This post was originally published on this site

As rents continue to rise, consumers are beginning to feel the squeeze, a report notes.

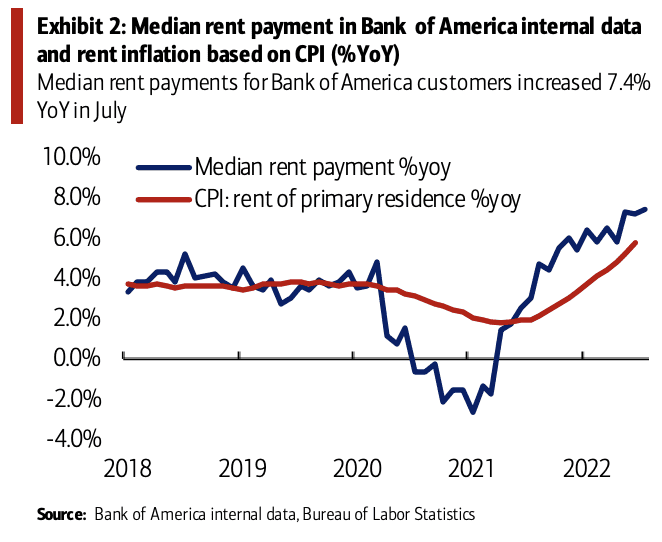

Analysis of dollars spent on Bank of America credit and debit cards in July by the Bank of America Institute found that median rent payments paid increased by 7.4%, as compared to the previous year.

Median rent payments are ticking up sharply, according to Bank of America Institute’s analysis of credit and debit card spend.

(PHOTO: Bank of America Institute)

Roughly a third of U.S. households overall are renters, the report said, and for this group, a “sizeable increase in rental prices have squeezed consumer wallets.”

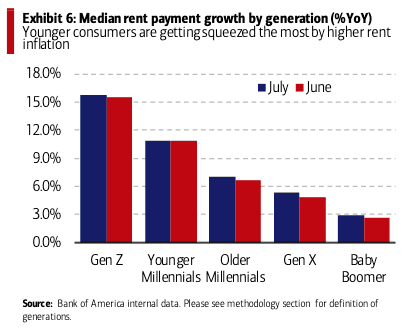

The groups most affected by rising rents include middle-income households, and younger generations.

Overall, total payments on Bank of America cards increased by 7% in July as compared to last year, roughly the same amount in June.

But the increase in dollars spent on rent was notable. As seen in the chart below, median rent payments ticked up in June by 7.2% as compared to the previous year, and even further in July by 7.4%.

Rents feed into the overall inflation number, which has hit a 40-year high as prices across a range of consumer goods, from groceries to clothes to gas to rent, have soared.

“Housing represents about a third of the value of the market basket of goods and services that the Bureau of Labor Statistics (BLS) uses to track inflation in the Consumer Price Index,” Brookings Institution said in a report. “A rise in the price of shelter, the BLS label for housing, contributed to the increase in inflation in early 2022.”

Rents in June surged, according to the last CPI report. The rent index posted the largest monthly increase since 1986. (July CPI data was scheduled to be released on Wednesday morning.) The Bank of America report estimated that 47% of lower-income families are renters, and noted that they are likely to see a bigger impact on their household finances from rising rents.

Based on the spend data, rents have been pretty universal in burdening households. According to Bank of America, all income groups, from those earning $50,000 a year to above $251,000 a year, saw rent payments tick up.

But the biggest increases were felt by households with an annual income between $51,000 to $150,000, the report added.

Gen Z is the group dealing with the biggest increase in median rent payments.

(PHOTO: Bank of America Institute)

Younger consumers are also “getting squeezed the most by higher rent inflation,” the report added, with the median rent payment for Gen Z up by 16% in July this year as compared to the previous year. Gen Z refers to those born after 1996. In stark contrast, median rent payments only went up by 3% for Baby Boomers.

Got thoughts on the housing market? Write to MarketWatch reporter Aarthi Swaminathan at aarthi@marketwatch.com

Learn how to shake up your financial routine at the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. Join Carrie Schwab, president of the Charles Schwab Foundation.