This post was originally published on this site

The initial estimate from the Bureau of Economic Analysis is that the U.S. economy shrank at an annual rate of 0.9% in the second quarter, a back-to-back contraction — commonly, but incorrectly, considered the definition of a recession.

Analysts at BCA Research wrote that the stock market rally on July 28 after the BEA’s announcement “suggests that equity markets have already discounted the risk of recession.”

Rex Nutting argues that a deeper look into the economy indicates it is not in recession and bashes both political parties for playing games with the R-word. One thing different this time around is that unemployment remains very low, at 3.6% in June. Nutting runs with this in an amusing piece about recession semantics.

More opinions about the economy:

Play it safe if you think a new bull market has started

Walt Disney is among five stocks Michael Brush recommends for nervous investors.

Getty Images

The S&P 500 has rallied 11% from its 2022 closing low on June 16. Michael Brush believes the time is ripe to increase your exposure to the market and recommends five “moat” stocks.

Hard times for Facebook and parent company Meta

The Meta sign at company headquarters in Menlo Park, Calif.

AP Photo/Tony Avelar

Facebook holding company Meta Platforms reported its second-quarter results on July 27, including its first decline in quarterly sales and its third straight drop in profit. Things are expected to get worse during the third quarter. Therese Poletti considers whether Facebook may be headed for a long-term downward spiral to become “Yahoo 2.0.”

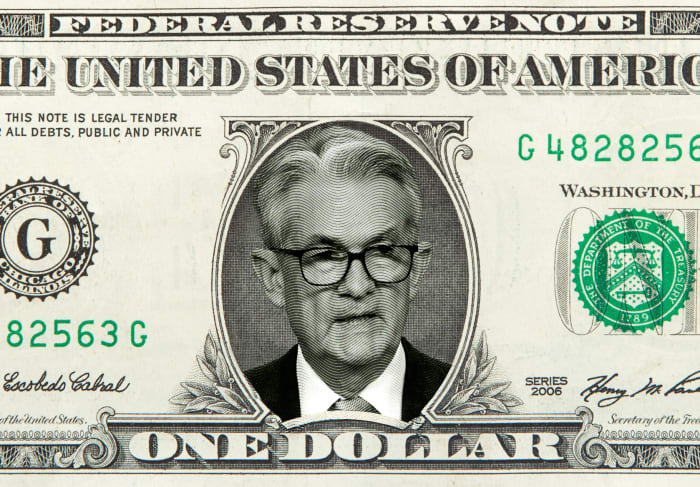

Rising interest rates and your financial decisions

MarketWatch photo illustration/iStockphoto, Getty Images

The Federal Open Market Committee has now raised short-term interest rates four times this year and has begun shrinking its bond portfolio to push long-term rates higher. Federal Reserve Chairman Jerome Powell said this week that the FOMC’s next moves after its September meeting will depend on the flow of economic data.

Meanwhile, the average interest rate on a 30-year fixed-rate mortgage loan has climbed to 5.30% from 2.80% a year ago. For a 15-year loan, the average rate has risen to 4.58% from 2.10%, according to a report from Freddie Mac on July 28.

Here are some steps you can take to prepare for large purchases during a time of rising interest rates.

Fighting inflation in the kitchen

MarketWatch photo illustration/iStockphoto

Here’s how you can inflation-proof your meals.

More about inflation and food:

- Walmart customers are spending on food, and not much else, as inflation takes a toll

- Robots are making french fries, chicken wings and more as restaurant kitchens gear up for an automated future

A new batch of dividend stocks made for these times

John Buckingham, editor of the Prudent Speculator, selects 15 dividend stocks for quality, value and income.

What retirees really should worry about

Robert Powell shares some important information for retirees, including insight about how to avoid outliving your money.

More about financial planning and investing:

‘Offices are toast’

A gloomy day in Frisco.

Justin Sullivan/Getty Images

Twitter’s review of its prime office space serves notice to office landlords in San Francisco and elsewhere.

What’s happening at Intel?

Getty Images

Intel lowered its sales and profit outlook dramatically when reporting disappointing second-quarter results on July 28. The stock was down 11% on July 29. Emily Bary rounded up harsh reactions from analysts, and Therese Poletti looked at Intel’s competition.

A happy ending for retired workers whose pensions were at risk

An April 2016 rally at the U.S. Capitol drew thousands of retirees protesting pension benefit cuts.

Allison Shelley/Getty Images

Eleanor Laise tells the story of a decade-long effort to help millions of retired workers secure pension payments.

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.