This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXMPEB280F6_M.jpg

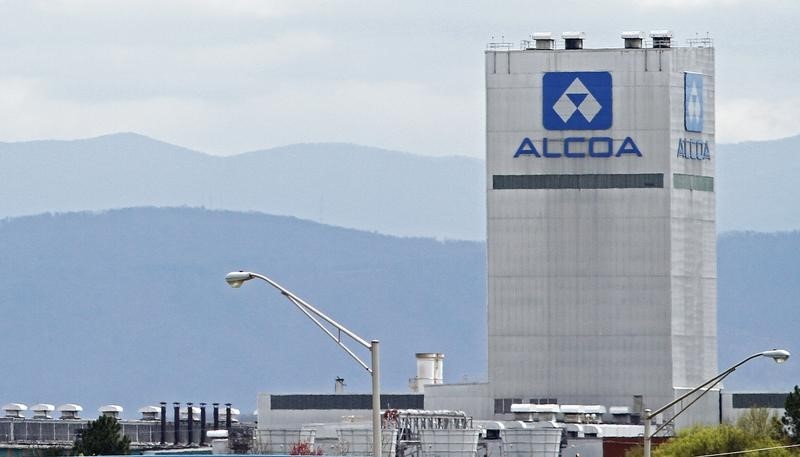

Shares of Alcoa (NYSE:AA) were downgraded to Peer Perform from Outperform at Wolfe Research Thursday, with its price target removed.

An analyst told investors in a research note that macro factors have “crushed” the aluminum bull case, and despite supply-side constraints and limited new capacity, “demand has disappointed from China and amid Europe’s energy crisis.”

In addition, she pointed to higher U.S. interest rates and a stronger USD as reasons for the lowered outlook.

“We downgrade to Peer Perform and cut 2022E/23E aluminum forecast on challenges that led to a global surplus rather than deficits. Most importantly China produced +2.6% Jan-Aug y/y but exports rose 31% ytd y/y, amid lockdowns and a faltering property sector (14% of global demand),” wrote the analyst. “Further threats include:1) steep global energy costs hurting demand; 2) rising global interest rates; and 3) Russia dumping supply on the LME.”

“Aluminum fell sharply from March’s $3,849 peak, despite >1Mt/yr of capacity closed in Europe and CENX shutting Hawesville’s 250Kt/yr smelter, as a testament to how much demand has fallen. This can set up for a sharp recovery when demand improves,” she added.

Alcoa shares are down over 3% Thursday.