This post was originally published on this site

Sky-high housing prices still threaten to complicate the Federal Reserve’s inflation fight, even as America’s market for single-family homes shows signs of cooling in response to sharply higher interest rates.

This week, Redfin reported the number of “stale” home listings climbed above 60% in July, reflecting the year’s surge in mortgage rates and concerns about the economy as homes linger on the market for longer.

With the central bank’s easy-money stance credited with helping home prices shoot roughly 20% higher annually, it makes sense that worries have emerged about a potential sharp correction in housing prices, one that could ripple through the economy.

Except, borrowers already took out trillions worth of low-cost, 30-year fixed-rate mortgage debt in recent years, leaving only about 10% of the $12.8 trillion mortgage market at adjustable rates, according to the Urban Institute.

That’s good for existing homeowners, since it dulls the kind of interest-rate shocks that sparked a wave of subprime mortgage defaults from 2007 to 2009, causing home prices to plunge and exposing reckless leverage in financial markets that spiraled into a global crisis.

“This is a different kind of borrower,” said Tracy Chen, a portfolio manager at Brandywine Global Investment Management, adding that she continues to invest in U.S. mortgage bonds, given higher underwriting standards in place over the past decade, plus meatier returns of late. “I’m a little insensitive to a consensus view that housing will collapse because of interest-rate hikes.”

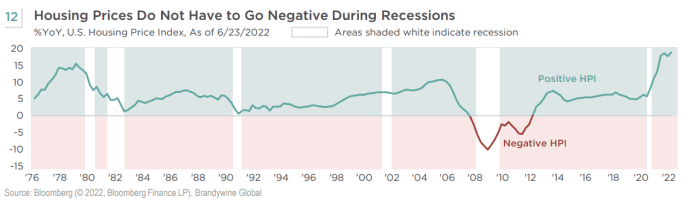

What’s more, even if a U.S. recession officially is declared in this tightening cycle, historical data (see chart) shows annual home price gains only once went negative during downturns in the past 46 years — the plunge around 2008 that took years to heal.

In the past 46 years, yearly home price gains only went negative in downturns during the wake of the 2008 recession.

Brandywine Global, Bloomberg

A ‘hangover’ in housing

While the Fed can’t solve America’s longstanding affordability crisis that stems in part from too few houses being built in the wake of the 2008 crisis, its pandemic policies may have made things worse for many first-time buyers.

That’s because a housing shortage favors existing homeowners and landlords, but not renters, particularly with prices for groceries in July surging the most since 1979. Shelter also continues “to anchor core inflation,” according to economists at Barclays, who said the 8.5% annual consumer-price index reading for July shows inflation potentially heading lower, or at least in the “right direction of travel,” in a Wednesday note to clients.

The Barclays team also expects shelter inflation to “begin to soften in the autumn,” but warned that inflation also could stay stubbornly high due to strong wages, a tight labor market and uncertainty around food and energy

CL00,

prices.

Scott Ruesterholz, a portfolio manager at Insight Investment, said he expects shelter, education and healthcare, or the big “sticky” components accounting for roughly 50% of the core consumer-price index, to keep CPI in the 5.5% to 6% range by the end of the year, in emailed comments.

“What we are going through right now is a Fed mistake,” Chen said by phone. “They should have tightened last year, and they are behind the curve still.”

In addition to aggressive rate hikes this year, the Fed also continues to reduce its balance sheet, which hit a record size of almost $9 trillion before the central bank started letting more of its Treasurys and mortgage bonds picked up during the pandemic mature, without reinvesting the proceeds.

“They are the largest holder of agency MBS,” Chen said of the central bank’s roughly $2.7 trillion mortgage-backed securities holdings. “This is a hangover from massive stimulus after COVID.”

Opinion: Inflation hasn’t peaked yet because rents are still rising fast

Stocks continued to advance Thursday, a day after a sharp rally following the July inflation report, with the S&P 500 index

SPX,

Dow Jones Industrial Average

DJIA,

and Nasdaq Composite Index

COMP,

posting their highest closing levels since early May.