This post was originally published on this site

The Dow Jones Industrial Average couldn’t outrun the bear.

The blue-chip gauge on Monday fell 329.60 points, or 1.1%, to close at 29,260.81. That left the Dow

DJIA,

20.5% below its Jan. 4 record finish of 36,799.65. A pullback of 20% or more is widely considered to mark a bear market.

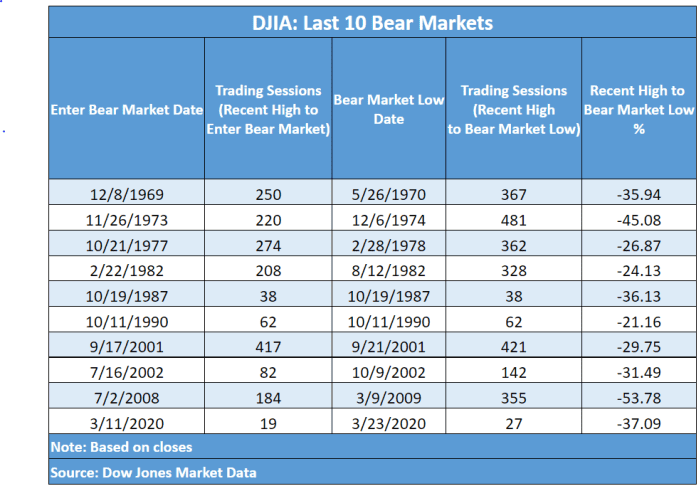

The Dow last fell into a bear market in early 2020 as the COVID-19 pandemic all but shut down the global economy and sparked financial chaos. The Dow dropped 37.1% from its Feb. 12, 2020, peak to its bear-market low on March 23, 2020. It exited the bear — ending 20% above its bear-market low — on March 26, 2020.

According to Dow Jones Market Data, the average Dow bear market sees a peak-to-trough decline of 35.5% and a median decline of 35.9%.

Dow Jones Market Data

Monday marked the 182nd trading day since the Dow’s Jan. 4 peak. On average, past bear markets have taken 133 trading days to fall from their high to enter bear status, or a median of 114 trading days, according to Dow Jones Market Data. To reach bear-market lows, on average it’s taken 272 trading days from the recent high, or a median of 197 trading days.

The S&P 500

SPX,

confirmed its entry into a bear market in June, falling more than 20% from its Jan. 3 record. The large-cap benchmark on Monday fell 38.19 points, or 1%, to close at 3,655.04, taking out its previous 2022 closing low set on June 16, for its lowest close since Dec. 14, 2020.

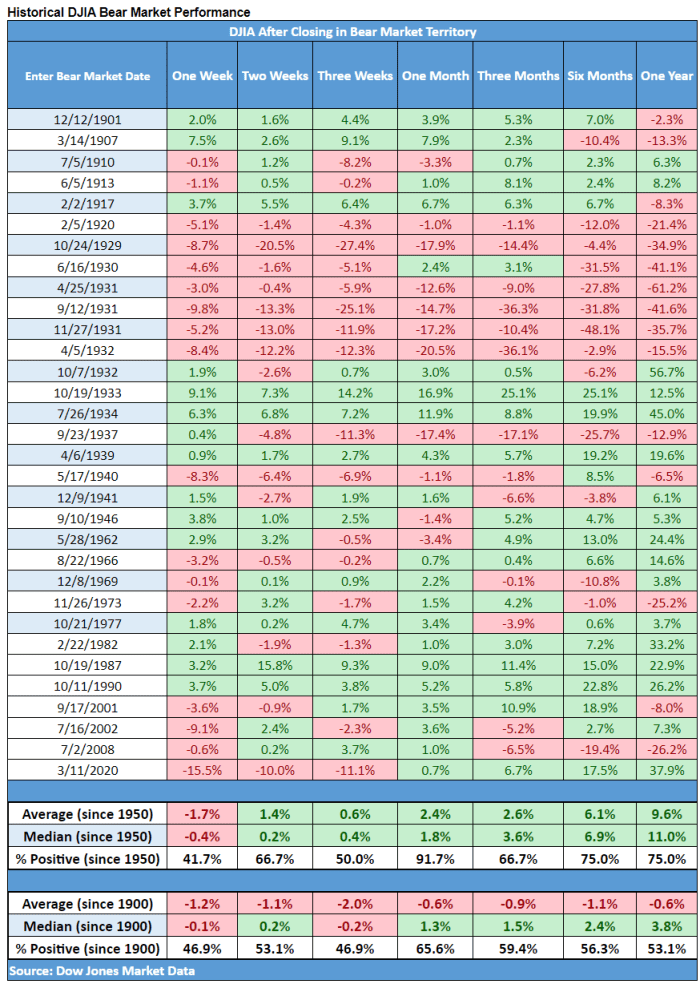

According to Dow Jones Market Data going back to 1950, the average and median returns for the Dow were negative in the week after entering a bear market, while average and median returns for periods up to one year later were positive.

The table below offers a more detailed look at performance going back to 1900:

Dow Jones Market Data