This post was originally published on this site

A powerful rally across financial markets sparked this month as more investors bet on the Federal Reserve pivoting away from aggressive interest rate hikes has gone “too fast, too soon” for debt tied to major U.S. corporations, warned a team of Goldman Sachs credit researchers.

The emerging “embrace of a dovish Fed view” could come back to bite investors, given that the Federal Reserve “has not yet seen any concrete evidence that inflation has come under control,” Lotfi Karoui’s credit team at Goldman wrote, in a weekly note.

“We continue to fade the rally and recommend using it as opportunity to cut

risk and rotate further up in quality.”

A surge in inflation to a four-decade high has been squeezing households, particularly those in the bottom income brackets, while higher borrowing costs, designed to cool demand for goods and services, have yet to dampen demand for cars in short supply or for things like Apple Inc.’s

AAPL,

iPhone.

Corporate earnings, however, have been retreating from record levels, while tighter financial conditions and recession fears fueled a dramatic rout in stocks and bonds in the first half of the year.

In July, spreads on corporate bonds tightened, gathering further steam after the Fed on Wednesday raised rates by another 75 basis points in a bid to quickly tame high inflation. Chairman Jerome Powell, in an afternoon news briefing, argued that a slowing economy doesn’t mean the U.S. is in a recession right now, particularly with its strong labor market.

Past recessions often have been accompanied by wider bond spreads, on fears that a souring economy will further squeeze margins, but also that liquidity can dry up and result in more corporate defaults.

At last check, bonds of investment-grade companies deemed a relatively low default risk were paying investors a roughly 1.54% spread, or premium above the risk-free Treasury rate

TMUBMUSD10Y,

according to the ICE BofA US Corporate Index. That’s down from a 1.65% high so far this year, but off the lows closer to 0.86%.

High-yield spreads rallied closer to 90 basis points, or nearly 1%, relative to the widest levels of July, according to Goldman data. The Dow Jones Industrial Average

DJIA,

and S&P 500 index

SPX,

booked their best month since Nov. 2020, while the Nasdaq Composite Index

COMP,

had its best month since April 2020, according to Dow Jones Market Data.

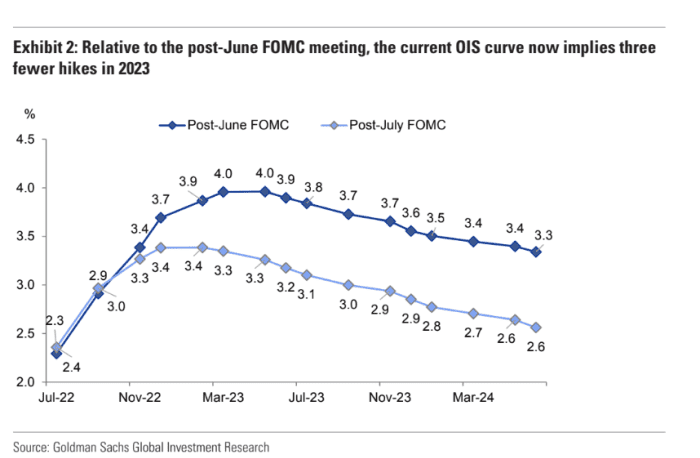

Part of that rosier backdrop has been a view by some investors that the Fed will erase (see chart) at least some of its penciled-in rate hikes by the end of next year.

Corporate bond spreads imply fewer Fed rate hikes

Goldman Sachs Global Investment Research

The Fed in June indicated its policy rate was expected to reach about 3.5% by the end of 2022 and 4% in 2023, which would be an sharp increase from its current 2.25% to 2.5% range.

While a “decline in inflation measures could surprise positively in terms of its magnitude, we struggle to see a sustained compression in risk premia, and therefore an easing of financial conditions,” the Goldman team wrote.

Read: Was Fed’s Powell dovish or not? 4 key takeaways from Wednesday’s press conference.