This post was originally published on this site

The moribund IPO market is yet another reason to expect U.S. stocks to remain mired in a bear market for at least another few months.

So far this year, according to Renaissance Capital data, the number of U.S. market IPOs is down 81% from a year ago, and those that have gone public have been smaller, on average: the total of IPO proceeds raised this year is down 95% from a year ago.

“ IPO market sentiment is a short-term momentum indicator .”

These data’s significance depends on your investment horizon, according to Malcolm Baker, a professor at Harvard Business School. In an interview, he said that IPO market sentiment is a short-term momentum indicator for the market as a whole and a longer-term contrarian indicator. “More often than not historically, the market has fallen for several months in the wake of a plunging IPO market, but then turned back up.”

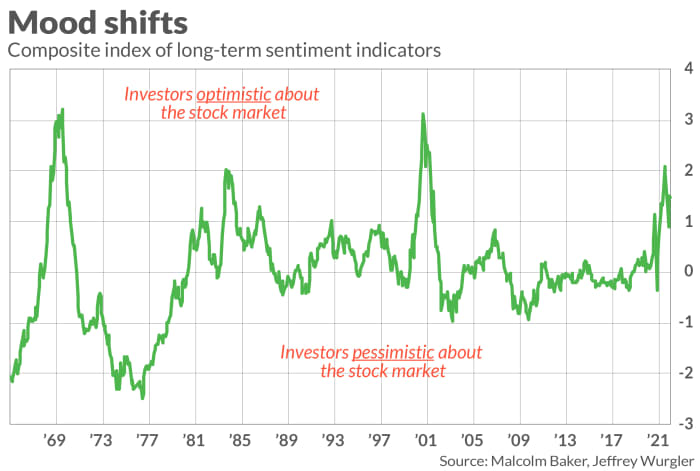

Baker is the co-author, with Jeffrey Wurgler of New York University, of perhaps the pre-eminent academic study of investor sentiment’s impact on the stock market. They constructed a sentiment index that incorporates a half-dozen separate indicators, two of which are derived from the IPO market.

Based on data going back to 1961, the professors found that the stock market tended to perform poorly after their index hit extreme high levels — and vice versa. This tendency was especially pronounced for the most speculative issues — “small stocks, young stocks, high volatility stocks, unprofitable stocks, non-dividend-paying stocks, extreme growth stocks, and distressed stocks.”

Details about the various indicators included in their sentiment index are provided at Wurgler’s website. Overall, the Baker-Wurgler index reinforces the bearish short-term story told by the IPO data. This is illustrated in the chart above, which plots this index’s gyrations over the past six decades. It not only shows the index’s decline since the beginning of 2022, it also shows that on past occasions when it has fallen from a high level, it typically continues to decline until it is in negative territory. We’re not there yet.

As you can also see from the chart, this shorter-term decline should set up the preconditions for a strong bull market over the longer term. As recently as the summer of 2021, as I wrote at the time, the Baker-Wurger index was “painting a picture of a very vulnerable market.” The last year has amply illustrated just how vulnerable it was.

So don’t jump the gun. History suggests that good times are coming, but things will get worse before they get better.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Learn how to shake up your financial routine at the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. Join Carrie Schwab, president of the Charles Schwab Foundation.

Plus: Stocks may be headed for another selloff according to RBC’s ‘hedge fund hot dogs’ basket