This post was originally published on this site

Defaulting on your student loans could lead to the federal government withholding your wages, your tax refunds and possibly your Social Security income — a process that’s both blunt and punitive, one government official says.

“Even if you were a hard-nosed accountant who only cared about collecting money for taxpayers, it makes no sense to try and collect a loan by driving borrowers into poverty and preventing them from getting back on their feet,” Education Department Undersecretary James Kvaal said in his opening remarks during a virtual panel held by the Student Borrower Protection Center.

“There are lives at stake here,” he added.

According to Kvaal, more than 7.5 million student loan borrowers, or one out of every six borrowers, was in default prior to the pandemic. In fact, before the pandemic-era payment pause began, Kvaal said, a million debtors defaulted for the first time every year.

“There is really nothing good that comes out student loan defaults, except to debt collectors … all default does is drive borrowers who are already facing financial hardships into an even deeper hole,” Kvaal said.

Default can have wide-ranging effects on a borrower’s life. In addition to seeing their wages garnished, Social Security checks seized and tax refunds withheld, borrowers can take a hit to their credit scores — “driving up the cost of every financial product,” Kvaal said.

“The consequences of default are so punitive, it’s as if whoever designed these policies assumed that borrowers were somehow trying to beat the system,” he added. “Defaulting on your student loan is about the farthest thing from a get-rich-quick scheme. It’s more like a stay-in-debt-forever scheme.”

Related: Here’s what government intervention did to Americans’ credit scores

The Biden administration has repeatedly extended the student-loan collection pause enacted by the Trump administration in response to the pandemic’s economic impact. That payment pause has been a boon to millions of student debtors, according to a new report from the New York Federal Reserve.

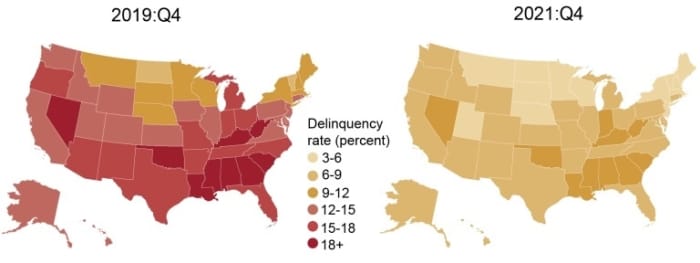

Over the last decade, prior to the payment pause on federal student loans, around 15% of borrowers had loans that were in delinquency status, or in default, in 2019. The pause on payments — and debt collections — helped a wide swath of the 38 million debtors who hold federal student loans, with the share of borrowers with a delinquent or defaulted loan falling to 7.5% at the end of last year.

Debtors in the South were struggling more with their student loans prior to the pandemic payment pause.

New York Fed

Prior to the pandemic, delinquency rates on student loans were highest in Mississippi, where 21.6% of borrowers were behind on payments, followed by Puerto Rico, at 20.1%, and Louisiana, at 20%. Debtors in the South “had the highest borrower delinquency rates,” the New York Fed added, “claiming ten of the top twelve states.”

The pandemic pause on collections, along with borrowers’ newfound ability to rehabilitate their defaulted loans, halved delinquency rates.

The Biden administration has approved nearly $28 billion in debt relief for 1.4 million student loan borrowers, Kvaal said. “More borrowers qualify every day,” he added, “and we will keep working tirelessly to make sure that everyone eligible gets the relief that they’re entitled to.”

The administration is also trying to make it easier for student loan borrowers who default on debt find a way out of their financial hole. The Education Department announced in April that it would give defaulted student debtors a “fresh start” by restoring their loans to current status to give them a better chance at repayment.

“By and large, borrowers who default on their loans are people who have been failed by the policies and lagging investments in college affordability,” Kvaal said. “They provide the most compelling evidence that the student loan system needs fundamental change.”

“Defaulting on a student loan should not be a lifelong sentence of financial struggle and despair,” he added.

Read more: Borrowers are on edge — will Biden cancel student debt or not? Here’s what’s going on.

Write to MarketWatch reporter Aarthi Swaminathan at aarthi@marketwatch.com.

Learn how to shake up your financial routine at the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. Join Carrie Schwab, president of the Charles Schwab Foundation.