This post was originally published on this site

A “great slowdown” is happening in the U.S. housing market, a new report from Bank of America says, as mortgage originations shrink and spending on household items softens.

Amid weak home sales numbers, builder confidence, and new construction, there’s a lot of chatter about whether the housing sector is in a recession.

New data from Bank of America adds more gloom via two data points.

Residential mortgage originations fell by 29% during the second quarter compared to last year, down to $14.5 billion, according to internal data from Bank of America

BAC,

customers, the Bank of America Institute found.

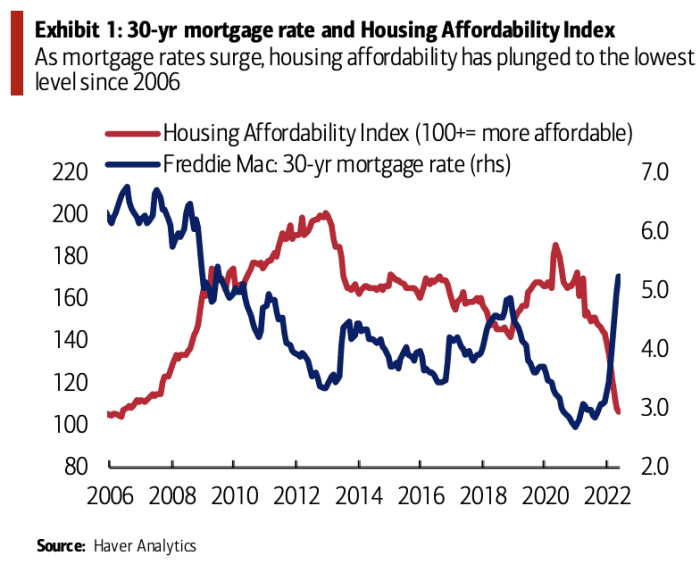

That’s because borrowing costs are much higher now compared to a year ago, thanks in part to the Fed’s rate hikes. Since January, the average rate on a 30-year mortgage has increased by more than 200 basis points, according to the report, “reaching the highest level since 2008.”

As of July 28, the average rate on the 30-year fixed-rate mortgage was 5.3%, according to Freddie Mac. A year ago, it was at 2.5%.

Higher interest rates on top of soaring home prices make homes even more expensive for buyers. In the chart below, Bank of America highlighted how housing affordability has plunged to the lowest level since 2006.

Housing affordability has plunged to the lowest level since 2006, BofA says.

(SCREENSHOT: Bank of America)

With the pace of home sales slowing, consumers are also pulling back purchases on home-related items.

It’s worth noting that nearly a quarter of first-time home buyers open a new credit card within six months of buying a home, a separate study by Realtor.com and Experian found.

But based on internal data, the Bank of America report found that spending per household at furniture and home improvement stores on Bank of America cards has been dropping: Spending has fallen on a year-over-year basis across the country since March 2022.

Furniture and home improvement spending fell significantly specifically in the West and Northeast, the report added, by 7.4% and 8.1%, respectively.

Write to MarketWatch reporter Aarthi Swaminathan at aarthi@marketwatch.com.

Hear from Ray Dalio at the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. The hedge-fund pioneer has strong views on where the economy is headed.