This post was originally published on this site

Investors are bracing for some choppiness on Wall Street, with oil prices falling as growth worries rattle around the globe. That’s as the clock ticks down to CPI and the start of a earnings season later this week, and in the backdrop a war is intensifying in Europe.

Tough times don’t last, but tough investors do right? Maybe, hopefully. In any case, focusing on the distant future might offer some comfort right now.

And that’s where we’re headed with our call of the day from Citigroup, whose strategists have stock ideas to play what they expect will be one of the ten fastest-growing markets through 2040.

They are talking about the global fuel cell industry, a direct play on the green energy debate, and “reaching the part that batteries cannot.”

“Fuel cells enable both de-carbonization and energy resilience, and we see them as crucial in harder-to-abate sectors like commercial vehicles and marine,” a Citi team led by research analyst Martin Wilkie told clients in a note on Tuesday.

Their base case sees this market reaching 50 gigawatts (GW) and $40 billion by 2030, offering a compound average growth rate of more than 35% in dollar terms, with further acceleration to 500GW/$180 billion by 2040.

They admit they’re on the bullish side with these projections, and note fuel cell stocks are on average down around 70% since their January 2021 peaks .

“The fuel cell equity story has had false starts before, but we see the impetus from emissions policy as well as announced hydrogen plans as creating attractive opportunities,” said the Citi analysts, highlighting policies such as the U.S. Inflation Reduction Act, which aims at beefing up renewable energy and a recent EU move to offer more green-energy research and development subsidies.

While passenger cars were a big source of demand for the growing fuel cell market in 2021, they don’t think it can be a big competitor to battery electric. However, stationary power, such as distributed and backup power generation and heavy-duty transport, think commercial vehicles, off-road and later marine are set to become key fuel-cell markets.

U.K.-based Ceres Power

CWR,

Plug Power

PLUG,

Belgium’s Umicore

UMI,

and Japan’s Toyota

7203,

TM,

are Citi’s buy-rated stocks with high exposure to the fuel-cell theme.

Other names they mention, include Daimler Truck

DTG,

and Volvo

VOLV.B,

VOLV.A,

which are working with Germany’s Traton

8TRA,

on a joint venture called Cellcentric that aims to develop that technology for trucks, with a production goal of 2025. Others are outsourcing fuel-cell tech, such as Italy’s Iveco Group

IVG,

which has teamed up with South Korea’s Hyundai

005380,

and U.S.-based Paccar

PCAR,

with Toyota

TM,

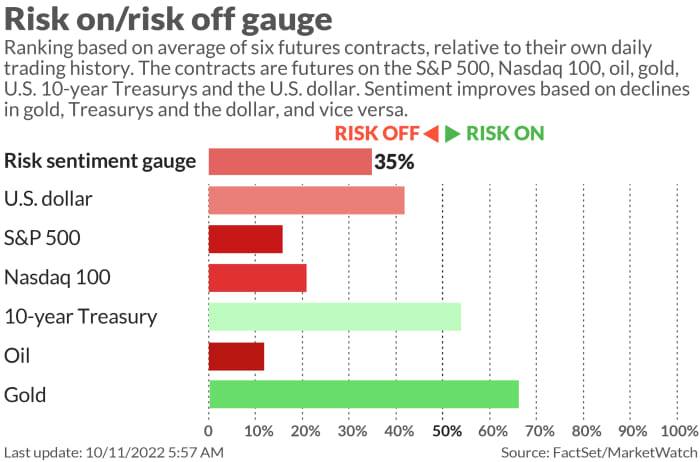

The markets

Stock futures

ES00,

NQ00,

have pared some losses, while bond yields

TMUBMUSD10Y,

TMUBMUSD02Y,

are mixed, and the dollar

DXY,

has turned lower. Oil prices

CL.1,

are also pressure.

The buzz

Shares of the world’s biggest chip maker, TSMC

2330,

fell 8% in Taiwan

Y9999,

where stocks dropped more than 4% following new limits by the U.S. imposed on exports of semiconductors and chip-making equipment to China.

The Bank of England made the second move this week to calm jittery markets, saying Tuesday it will expand its bond purchases to index-linked U.K. bond. But the program still ends Friday, something the pensions fund industry wants to see extended. Those yields

TMBMKGB-10Y,

TMBMKGB-30Y,

meanwhile, continue to creep higher.

The National Federation of Independent Business small-business index showed confidence rising in September, but inflation a nagging problem. At noon Eastern we’ll hear from Cleveland Fed President Loretta Mester.

Subscription-based private aviation company Flexjet plans to go public through a merger with SPAC Horizon Acquisition

HZON,

valuing it at $3.1 billion.

The U.S.’s third-biggest railroad union will be back at the negotiating table with employers on Tuesday, after rejecting a deal and raising the possibility of crippling strikes.

The Kremlin’s war hawks were thrilled at the devastating strikes across Ukraine on Monday. Now they want more. G-7 leaders are holding an emergency meeting to discuss the ramping up of the war.

Amazon’s

AMZN,

second Prime-Day like event kicks off Tuesday.

Best of the web

U.K. spy chief says Russians are starting to realize the cost of Putin’s war in Ukraine

India’s biodegradable bags are in demand, and reviving its industry

We are not at peace. The world needs to get ready for more sabotage

One of the greatest transfers of intergenerational wealth is coming, says head of TIAA

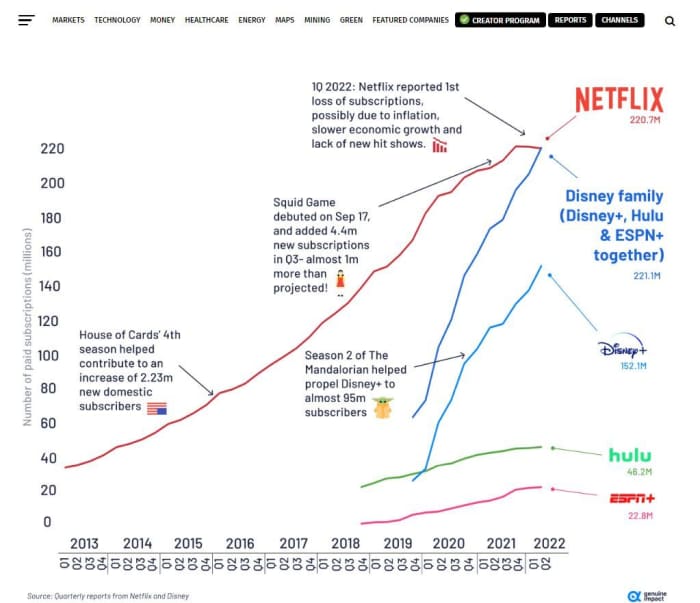

The chart

This graphic by Visual Capitalist’s Truman Du, shows Disney’s

DIS,

streaming empire — Disney+, Hulu, ESPN+ — is “giving Netflix

NFLX,

a run for its money.”

Visual Capitalist, Disney, Netflix quarterly reports

The tickers

These were the top searched tickers on MarketWatch as of 6 a.m. Eastern Time:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment Holdings |

|

AAPL, |

Apple |

|

NIO, |

NIO |

|

BBBY, |

Bed Bath & Beyond |

|

APE, |

AMC Entertainment Holdings preferred shares |

|

NVDA, |

Nvidia |

|

TWTR, |

|

|

AMD, |

Advanced Micro Devices |

Random reads

Everyone hail to this 2,560-pound pumpkin.

“Where’s Tony gone?” Supply-chain woes hit (shudder) Frosted Flakes.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.