This post was originally published on this site

U.S. stocks posted their worst daily drop in two months Monday on fears that the recent rally was based on an overly optimistic view that the Federal Reserve would pivot away from sharply higher interest rates to fight inflation.

How did stocks trade?

-

The Dow Jones Industrial Average

DJIA,

-1.91%

closed down by 643.13 points, or 1.9%, at 33,063.61, after dropping as much as 699.11 points earlier in the day. - The S&P 500 SPX ended down by 90.49 points, or 2.1%, at 4,137.99.

-

The Nasdaq Composite

COMP,

-2.55%

finished down by 323.64 points, or 2.6%, at 12,381.57.

Last week, the Dow Jones Industrial Average finished down by 54.31 points, or 0.2%, at 33,706.74. The S&P 500 closed down by 51.67 points, or 1.2%, at 4,228.48, while the Nasdaq Composite declined 341.97 points, or 2.6%, to 12,705.22.

What drove markets?

Stocks ended Monday with chunky declines as investors expressed wariness over a series of monetary, technical and seasonal factors. Dow industrials and the S&P 500 had their worst drops since June 16, while the Nasdaq Composite experienced its worst since June 28, according to Dow Jones Market Data.

Until recent days, the benchmark S&P 500 had been rallying sharply off its mid-June low, partly on hopes that indications of peak inflation would allow the Fed to slow the pace of interest rate rises and even pivot to a dovish trajectory next year.

However, that assumption was challenged last week by a succession of Fed officials who appeared to warn traders about embracing a less hawkish monetary policy narrative. Central bankers will gather this week at their annual retreat in Jackson Hole, Wyo., and Federal Reserve Chairman Jerome Powell is expected to deliver a highly anticipated speech on the economic outlook.

“Markets have been too complacent to the outstanding risks to the macroeconomic environment,” said Michael Reynolds, vice president of investment strategy at Glenmede, which oversees $45 billion in assets from Philadelphia. “We see the risk of recession at 50%, maybe higher than that, in the next 12 months. Based on where we sit, the market looks a little overheated at these valuations and we continue to be underweight equities.”

“The risk to earnings is what matters most to investors and there’s downside risk here for markets,” Reynolds said via phone on Monday.

Powell’s Jackson Hole speech on Friday will be a “double-edged sword” for markets, by giving traders and investors more certainty on the path of rates along with the need to adjust their expectations, according to Reynolds. “Markets are underestimating how much the Fed needs to tighten and how high rates need to stay to bring inflation back under control. The market needs to come to terms with how hard the Fed needs to tighten here. Part of what we’re expecting from Jackson Hole is for Powell to come out pretty strong and say that the Fed will tighten even if it risks a recession. It’s a sobering message that could lead to further risk-off moves.”

See: Here are 5 reasons that the bull run in stocks may be about to morph back into a bear market

Falling bond yields earlier this summer had helped support equities in their recent rally. But after dropping below 2.6% at the start of August, the 10-year yield

TMUBMUSD10Y,

moved above 3% again on Monday.

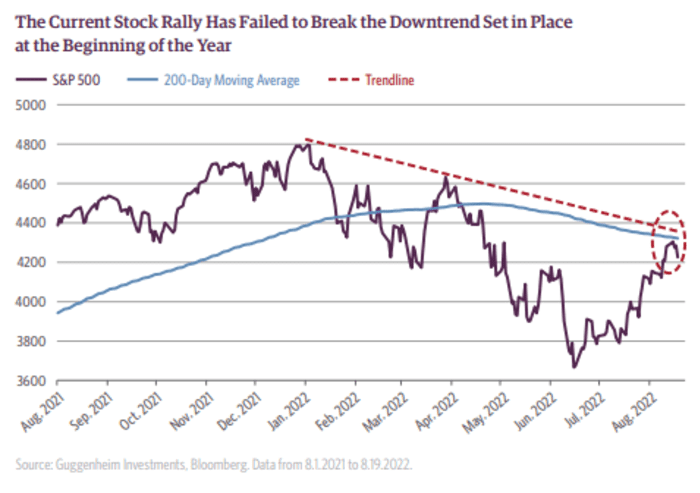

Another issue worrying the bulls is the S&P 500’s failure to break through a key technical level, raising fears the market remains in a downtrend. The large-cap index had its second consecutive loss of 1% or more on Monday, the longest such streak since the four trading days that ended on June 13, according to Dow Jones Market Data.

Source: Guggenheim

“We’re seeing fears of the Federal Reserve acting aggressively or continuing to act aggressively in hike interest rates drag stocks lower,” said Fiona Cincotta, senior financial markets analyst at City Index in London. “The market is having this realization that the Fed is unlikely to have a dovish pivot anytime soon, even though there was a softer inflation reading a couple of weeks ago.”

“Powell’s speech is going to be the key event this week, but the market is not really expecting a dovish pivot anymore from the Fed, which is why we see equities under pressure and the dollar rallying,” she said via phone. Now that the S&P 500 has fallen below 4,180, this opens the door for the index to keep falling to 4,100 or 3,970, according to Cincotta.

See: Once offering the worst return on Wall Street, cash is now looking like the best asset to own, says Morgan Stanley and ‘Uncomfortable’ with S&P 500 valuations? Investors may still find ‘bargains’ in small-cap stocks, says RBC

The dollar index

DXY,

is back near 20-year highs as worries about the European economy amid surging energy prices pull the euro

EURUSD,

to below parity with the buck. A strong dollar is associated with weaker stocks, since it erodes foreign earnings of American multinationals by making them worth less in U.S. dollar terms.

Which companies were in focus?

-

Shares of AMC Entertainment Holdings

AMC,

-5.51%

finished down by 5.5% as the company’s new preferred share class began trading under the ticker ‘APE.’ -

Signify Health

SGFY,

+32.08%

shares closed up 32.1% following a Wall Street Journal report saying that Amazon.com Inc. is among several companies bidding for the home-health-services provider. The healthcare company is said to be for sale in an auction that could value it at more than $8 billion, according to The Wall Street Journal, citing people familiar with the matter. -

Travel stocks declined with cruise line stocks Carnival Corporation

CCL,

-4.86% ,

Royal Caribbean Group

RCL,

-4.72%

and Norwegian Cruise Line Holdings

NCLH,

-4.78%

finishing down by 4.9%, 4.7% and 4.8%, respectively.

How did other assets fare?

-

The 10-year Treasury yield

TMUBMUSD10Y,

3.026%

rose 4.8 basis points to 3.04%, the highest since July 20, based on 3 p.m. levels. - The overall risk-off tone in the market impacted most asset classes. Oil futures fell, with the September WTI contract slipping 54 cents, or 0.6%, to end at $90.23 a barrel on its expiration day.

-

Gold futures logged their lowest settlement in almost four weeks, down a sixth straight session for their longest such losing streak since early July. Gold futures

GCZ22,

-0.79%

for December delivery fell $14.50, or 0.8%, to settle at $1,748.40 an ounce, the lowest most-active contract finish since July 27, FactSet data show. -

The ICE U.S. Dollar Index

DXY,

+0.75% ,

a gauge of the dollar’s strength against a basket of rivals, was up 0.8% at 109, surpassing the multi-decade high reached last month. -

Bitcoin

BTCUSD,

-0.10%

fell 0.7% to $21,075. -

In Europe, the Stoxx 600 equity index

SXXP,

-0.96%

finished down by 1%, while the UK stock-market benchmark FTSE 100

Z00,

-0.11%

closed 0.2% lower. In Asia, most bourses were also lower, though China’s Shanghai Composite

SHCOMP,

+0.61%

bucked the trend to finish up by 0.6% after the country’s central bank trimmed mortgage rates to support the struggling property sector.

— Jamie Chisholm contributed to this article.