This post was originally published on this site

Stocks aren’t the only thing sizzling this summer.

U.S. corporate bonds with speculative, or “junk,” credit ratings also have staged a breakneck rally in recent weeks, picking up momentum seen lately in major stock indexes as investors bet on a softish landing for the economy.

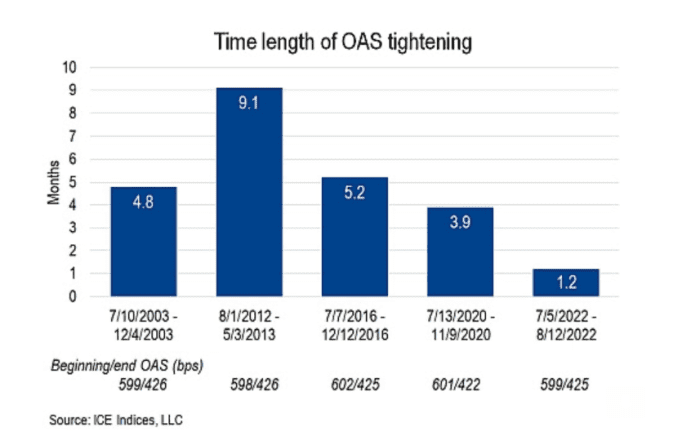

Junk bond spreads last week posted their quickest retreat on record — only 1.2 months — narrowing from roughly 600 basis points to 425 basis points above the risk-free Treasury rate from July 5 to Aug. 11, according to Martin Fridson, chief investment officer at Lehmann Livian Fridson Advisors. Spreads are a gauge of credit risk.

That marks the quickest spread retreat on record in that range (see chart), or at least since 1996 when the ICE BofA US High Yield Index was created, according to Fridson.

Junk bonds stage a record rally in July to August

Lehmann Livian Fridson Advisors, ICE Indices

“Prior to this year, such movements never took place over less than 3.9 months,” Fridson wrote Tuesday, in commentary that first appeared in PitchBook LCD.

“Over a strikingly short interval, high-yield investors came around to believing inflation was sufficiently under control, and that the Fed would not have to hike interest rates dramatically enough to trigger a deep recession,” Fridson wrote. “Time will tell whether they were correct in changing their views on that matter.”

Companies with speculative credit ratings often have been the first to buckle whenever the U.S. economy slows or a recession hits, particularly if it also coincides with scarce, or more expensive borrowing costs.

Investors often gain exposure to junk bonds through exchange-traded funds. The two largest are the iShares iBoxx $ High Yield Corporate Bond

HYG,

and the SPDR Bloomberg High Yield Bond ETF

JNK,

This year the funds were down 9.9% and 10.7%, respectively, as of Tuesday, according to FactSet data.

Historic losses in bonds in the year’s first half were pegged mostly to volatile Treasury yields, with the 10-year

TMUBMUSD10Y,

rate on Tuesday near 2.8%, up from 1.2% a year ago. Although, the focus lately has turned to potential default risks as weaker companies navigate the Fed’s tightening cycle.

On a yield basis, the ICE BofA US High Yield Index narrowed to about 7.2% on Monday from a peak yield this year of about 8.9% on July 30.

Federal Reserve Chairman Jerome Powell began talking about the potential for a “softish” landing for the U.S. economy in March, as the central bank began lifting interest rates from pandemic-era lows to fight stubbornly high costs of living.

Recession fears have climbed since this spring as investors worry about consumers potentially pulling back on spending with inflation soaring and higher borrowing costs biting as the Fed increases interest rates.

Read: Why Vanguard likes U.S. high-yield bonds in near-term after recent big gains

The S&P 500

SPX,

was up more than 17% through Monday from its mid-June low, but still was down9.7% on the year through Tuesday.