This post was originally published on this site

Shares of Plug Power Inc. pulled a U-turn to trade sharply higher Wednesday, as investors and analysts appeared to embrace the hydrogen and fuel cell company’s glowing praise of the Inflation Reduction Act (IRA), over the company’s disappointing second-quarter results.

The IRA, which passed the Senate over the weekend and is now headed to the House of Representatives, provides billions of dollars for clean and renewable energy production, and would enact a production tax credit (PTC) that provides an incentive to product clean hydrogen. Read more about the IRA.

Plug Chief Executive Andrew Marsh said on a post-earnings conference call with analysts that the IRA provides a “trifecta effect,” as it’s good for the climate, for jobs and for national security. And it’s great for the company.

“With the passage of the Act, we expect a boom for our electrolyzer and green hydrogen business,” said Marsh said, according to a FactSet transcript. “All applications that use gray hydrogen [produced from fossil fuels] today, such as fertilizer manufacturing, will now be able to buy green hydrogen at a competitive price with gray.”

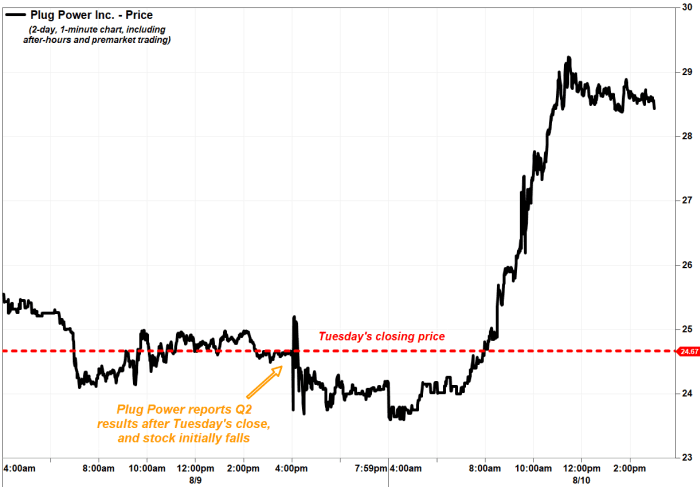

The stock

PLUG,

charged 15.3% higher in afternoon trading. It was down as much as 4.0% in after-hours trading Tuesday soon after Plug reported second-quarter results, and down as much as 4.3% in Wednesday’s premarket, before reversing course.

FactSet, MarketWatch

The company reported after Tuesday’s close a second-quarter net loss that widened to $173.3 million, or 30 cents a share, from a loss of $99.6 million, or 18 cents a share, in the same period a year ago. That missed the FactSet consensus for per-share losses of 21 cents.

Revenue grew 21.4% to $151.3 million, but was below the FactSet consensus of $159.0 million.

Cost of revenue rose less than revenue, up 11.5% to $183.7 million, as gross margin improved to 21.5% from 32.4%.

The company reiterated its 2022 target of $900 million to $925 million in revenue.

In a letter to shareholders, the company said the IRA was a “tremendous catalyst” for all forms of clean energy development, and “a game changer” for Plug, as the PTC should further enhance its leadership in the green hydrogen ecosystem.

“We believe that the PTC will help capital formation, recycling of capital, and back leveraging,” the letter said.

“We believe this dynamic provides access to a larger pool of capital to help accelerate the growth of the green hydrogen industry while reducing the levelized cost of green hydrogen,” the letter added.

J.P. Morgan analyst William Peterson reiterated his overweight rating on Plug, but raised his stock price target to $32 from $28. Although the results confirmed the headwinds to margins that he was expecting, they also showed improvement, which could speed up the timeline to profitability.

“[R]ecent policy updates, including the proposal of hydrogen production tax credits and fuel cell investment tax credits in the Inflation Reduction Act could bring the company toward profitability inflection ~6 months earlier than expected, provide $500 million of incremental annual cash flow and reduce hydrogen plant payback periods by 4-5 years (~half the time than without incentives),” Peterson wrote in a note to clients.

Also read: Fuel cell, EV and solar stocks rally as climate bill makes ‘alternative’ energy ‘more in the money.’

Oppenheimer’s Colin Rusch also kept his rating at outperform and his stock price target at $63, which implies a more than doubling from current levels.

“We believe Plug is uniquely positioned to benefit from the [IRA] legislation with its leading position in green hydrogen,” Rusch wrote. “We expect the company to aggressively book new business with numerous customers and build out a comprehensive green hydrogen network in the U.S. serving industrial applications first, followed by incremental material handling, stationary power and over-the-road transportation.”

Plug’s stock has soared 81.1% over the past three months, while the S&P 500 index

SPX,

has gained 4.9%.