This post was originally published on this site

The fact that the S&P 500 is now flirting with the 4,000 level after clinching its second weekly gain out of the last three weeks has got some of Wall Street’s most prominent bears wondering what exactly is driving this latest rebound — and whether it’s a bear-market rally, or if the bottom is, indeed, in.

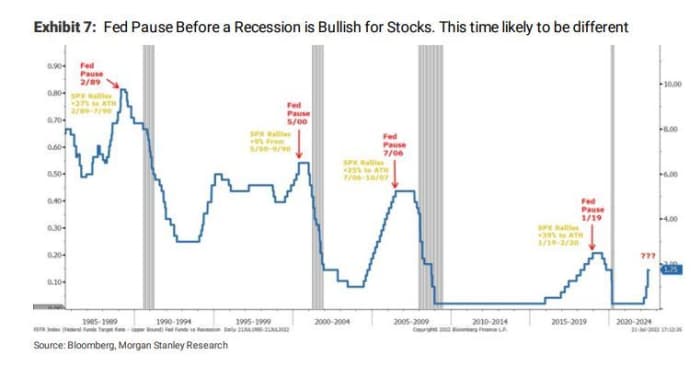

In his latest note, Morgan Stanley’s Michael Wilson — the head of U.S. equity research who was one of the few people on Wall Street to correctly anticipate this year’s selloff — suggested that equity investors have perhaps been a little too eager to price in a “pause” to the Fed’s rate-hike cycle this week.

During the past few Fed tightening cycles, there has typically been a pause between the end of the Fed’s rate hikes and the start of a recession. But with inflation running at its highest level in 40 years, and leading indicators suggesting that growth is already slipping, Wilson believes that the situation will likely be different this time around.

The question, now, is whether the Federal Reserve will halt its rate hikes later this year in an attempt to save the economy from a punishing recession. Fed Chairman Jerome Powell has already acknowledged that the Fed’s rate hikes could drive the economy into a recession, although he has insisted that this isn’t the Fed’s goal — rather, the central bank is hoping to engineer a “soft landing” that will see the unemployment rate move toward 5%, enough to blunt demand in a way that would undercut inflation.

Source: Morgan Stanley

And while Wilson believes that markets are likely correct in assuming that inflationary pressures have likely already peaked (given the recent weakness in commodity prices), the notion that the Fed could stave off a recession by dialing back rate hikes later this year seems more like wishful thinking.

“While we appreciate that the market (and investors) may be trying to leap ahead here to get in front of what could be a bullish signal for equity valuations, we remain skeptical that the Fed can reverse the negative trends for demand that are now well established,” Wilson said.

Morgan Stanley isn’t the only bank wondering whether markets have been too quick to price in the possibility that the Federal Reserve could start cutting interest rates as soon as February (which is what Fed funds futures markets currently suggest, according to the CME’s FedWatch tool).

Read: The Fed could get lucky or things might go wrong. A guide to where the economy might go from here

Economists at Deutsche Bank speculated last week that the Fed won’t be able to start cutting rates again until the official data reflect a sharp slowdown in price pressures while unemployment moves above 6%.

Former Richmond Federal Reserve President Jeffrey Lacker expressed a similar view on Friday. He said that the Fed will likely need to continue hiking rates into a recession, and that the Fed funds rate would likely need to surmount the rate of core inflation — which presently stands at just under 6% — to effectively constrain inflation. Of course, Fed funds traders don’t expect the benchmark rate to rise anywhere close to this level.

Wilson also claimed that stocks could face headwinds as expectations for corporate earnings over the next year continue to weaken as inflation saps consumer spending power while increasing input costs for corporations. Right now, more analysts are cutting expectations for S&P 500 sector earnings than are raising them, which is another reason to favor “defensive” growth stocks over the megacap tech stocks that led the market higher for years after the Great Financial Crisis, and have also led the latest rebound.

Read: Morgan Stanley finds a way to trade U.S. dollar based on obscure market’s accuracy on inflation

Depending on the sector, analysts have cut earnings expectations over the next 12 months by a range of 28% to a whopping 45%. Transportation, materials, insurance and consumer durables are seeing the biggest downward revisions.

For now, at least, stocks appear content to grind higher despite the event risk lying ahead: in addition to this week being the busiest week for corporate earnings, the Federal Reserve is expected to announce its next rate hike Wednesday following the conclusion of its latest two-day policy meeting.

The S&P 500

SPX,

was up 0.2% in recent trading, while the Dow Jones Industrial Average

DJIA,

was up 0.3%. Only the Nasdaq Composite

COMP,

was lower on the day, down 0.2%.