This post was originally published on this site

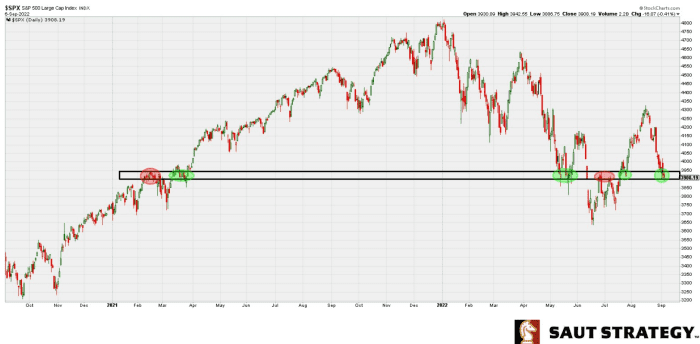

The biggest one-day drop in more than two years left U.S. stock-market bulls staring at crucial support for the S&P 500 index around 3,900 — a convincing move below that level would signal the risk of significant pain ahead, chart watchers warned.

Market risk “is elevated as long as the index sits below 3,900. Buyers need to throw everything they have at stocks right now to prevent further damage,” said technical analyst Andrew Adams in a Wednesday note for Saut Strategy.

The S&P 500

SPX,

was up 0.1% in afternoon activity Wednesday to trade near 3,937, as modest early gains faded. The large-cap benchmark dipped in earlier trade, hitting a session low of 3,918.78, according to FactSet, taking it below Tuesday’s intraday low at 3,921.28.

The S&P 500 fell 4.3% on Tuesday to close at 3,932.69, its lowest finish since Sept. 6, after the August consumer-price index showed inflation failed to cool in line with expectations. The Dow Jones Industrial Average

DJIA,

dropped over 1,200 points for a 3.9% decline, while the Nasdaq Composite

COMP,

slumped 5.2% — the biggest one-day percentage drops for all three benchmarks since June 11, 2020.

Saut Strategy

The development of a “battleground” around the 3,900 to 3,950 level for the S&P isn’t a surprise, Adams wrote, noting that it’s served as an important region since early 2021, providing both support and resistance. A break below that level would be troubling because it would suggest bears have maintained control, he said (see chart above).

Chart watchers had highlighted the 3,900 area as an important line in the sand as the S&P 500 bounced off it early last week.

Analysts at Bespoke Investment Group argued that the 3,920 area is crucial, marking an uptrend line drawn off the 2022 low set on June 16.

“If that trendline…doesn’t hold today, it won’t be much of a positive backdrop for a time of year that has historically already been among the weakest times of the year,” the Bespoke analysts said, in a note, referring to September’s history as the weakest month of the year for equities.

Adams said there is still time for the 3,900-3,950 area to produce a bounce, but it needs to happen soon.

The worry, he wrote, is that “the deeper we drop the more likely we have begun a new wave to the downside that will take us to lower lows. If stocks are going to reverse higher to take out their recent highs, I think around current levels is the likeliest spot for that to happen.”

See: The biggest Fed rate hike in 40 years? It could be coming next week.