This post was originally published on this site

This week Freddie Mac said the average interest rate on a 30-year mortgage loan in the U.S. had climbed to 6.70% from 6.29% the week before and 6.02% two weeks ago. The average rate a year ago was 3.01%.

Would-be sellers who have low-rate mortgage loans are reluctant if it means they need to take out a new loan to fund their next home. Would-be buyers are forced out of the market, as the monthly principal and interest payment for a new 30-year loan, based on Freddie Mac’s figures, has increased 53% from a year ago.

Home-sale contracts are being canceled at a record pace in some areas.

But these factors could lead to a buyer’s market in 2023 if prices plunge. Here are the areas economists expect to see the largest home price declines.

The strong dollar and the stock market

Khaled Desouki/Agence France-Presse/Getty Images

The dollar has strengthened as the Federal Reserve has taken the lead among central banks in raising interest rates. This is reverberating across the world, making it more costly for countries to make interest payments on dollar-denominated debt and increasing the cost of any commodity traded in dollars.

The rising dollar lowers prices on imported goods for Americans and can also lower their international travel costs. But Michael Wilson, Morgan Stanley’s chief equity strategist, warns that earnings for the S&P 500

SPX,

would decline as a direct result of the strong dollar and called the current foreign-exchange backdrop an “untenable situation” for the stock market.

On the other hand: Companies are trying to blame weak earnings on the strong U.S. dollar, but that’s a lame excuse

This is what happens when bearish sentiment runs high

Michael Brush interviews David Baron, co-manager of the Baron Focused Growth Fund

BFGFX,

who describes opportunities cropping up as institutional investors dump stocks. He also explains his winning long-term strategy, which has included a very long-term investment in Tesla Inc.

TSLA,

A a positive sign for the stock market: These 12 stocks have seen strong insider buying

Time to buy bonds?

When interest rates rise, bond prices fall. But it also means that if you have money to put to work, bond yields have become much more attractive.

Khuram Chaudhry, a European equity quantitative strategist at JPMorgan in London, makes the case for buying bonds now.

What about preferred stocks?

Getty Images/iStockphoto

Preferred stocks feature stated dividend yields and prices that move the same way bond prices do. That means prices for many issues are now heavily discounted to face value and that current yields are much higher than they were at the end of 2021. Here’s an in-depth guide on how to research preferred stocks and make your own selections.

Related: 22 dividend stocks screened for quality and safety

The problem with macro market projections

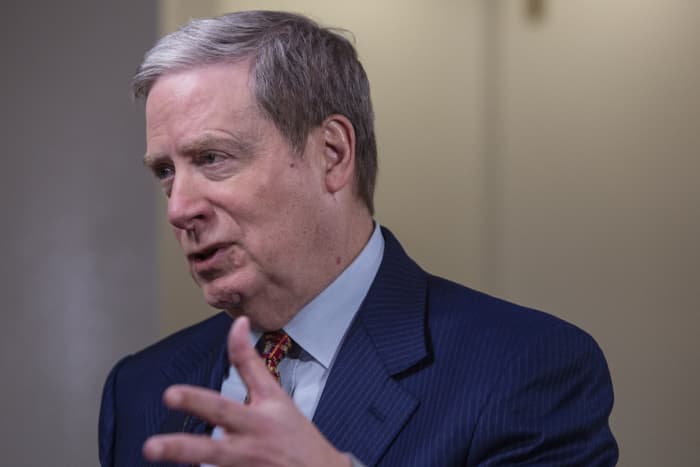

Stanley Druckenmiller predicted a “hard landing” in 2023 for the U.S. economy while speaking at CNBC’s Delivering Alpha Investor Summit on Sept. 28.

Bloomberg

Stanley Druckenmiller predicted a U.S. recession in 2023 as a result of monetary policy tightening by the Federal Reserve. That may not be much of a stretch, considering that the U.S. economy contracted during the first half of 2022, according to revised GDP figures from the Bureau of Economic Analysis.

But investors should be careful — macro forecasts often turn out to be incorrect, Mark Hulbert warns.

More on stocks: It’s the worst September for stocks since 2008. What that means for October.

Recessions and your retirement plans

Getty Images

Alessandra Malito has advice on how retirees and people planning for retirement can prepare for tough economic times.

Investors tremble and a central bank scrambles

The Bank of England’s headquarters.

Agence France-Presse/Getty Images

After the new U.K. government of Prime Minister Liz Truss announced a massive tax cut along with a new spending program to help counter rising fuel costs and new borrowing, the pound hit a new low against the dollar on Sept. 26 as investors and money managers panicked and sold-off U.K. government bonds. Steve Goldstein explains how and why the Bank of England came tot the rescue.

A closer look at reverse mortgages

Getty Images/iStockphoto

Beth Pinsker digs deeply to explain how to use a reverse mortgage as a financial planning tool.

Poking a little fun at Elon Musk

Getty Images

After Tesla CEO Elon Musk said the upcoming Cybertruck would be sufficiently waterproof to “serve briefly as a boat,” the San Francisco Bay Ferry offered this advice to patrons.

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.