This post was originally published on this site

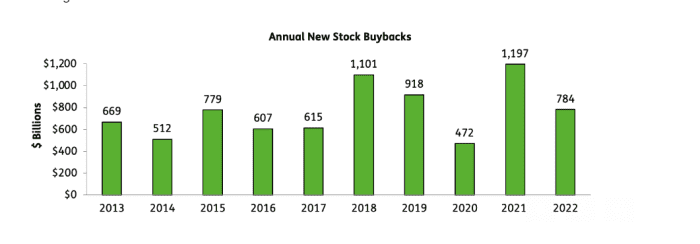

Companies already announced another $800 billion deluge of planned stock buybacks this year, after last year’s record of almost $1.2 trillion, according to a tally from EPFR.

That’s a bigger batch than most years in roughly the past decade (see chart), with the 1% tax on share buybacks under the Inflation Reduction Act viewed as unlikely to dull the appeal of share repurchases by many large companies.

Companies are announcing another deluge of share buybacks in 2022

EPFR

“This isn’t the first time an excise tax on buybacks has been proposed,” said George Catrambone, head of Americas trading at DWS Group. “I would expect the effect of a 1% buyback tax to be small,” he said, particularly with high levels of cash on company balance sheets making buybacks an appealing alternative to dividends and capital expenditures, “because they offer a lot more flexibility and aren’t multi-year commitments.”

An earlier version of the bill, known as Build Back Better, that failed to pass in 2021 proposed a 2% tax on buybacks.

The Inflation Reduction Act also contains a 15% minimum tax for large companies, which aims to bring dozens of Fortune 500 companies paying little or nothing in income tax back into the fold.

Goldman Sachs analysts said both provisions “pose a modest downside risk,” while estimating they would lower S&P 500 index

SPX,

earnings per share by roughly 1% in 2023, with larger declines in the “low effective tax rate sectors” of healthcare and information technology.

Higher earnings per share signal a willingness by investors to pay more for stock based on its profit outlook.

Read: An investor’s guide to the Inflation Reduction Act — and what the bill means for your portfolio

The House of Representatives voted to approve the measure, after it passed by the Senate. It will now be sent to President Joe Biden to sign shortly thereafter.

A bigger potential concern for American Companies may be a proposal from the U.S. Securities and Exchange Commission, Catrambone said, since it looks to add enhanced rules around how companies execute share repurchases and to require more timely and detailed disclosures.

It also strives to give investors more insights into when an issuer or related party plans to buyback shares, since “issuers are not required to, and typically do not, disclose the specific dates on which they will execute trades,” according to the SEC proposal.

U.S. stocks rallied Friday, with the S&P 500, Dow Jones Industrial Average

DJIA,

and Nasdaq Composite Index

COMP,

headed for weekly gains of about 2.8% to 3.1%, according to FactSet.