This post was originally published on this site

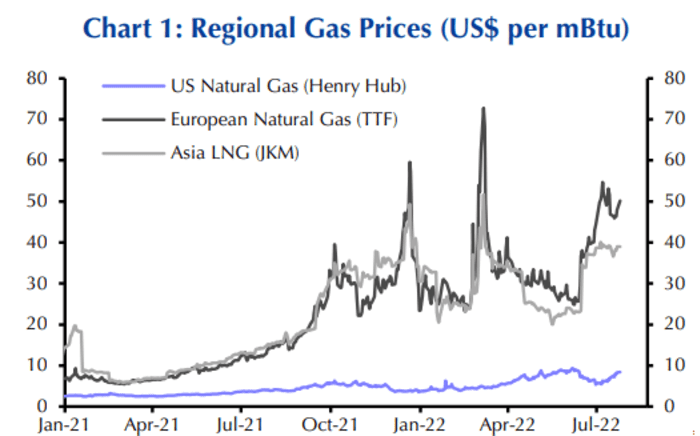

European natural-gas prices soared in the past two sessions after Russia’s state energy giant Gazprom on Monday said it would dramatically cut natural-gas deliveries through its main pipeline to Europe, which will further reduce natural-gas flows to Germany.

Capital Economics warned that Europe may struggle to meet its gas needs, and the European gas price (TTF), the region’s benchmark wholesale gas price, will remain elevated for years to come.

“We have revised up our forecasts of the European gas price (TTF) to reflect the fact that Russia is now clearly withholding gas from the European market,” said Jennifer McKeown, head of global economics service at Capital Economics, and Caroline Bain, chief commodities economist, in a client note on Tuesday. “This has the potential to derail Europe’s efforts to fill its storage to 80% of capacity by November (ahead of the winter-related surge in demand).”

The European Union has planned to reach a minimum storage target of 80% in the coming months to ensure enough gas for winter, but data from Gas Infrastructure Europe shows its gas storage levels were only 66.7% full as of July 26.

“Given the constraints on securing natural gas from alternative suppliers (pipelines and liquefied natural gas (LNG) import capacity), we expect Europe to struggle to meet its gas needs, which will keep the TTF price elevated for some time yet,” said McKeown and Bain. “We now forecast the European gas price to stand at around €150 per MWh by end-2022, before falling to a still historically high €100 at end-2023.” (See chart below)

SOURCE: REFINITIV, CAPITAL ECONOMICS

Futures contracts for delivery next month tied to TTF jumped 21% on Tuesday to more than 210 euros per megawatt hour, the highest level since March. U.S. natural-gas futures

NGQ22,

also climbed on Tuesday to settle at their highest since June 7, according to FactSet data. August natural gas

NGQ22,

was up 3.1% to settle at $8.993 per million British thermal units on the New York Mercantile Exchange.

September West Texas Intermediate crude

CL00,

CL.1,

fell $1.72, or 1.8%, to settle at $94.98 a barrel on Tuesday. September Brent crude

BRNU22,

the global benchmark, lost 75 cents, or 0.7%, at $104.40 a barrel on ICE Futures Europe.

Read more: Oil ends lower; natural gas at highest in 7 weeks

According to Capital Economics, the potential gas shortage in Europe increases the likelihood of recessions in the region as inflation pressures have been persistent. The International Monetary Fund warned Tuesday that the global economy is facing the possibility of a severe downturn. The organization cut its global growth projections for 2022 from 3.6% to 3.2%. In 2023, the IMF projected global output at just 2.9%.

The European Central Bank raised its benchmark deposit rate by 50 basis points last Thursday, its first hike in 11 years. Meanwhile in the U.S., the Federal Reserve started its two-day policy meeting Tuesday, which is expected to conclude Wednesday with another 75-basis-point rate increase to tame hotter-than-expected inflation.

Read more: Four things you will want to listen for at Wednesday’s Federal Reserve meeting

Some of the world’s biggest LNG exporters may benefit from higher gas prices, according to Capital Economics. Countries such as the U.S., Australia and Qatar “should see higher investment by energy companies or higher government revenues offsetting at least some of the drag on real activity from higher inflation and lower real household incomes,” economists wrote.

However, these countries can’t increase output quickly enough to ease global supply constraints or to profit fully from it. As McKeown and Bain pointed out, Qatar has said that it cannot increase its supply until 2025. It’s also possible that exports will be limited to prevent large price increases for domestic consumers.

In theory, metals manufacturers such as India and China might fill the gap left by their counterparts in the EU, like Germany, but China still has limits on its exports and production so it isn’t easily able to make up for the shortage.

“Any benefits from limits to Russian gas supply and higher gas prices will be more than offset by the costs at the global level,” according to McKeown and Bain. “Recessions in Europe will drag on average growth and reduced energy supply from Russia threatens to reverse the recent encouraging let-up in global supply shortages.”