrictive investment environment for foreign investors.

But investors may get some clues from the twice-a-decade Communist Party congress slated to start on Oct.16, where Xi Jinping, China’s top leader, is expected to secure his third five-year term as the president of the country and the chairman of the military.

The congress is set to present a road map for the next five years, including clues on how to spur a recovery in Chinese economic activity, signs of a meaningful pivot away from the zero-COVID approach, and plans to stabilize the embattled property sector.

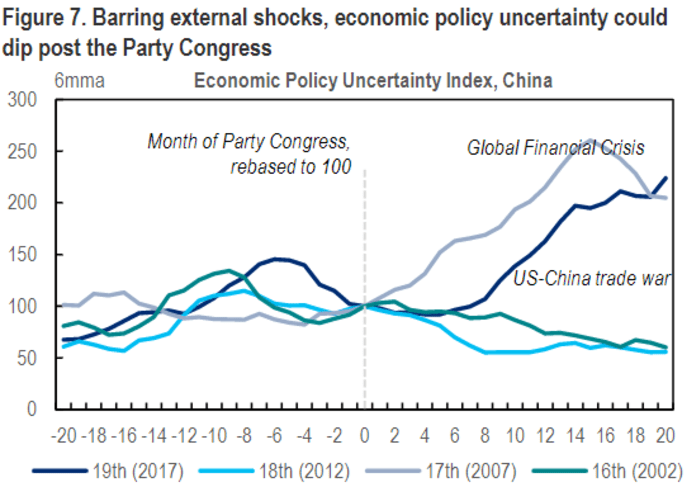

In the past the congress has often reduced policy uncertainty and allowed Beijing to refocus on economic development, said Xiangrong Yu, China chief economist at Citi Research, in a note. The economic policy uncertainty index typically moderated after the leadership gathering except for the periods of the global financial crisis in 2008 and the U.S.-China trade war in 2018 (see chart below).

SOURCE: EPU, CITI RESEARCH

“2023 could be a natural window for reflections on the COVID strategy,” Citi’s economists led by Yu wrote. “In the coming months, China will continue to prepare for a reopening while optimizing the implementation of ‘dynamic zero-COVID’ policy to minimize the economic costs.”

“However, the power reshuffle provides an opportunity for the CPC leadership to think about the long term and take a pragmatic approach. With more preparation ahead, we continue to expect a meaningful change to the COVID strategy after March 2023 as our baseline,” they said.

However, markets are far from convinced. The benchmark CSI 300 Index

000300,

which tracks the top 300 large-cap stocks traded on the Shanghai and Shenzhen stock exchanges, is down 32.5% year to date, per Dow Jones Market Data. It has lost 20% since August 2021 when the “zero-COVID” policy was first introduced.

The MSCI China Index

CNUA,

has typically generated about 2% returns in the month before the Party congress in the past, the Goldman Sachs strategists said in a note dated Sept.18, but the index posted a negative return of 14.6% in September and is down 10.9% so far in October, according to Dow Jones Market Data.

Quincy Krosby, chief global strategist at LPL Financial, thinks it is a mounting concern if Xi still views his “zero-COVID” policy, which has been blamed for the slowdown of the world’s second largest economy, as a key goal for the country.

“It is increasingly perceived that he remains wedded to maintaining the strict measures and this clearly indicates that it takes precedence over economic considerations,” Krosby wrote in a note earlier this month. “Throughout China, lockdowns and quarantines have created an environment of uncertainty with regard to business planning, investing, hiring, or borrowing, not to mention anxiety for the general population.”

See: China’s real estate crisis will cause a more severe downturn in iron ore prices: Goldman Sachs

The “zero-COVID” approach also worsened the weakness in the country’s property market which left home developers unable to complete and deliver properties to buyers as many buyers refused to pay their mortgages for uncompleted apartments. The crisis was exemplified by the default of Evergrande

EGRNF,

last November, the country’s most indebted real-estate developer, along with other developers who have trouble making interest payments on time.

Citi’s Yu said the property market weakness has continued until now, while the efforts to deal with the problem are not fully coming through.

“Despite the series of recent efforts, Beijing does not seem to have come up with a holistic way to manage this single most important sector for the Chinese economy yet,” Yu and his team wrote. “How to engineer a soft landing amid the great demographic transition and guided by the ‘housing is for living not for speculation’ principle looks to be a major challenge left for the new economic leadership.”

“Much of China’s expansion in real estate domestically and abroad was fueled by enormous debt that ultimately led to bailouts and various forms of receivership by the Chinese government,” said Krosby. “Consequently, if the endemic problems of the industry are not resolved, there are fears that China could undergo its own version of the subprime mortgage collapse that engulfed markets globally 14 years ago.”

The Chinese yuan fell to a 14-year low last month, while the offshore currency has weakened 11.6%

CNYUSD,

against the U.S. dollar year to date. Chinese stock benchmarks rallied in the last trading day ahead of the congress with Hong Kong’s Hang Seng Index

HSI,

up 1.2% on Friday and Shanghai Composite

SHCOMP,

gained 1.8%. The CSI 300 rose 2.4%, according to Dow Jones Market Data.