This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXMPEB280F6_M.jpg

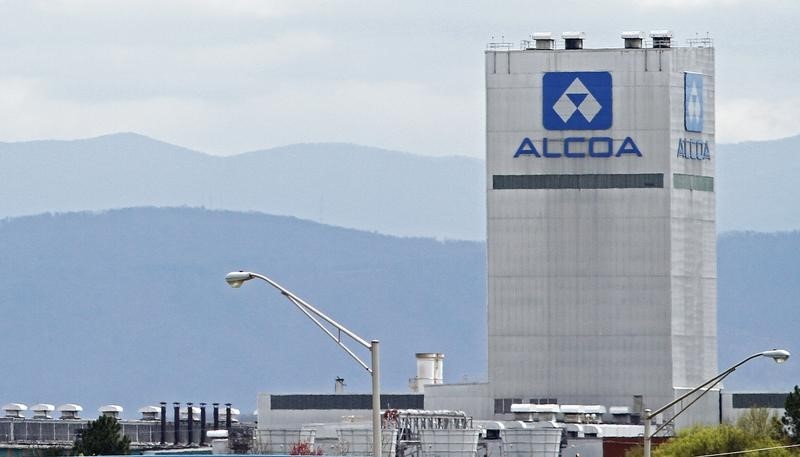

A Morgan Stanley analyst upgraded shares of miners Teck Resources (NYSE:TECK), Alcoa (NYSE:AA), and Nexa Resources (NYSE:NEXA) to Overweight in a note Thursday, stating value is starting to emerge.

However, despite strong balance sheets and cheap valuations, they are only selectively upgrading mining stocks of companies where they see “deep value and/or self-help stories amid persisting macro/China recovery uncertainties.”

The analyst said Teck is the firm’s Top Pick.

“We are selectively turning more positive on mining equities as most stocks in our coverage trade at increasingly attractive stock valuations — global Metals & Mining stocks’ relative valuation stands at 1.4 standard deviations below their historical average — despite strong FCF generation, capex discipline, and low leverage,” wrote the analyst.

Teck’s price target was raised to $51 from $41, Alcoa’s price target was lifted to $66 from $51, and Nexa’s price target was lowered to $6.6 from $7.2.

“Macro uncertainties persist with global growth still decelerating, driven by DM and EM ex-China. However, our China economics team forecasts a modest rebound to 5.2% in 2023, up from a below-consensus 2.8% GDP growth this year, as Beijing gradually alleviates housing and Covid overhangs,” the analyst explained. “The recovery depends heavily on policy, but the team believes Beijing will likely ramp up policy support for the housing sector, providing additional funding and better-coordinated intervention to ensure contracted home construction is completed. The team expects a gradual exit from Covid-zero next spring. The stimulus targeting the property and infrastructure in China are particularly positive for the M&M sector, as the country accounts for 50% or more of global demand for most metals.”