This post was originally published on this site

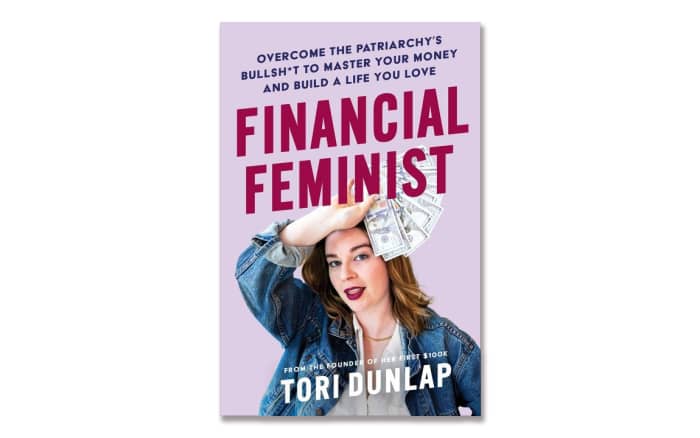

By the age of 25, Tori Dunlap had saved $100,000 and used the money to start a company, called Her First $100K. Three years later, the personal finance educator boasts more than 2 million TikTok followers, a No. 1-rated podcast, and a book scheduled for release later this year: “Financial Feminist: Overcome the Patriarchy’s Bullsh*t to Master Your Money and Build a Life You Love.”

Dunlap says she’s now financially independent — a goal that she believes all women should achieve. While Dunlap’s purpose is to help women pay off debt, save money and invest wisely, her advice also applies to men.

A strong financial foundation is essential, Dunlap says, to provide the freedom to leave toxic work environments and other unhealthy situations. “I want every woman to feel financially confident,” she adds. “It’s so important to get a financial education. The goal is to use money as a tool to build a better life for you, your family, and your community.”

1. Money is an uncomfortable topic for many women: The first step is to get more women to talk about money. “According to statistics, men are more likely to talk about money than women,” Dunlap says. “Women will talk about sex, death and religion more than they do about money, and I’m working to change that.”

2. Create an emergency fund: One of the most important financial goals is to create an emergency fund. “You need at least three months of living expenses in a high-yield savings account,” Dunlap advises. “Start putting money aside that will supplement your income in case of an emergency.”

3. Pay yourself first: A top priority, Dunlap says, is to pay yourself first. “Treat your future self like another bill,” she says. “Then you’ll be able to save that money and put it on autopilot without having to think about it. I sometimes joke that many people give Netflix more money each month than they are giving themselves. I’m not saying to cancel Netflix, but you deserve to give yourself at least the amount of money you pay for movies.”

4. Set up an automatic transfer: Dunlap is a big believer in automatic transfers. “Regardless of how much debt you have, set up an automatic transfer from your checking account to your 401k, IRA (Individual Retirement Account), or savings account every week or month, or set up a direct deposit from your paycheck. Also, autopay your bills as much as you can. You want to automate your financial life as much as possible to make it easy to save money.”

5. Count on index funds: Like many financial experts, Dunlap recommends creating a long-term investment strategy. “The beautiful part about thinking of investing as a long-term commitment is that the strategy doesn’t change so it’s way less work because you’re not managing it all of the time.”

“I’m not thinking of next week or next year but 10-, 20- or 30 years from now,” she says. “There are going to be peaks and valleys. The most important part is to manage your emotions. For me, investing should not be sexy. That is why I will invest in index funds until I die.” Her personal favorite is Vanguard Total Stock Market ETF

VTI,

During a bear market or recession, Dunlap doesn’t change her index-buying strategy. “I stay the course,” she says. “During a down market, index funds are on sale. I’m also thinking strategically about building a bigger emergency fund. If you don’t have an emergency fund or one that will supplement you, then increase your income by negotiating for a raise, or getting a secondary source of income even if it’s a couple of hours a week.”

Bridging the gender gap

Studies show a huge gap between men and women regarding financial education, Dunlap says.

In the media, for example, financial advice for men, Dunlap says, is geared towards investing, wealth building, negotiating salaries and buying real estate. In contrast, financial articles for women, she says, “are about deprivation, such as ‘You are not rich because you don’t work hard enough, you are a frivolous spender, or you buy too many lattes or avocado toast.’ This is not true!”

Dunlap is determined to change that stereotype. “I want women to grow their wealth as opposed to shrinking smaller. I need them to make strategic decisions about their money rather than minimizing spending. All of the advice on deprivation don’t work (one of the reasons most diets don’t work). The goal is to find that balance between spending and saving.”

Dey Street Books

Dunlap says many women don’t realize that investing is a two-step process. Step one is to deposit money into a retirement-oriented investment account such as an IRA or 401k. Step two is to choose an investment, such as a stock- or index fund. Says Dunlap: “Too many women miss step two and the money sits in financial purgatory, not earning interest. This may be obvious to financial reporters but so many women I meet never purchased an investment. No one taught them how to do it.”

Dunlap also advocates “value-based spending” — figuring out what you truly value and spending the majority of your discretionary income on those things. “I tell people that you don’t have to stop spending money,” she says. “Just stop spending money on things you don’t care about.”

Michael Sincere (michaelsincere.com) is the author of “Understanding Options” and “Understanding Stocks.” His latest book, “How to Profit in the Stock Market” (McGraw-Hill, 2022) is aimed at sophisticated traders and investors.

More: Hear from Carl Icahn at the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. The legendary trader will reveal his view on this year’s wild market ride.