This post was originally published on this site

Should you buy stocks now, or wait?

Timing the market has been a nagging question for investors ever since stocks began their decline by roughly 25% in January of this year. The right answer likely hinges on whether or not the Federal Reserve follows through with plans to raise its benchmark interest rate to 4.5% or higher, as market-based indicators and the Fed’s latest batch of projections anticipate.

Global markets are on edge about the possibility of an emerging-markets crisis resulting from higher interest rates and a U.S. dollar at a 20 year high, or a slump in the housing market due to rising mortgage rates, or the collapse of a financial institution due to the worst bond market chaos in a generation.

See: A rampaging U.S. dollar is wreaking havoc in markets: Why it’s so hard to stop.

Fears that the Fed could cause something in the global economy or financial system to “break” have inspired some to question whether the Fed can successfully whip inflation by hiking interest rates by the most aggressive pace in decades without causing collateral damage.

The Fed’s efforts are already whipsawing markets almost on a daily basis.

Ongoing volatility in markets makes it difficult to ascertain when buying opportunities might arrive, said Bill Sterling, the global strategist at GW&K Investment Management.

The peak in interest rates matters for stocks

A look back at how the Fed has managed monetary policy compared with its own projections offers good reason to be skeptical of expectations surrounding when the Fed will shift back toward a policy of monetary easing.

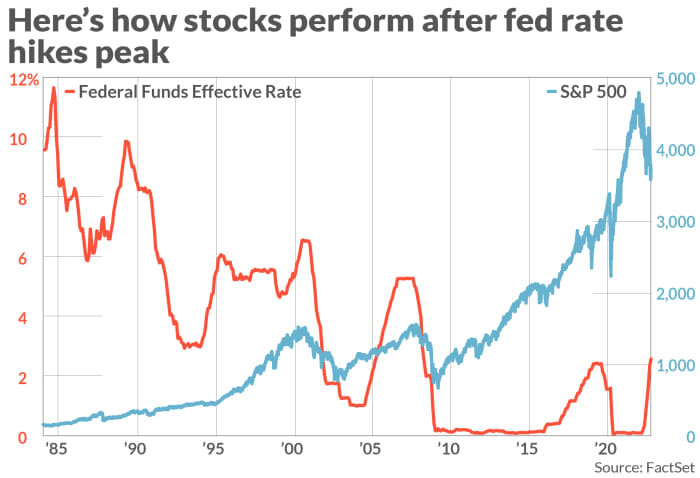

It’s important to remember that stocks have often reacted positively when the Fed has shifted back to cutting interest rates. Dating back to August 1984, the S&P 500 index has risen on average more than 17% in the 12 months (see chart) that followed a peak in the fed-funds rate range, according to Sterling at GW&K and Fed data.

FEDERAL RESERVE, FACTSET

The chart also shows the Nasdaq Composite and Dow Jones Industrial Average rose sharply in the year after the Fed’s brought interest rates to their peak levels in prior monetary policy tightening cycles over roughly the past 40 years.

The same holds true for bonds, which have historically outperformed after the Fed’s interest rate hiking-cycle reached its apex. Sterling said yields historically retreated by, on average, one-fifth of their value, in the 12 months after Fed benchmark rates peaked.

Still a factor that differentiates modern times from the persistent inflation of the 1980s is the elevated level of geopolitical and macroeconomic uncertainty. As Tavi Costa, portfolio manager at Crescat Capital, said, the weakening U.S. economy, plus fears of a crisis breaking out somewhere in global markets, are complicating the outlook for monetary policy.

But as investors watch markets and economic data, Sterling said that “backward-looking” measures like the U.S. consumer-price index and the personal-consumption expenditures index, aren’t nearly as helpful as “forward looking” gauges, like the breakeven spreads generated by Treasury inflation-protected securities, or survey data like the University of Michigan inflation expectations indicator.

“The market is caught between these forward looking and encouraging signs that inflation could come off in the next year as seen in the [Treasury inflation-protected securities] yields,” Sterling said.

Stocks kicked off the past week and fourth quarter with a two-day rally after major indexes ended Sept. 30 at their lowest since 2020. Those gains faded over the course of the week as Fed officials and economic data undercut investor expectations around a potential Fed “pivot” away from its program of aggressive interest-rate increases. Stocks ended the week higher, but with the Dow Jones Industrial Average

DJIA,

up just 2% from its Sept. 30 low, while the S&P 500

SPX,

trimmed its weekly rise to 1.5% and the Nasdaq Composite

COMP,

advanced just 0.7%.

Read: Dashed hopes for a Fed pivot are morphing into a sense of dread in financial markets

Minneapolis Fed President Neel Kashkari and Fed Governor Christopher Waller have said that policy makers have no intention of abandoning their interest-rate hiking plan, in what were only the latest round of hawkish comments made by senior Federal Reserve officials.

However, some on Wall Street are paying less attention to what senior Fed officials are saying and more attention to market-based indicators like Treasury spreads, relative moves in sovereign bond yields, and credit-default spreads, including those of Credit Suisse Inc.

CS,

Costa at Crescat Capital said he sees a growing “disconnect” between the state of markets and the Fed’s aggressive rhetoric, with the odds of a crash growing by the day.

Because of this, he’s waiting for “the other shoe to drop,” which could be an important turning point for markets.

He anticipates a blowup will finally force the Fed and other global central banks to back off their policy-tightening agenda, like the Bank of England briefly did last month when it decided to inject billions of dollars of liquidity into the gilts market — although the BoE is preparing to continue raising interest rates to battle inflation

But before that happens, he expects trading in fixed-income to become as disorderly as it was during the spring of 2020, when the Fed was forced to intervene to avert a bond market collapse at the onset of the coronavirus pandemic.

“Just look at the differential between Treasury yields compared with junk-bond yields. We have yet to see that spike driven by default risk, which is a sign of a totally dysfunctional market,” Costa said.

See: Cracks in financial markets fuel debate on whether the next crisis is inevitable

A simple look in the rearview mirror shows that the Fed’s plans for interest-rate hikes rarely pan out like the central bank expects. Take the last year for example.

The median projection for the level of the fed-funds rate in September 2021 was just 30 basis points one year ago, according to the Fed’s survey of projections. Turns out, those projections were off by nearly three whole percentage points.

“Don’t take the Federal Reserve at its word when trying to anticipate the direction of Fed policy over the next year,” Sterling said.

Looking ahead to next week

Looking ahead to next week, investors will receive some more insight into the state of the U.S. economy, and, by extension, the Fed’s thinking.

U.S. inflation data will be front and center for markets, with the September consumer-price index due on Thursday. On Friday investors will receive an update from the University of Michigan’s on consumer sentiment survey and its inflation expectations survey.

The inflation data will be scrutinized especially closely as investors grapple with signs that the U.S. labor market may indeed be starting to weaken, according to Krishna Guha and Peter Williams, two U.S. economists at Evercore ISI.

The September jobs report on Friday showed the U.S. economy gained 263,000 jobs last month, with the unemployment rate falling to 3.55 to 3.7%, but job growth slowed from 537,000 in July, and 315, 000 in August.

But will inflation show signs of peaking or slowing its rise? Many fear that the crude oil production-quota cuts imposed by OPEC+ earlier this week could push prices higher later in the year.

Meanwhile, the Fed funds futures market, which allows investors to place bets on the pace of Fed interest rate hikes, anticipates another 75 basis-point rate hike on Nov. 3.

Beyond that, traders expect the fed-funds rate will top out in February or March at 4.75%, according to the Fed’s FedWatch tool.