This post was originally published on this site

The United States is perilously close to falling into a recession, despite the reassurances of Federal Reserve officials, Wall Street economists and financial journalists. That’s not just an idle opinion; it’s what the data say.

Let’s let the numbers speak for themselves.

‘A deep, widespread, and lasting downturn’

Contrary to what you’ve heard, a recession — at least in the U.S. — is not defined by two straight quarters of falling gross domestic product (GDP). It’s more nuanced than that.

Also read: A ‘fake’ recession? The U.S. economy is in decent shape for now despite weak GDP

According to the National Bureau of Economic Research, a private body that’s been accepted as the official historian of U.S. business cycles, “a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months.” The key elements are depth, diffusion and duration.

The decline in GDP in the first quarter would not meet the criteria, because the weakness was not widespread; it was confined to one part of the economy — the trade deficit — while the rest of the economy grew at a healthy rate. Indeed, imports were high precisely because domestic demand was strong.

And an expected decline in the just-concluded second quarter — we’ll find out next week when the data are released — might not meet the diffusion criteria either, because most of the apparent weakness was in home building and inventory growth, not in consumer spending or business output.

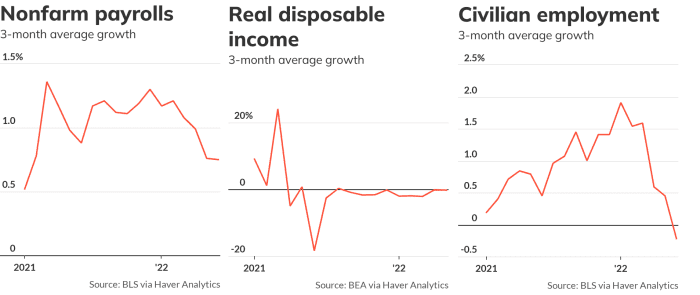

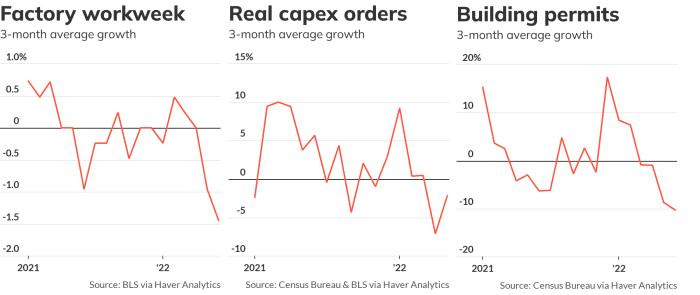

In practice, the NBER looks primarily at six coincident indicators to judge whether the economy is expanding or contracting, whether a slump meets the test of depth, diffusion and duration.

“ The U.S. has never endured a recession without a significant decline in jobs and a concurrent rise in unemployment. But Japan has. ”

The most important number is the growth of nonfarm payrolls, collected in a survey of businesses. Not only is employment inherently the most important gauge of the health of economy, but the payroll survey is considered to be the most statistically reliable of all the coincident indicators.

Other factors are also considered, such as growth of real personal incomes, industrial output and real sales by businesses. (“Real” means adjusted for inflation.)

The NBER also looks at a monthly estimate of GDP, and an alternate view of civilian employment obtained from a survey of households. NBER does not use the unemployment rate, because it’s a lagging indicator.

The coincident indicators

MarketWatch

Four of these six coincident indicators — real disposable incomes, real sales, civilian employment and monthly GDP — have declined over the past three months. (Caveat: I’m using a slightly different measure of incomes than the NBER has traditionally used, because the traditional measure is sending a misleading signal right now. But incomes are slowing quite a bit by either measure.)

A fifth indicator — industrial output of factories, mines and utilities — has been slowing and actually fell in the latest month.

Of the six indicators, only nonfarm payrolls have continued to grow at a decent rate. Is that enough to give us confidence that the economy is not in a recession? Typically, the answer would be “yes.” That’s why Fed Gov. Christopher Waller was so certain when he said recently that “it would be tough to say we have a recession with 3.6% unemployment.”

The U.S. has never endured a recession without a significant decline in jobs and a concurrent rise in unemployment. But Japan has.

In Japan, the economy can slip into recession without increasing unemployment because Japanese companies tend to retain employees even when their revenue drops sharply. Japan is an aging society, and workers are so scarce that companies will keep them on the payroll (at reduced pay and hours) through a slump until the economy recovers.

That sounds a lot like the current dynamic in the U.S. economy, with companies facing a shortage of able and willing workers. (And it’s becoming a structural problem for the U.S. as it is for Japan.) It’s possible that the U.S. economy will start behaving more like Japan’s now that its demographics look more like Japan’s.

Universally bleak

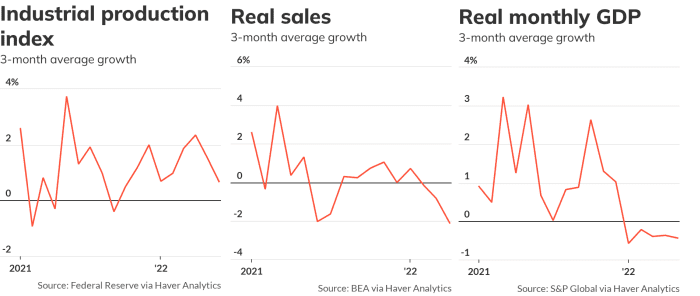

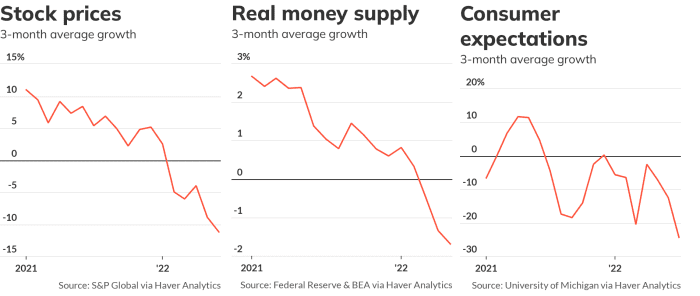

Aside from these six indicators that tell us how the economy is faring now, economists have identified other economic data that hint at what the economy will look like in the near future. These so-called leading indicators are universally bleak.

MarketWatch

The granddaddy of leading indicators is the yield curve, which is determined by the spread between the yield on the 2-year Treasury note

TMUBMUSD02Y,

and the 10-year note

TMUBMUSD10Y,

An inverted (or negative) yield curve is the best single predictor of an upcoming recession, and it recently turned negative. Maybe it’ll stay inverted; maybe it won’t.

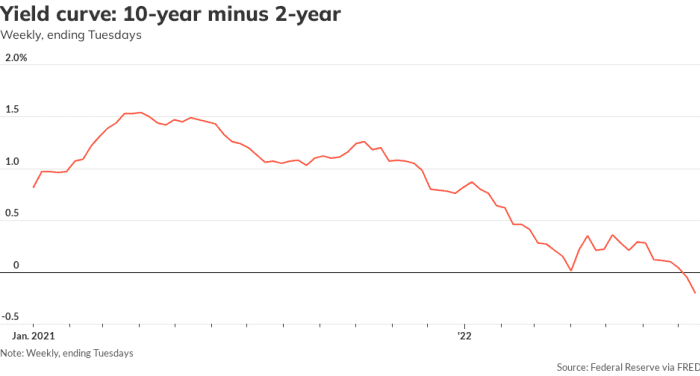

The other leading indicators

MarketWatch

The other major leading indicators were already negative. The money supply is falling now that the Fed is tightening up on credit and shrinking its balance sheet.

Building permits — which point to future construction — are collapsing as the Fed pushes up interest rates and makes homes even more unaffordable. Consumer expectations have sunk as inflation batters household budgets.

Businesses are losing confidence as well. With consumers retrenching, businesses have cut back on investments in capital goods, and factories are cutting workers’ hours. Stock prices

SPX,

COMP,

have suffered in line with lower expected profits, higher interest rates and heightened uncertainty.

The risk is high

I don’t have a crystal ball. I don’t forecast the economy. I don’t know if the U.S. is fated to fall into a recession, or if it’s already in one. Perhaps the bulls are correct that inflation will moderate just enough to give consumers and businesses confidence and income to keep the expansion going.

But I do worry that policy makers, economists, investors and journalists may be too nonchalant about the risk of a recession this year. The data suggest that the risk is high and rising.

Rex Nutting has been writing about economics for MarketWatch for more than 25 years.

Also from Rex Nutting

The real labor shortage is looming, and everything we’re doing is making it worse

The Federal Reserve can’t even get the direction of the economy right

There’s a big hole in the Fed’s theory of inflation — incomes are falling

Why interest rates aren’t really the right tool to control inflation