This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXNPEB63085_M.jpg

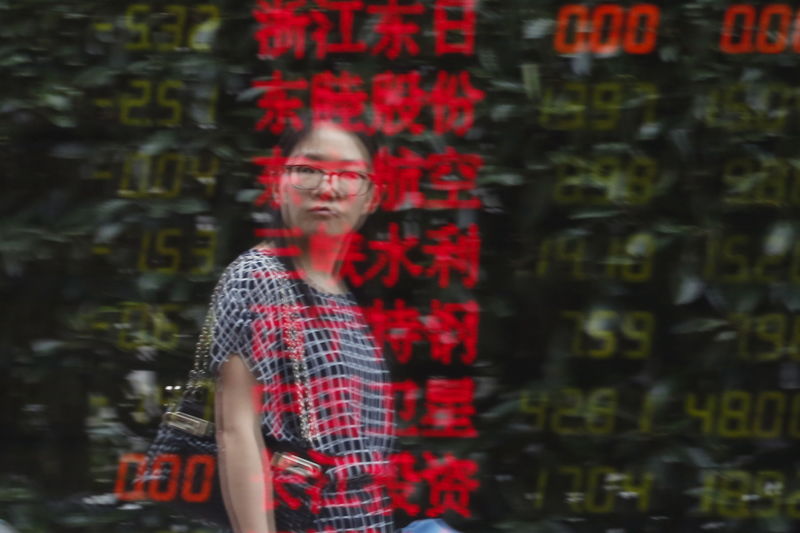

Investing.com– Asian stocks sank on Wednesday following hawkish comments from a Federal Reserve official, while concerns over a drought-driven power shortage in China also weighed on sentiment.

Chinese stocks were among the worst performers in the region, with the bluechip Shanghai Shenzhen CSI 300 index down 1.2%. The Shanghai Composite index fell 1.4%.

Industrial and automobile stocks, including Advanced Technology & Materials Co Ltd (SZ:000969) and Anhui Jianghuai Automobile Group Corp Ltd (SS:600418) were the worst performers on the bluchip index, down nearly 10% each.

Sentiment towards Asian markets was dented by comments from Minneapolis Fed President Neel Kashkari, who said the Fed is likely to keep raising interest rates until inflation is brought under control.

His comments supported the dollar and drove investors out of most risk-driven assets. They also come ahead of Fed Chairman Jerome Powell’s address to the Jackson Hole Symposium this Friday.

Asian markets traded lower in anticipation of the address, with traders fearing that the Fed Chair will reiterate the central bank’s hawkish stance.

Concerns over a power shortage in China also weighed on most Asian equities, given the country’s position as a trading hub for the region.

China is facing a severe heatwave, which has dried up several riverbeds and caused power shortages in regions dependent on hydroelectric power. The power crunch has also affected industrial activity in some parts of the country, with investors fearing it could spread to major hubs such as Shanghai.

While the power crunch is expected to ease after Summer, it comes during a time when the Chinese economy is struggling to recover from a series of damaging COVID lockdowns.

Industrial activity in the country is already in contraction territory.

In Southeast Asia, Thai stocks fell 0.2% after data showed the country’s trade deficit widened in July, amid falling exports. Philippine stocks bucked the trend, rising 0.7% on bargain buying into index heavyweights such as Ayala Corp (PS:AC).