This post was originally published on this site

Soaring used-car prices have kept a key spigot of funding for the record $1.6 trillion auto loan market open, even as cracks in consumer credit have begun to emerge.

Wall Street bond deals that bundle up used-car loans to borrowers with spotty credit have been rolling along despite fears of a new wave of auto repossessions as high inflation hits households least able to afford it.

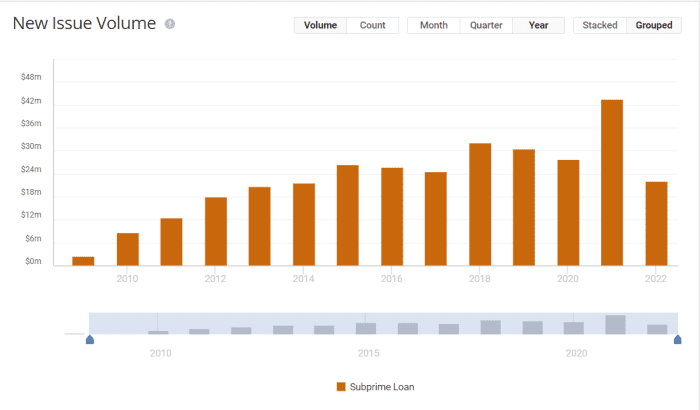

The tally of new U.S. subprime auto asset-backed bond deals has climbed to $22.1 billion so far in 2022, or about half of last year’s peak $42 billion yearly volume, according to Finsight.com, which tracks bond issuance.

Subprime auto bond boom continues

Finsight.com. Left-hand column represents billions.

Subprime borrowers tend to have credit scores in the 580 to 619 range. A recent $255 million bond deal from California-based United Auto Credit included a pool of loans to borrowers with an average credit score of 569 and interest rate of 21.4%, according to DBRS Morningstar.

The “deep subprime” lender touts: When others say “no,” United Auto Credit says “yes,” on its website. The company in February was sold to Vroom Inc.

VRM,

an online used-vehicle seller that went public in 2020. Vroom didn’t immediately respond to several requests for comment.

“Where we stand today, I’d say that consumers from a balance sheet perspective are in good standing with excess savings to meet their financial obligations,” said Toby Giordano, portfolio manager at Braddock Financial, in Colorado, and a longtime investor in the subprime auto and asset-backed bond market.

“Having said that, certainly there are early signs of cracks to consumer credit and strains,” Giordano said, by phone. “I’d expect it to materialized more in the subprime borrower.”

Car repos in focus

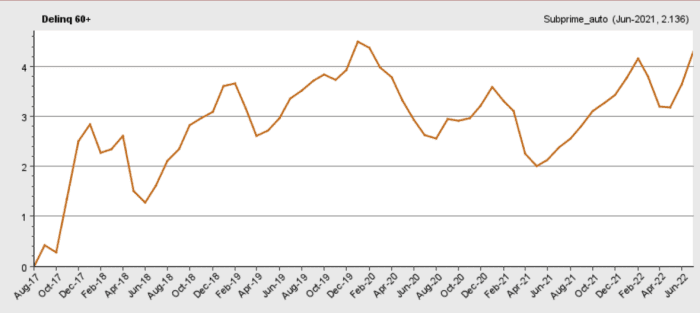

Loan delinquencies have been rising this year as the pandemic boost from government stimulus checks fades.

The rate of subprime auto loans past due at least 60 days in asset-backed bonds climbed above 4% in June (see chart), and was above the same month in 2019.

Subprime auto loan delinquencies edge up

Intex

While inflation has been biting into consumer paychecks, it also has kept average used-car price in the stratosphere, pegged at near a record $28,312 this summer. June’s reading of the closely watched consumer-price index showed a 7.1% increase in used cars prices in the past year.

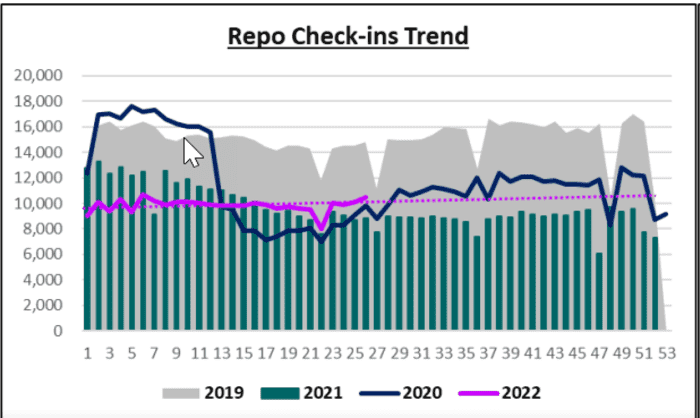

The stress of high prices for gas, groceries, cars and housing has put a focus on an uptick in car repossessions this summer in some areas. However, the overall volume of repossessions in recent months (see chart) has been running well below levels before the pandemic.

Car repossession are rising from pandemic lows

Cox Automotive

John Wennerholm, a repo man for the past 35 years in Utah, told MarketWatch that he’s not seeing volumes rise yet, even though he expects it to pick up soon. Another repo man in Texas working for a service with a national footprint said business has been slow. There isn’t one government source for repossession data.

Pandemic shocks that led to a supply crunch of vehicles has put the threat of abusive car repossession on the radar of the Consumer Financial Protection Bureau, an emboldened consumer watchdog under the Biden administration.

Read: Consumer watchdog fires warning shot to lenders over abusive auto repos as used-car prices soar

The agency has been monitoring repossessions and performance in the asset-backed bond sector closely. Consumers who believe they have been the victim of a wrongful repossession can submit a complaint to the CFPB.

What’s driving Wall Street

For Wall Street subprime auto bond deals, skyrocketing used-car prices have been a boon — at least for now.

The monthly recovery rate for repossessed vehicles in subprime auto bond deals was at 56% in May, down from a high of 75.2% in April 2021, according to BofA Global.

Bonds historically were underwritten with the expectation that vehicles recover only about 40 to 45% of their value, a veteran banker in the sector told MarketWatch. Higher recoveries helps cushion lower-rated bonds from potential losses.

Subprime auto bond yields also have climbed dramatically this year, along with a painful selloff in stocks

SPX,

and fixed-income markets as recession fears take center stage. The Federal Reserve has begun to dramatically raise interest rates and tighten financial conditions to fight inflation that last month hit the a 41-year high.

See: Stock-market investors face crucial week: Fed, earnings deluge, GDP

Specifically, the top-rated AAA class of the United Credit bond deal priced at a roughly 4.4% coupon last week, while its riskier BB bonds fetched 10%, which compares with a 1.1% and 5% coupon, respectively, from a similar deal in February, according to Finsight.

Read earlier MarketWatch coverage on car repossessions: Frontline workers in eye of pandemic storm for months, now fending off repo man