This post was originally published on this site

High-yield debt of riskier companies is not as junky as investors believe. So these bonds have sold off too much. Consider finding a place for them in your investment portfolio: Junk bonds are now a source of decent dividend yield and potential capital appreciation – and a compelling contrarian play.

“I’ve been doing this a long time, and I think now is a very attractive time to enter the asset class,” T. Rowe Price US High Yield fund

TUHYX,

manager Kevin Loome told me in a recent interview. Because of widespread fears of recession “the market assuming defaults are going to be higher than they actually will be,” says Loome, who has been analyzing junk bonds since the mid-1990s.

High yield or “junk bonds” are issues rated below BB by ratings firm Standard & Poor’s. The Standard & Poor’s credit rating scale ranges from AAA at the top to very risky C and D at the bottom. BB is where speculative-grade or junk status begins, one notch below the BBB range, which is the lowest investment-grade range. Moody’s and Fitch also rate bonds, with a similar scale though the names for ratings vary a bit.

High-yield debt now pays an 8.7% dividend yield overall, but the total return potential will be much greater if prices for junk bonds rise from here. That’s likely, for five reasons described below.

Loome particularly favors lower-rated CCC bonds, which recently paid a yield of close to 15% on average. Not only is the yield higher, but CCC bonds outperform when the market bounces back, he says.

How to play this market? You can consider owning high-yield exchange-traded funds or individual issues. But personally, at a confusing time like this I’d prefer a fund actively managed by an experienced portfolio manager like Loome. This is a tricky economic environment where some sectors and companies will fare worse than others. So it makes sense to have a portfolio manager working for you.

Plus, he’s overweight CCC rated bonds, the ones that stand to outperform if it turns out recession and default fears are exaggerated.

As for sector calls, he was recently overweight energy, telecom, consumer goods and retail while underweight healthcare.

His fund also pays a higher distribution yield, at 6.84%, than the iShares iBoxx $ High Yield Corporate Bond

HYG,

at 4.85% and the iShares Broad USD High Yield Corporate Bond

USHY,

at 5.94%.

Here are five reasons to consider junk-bond exposure now.

1. Junk bonds have been really slammed

T. Rowe Price US High Yield fund shares recently went for $8.05. That’s just a little above $7.95 where they bottomed out on March 20, 2009, during the 2008-2009 financial crisis. The S&P U.S. High Yield Corporate Bond Index was down almost 14% in late June. These kinds of exaggerated moves often make for good contrarian plays.

The only time in recent history that junk bonds were down more than this for the year was when they fell 26% in 2008, says Loome. Then they were up 55% for all of 2009. “As painful as 2008 was, if you just stayed invested you had a positive outcome,” he says.

“Investors who normally have no interest in high yield should be looking at this as a rare opportunity to deploy capital with strong projected returns,” agreed Bank of America, in a recent note.

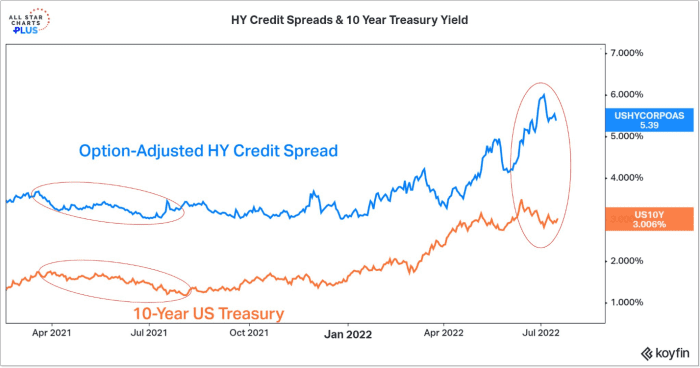

This chart reveals how much high-yield bonds have been hit; it shows how the spreads between junk debt and safer Treasurys

TMUBMUSD10Y,

have widened this year because of recession and default fears. Bond prices fall as yields rise.

The “options adjusted spread” (OAS) tweaks the yield on junk debt to account for the impact of options built into these bonds. This means the options issuers have to call bonds at a preset price, or the option owners have to sell back to the company from time to time.

2. Fears of a deep recession are exaggerated

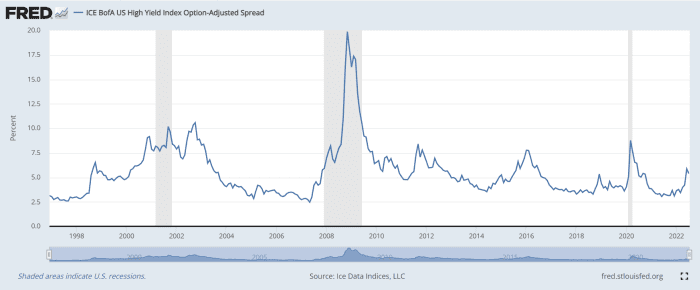

This chart from the St. Louis Fed shows that junk-bond prices can sink a lot more from here if a serious recession develops. Yields rise when bond prices sink as investors sell bonds due to worries about recessions and nonpayment.

But any recession that develops here will be shallow, believes Loome, and not like the recessions during 2020, the financial crisis and the early 2000s. As the chart above shows, those recessions sent junk yields spiraling as investors sold them off.

Read: A ‘fake’ recession? The U.S. economy is in decent shape for now despite weak GDP

Loome cites relatively strong employment and economic activity. “We assume that a recession will be shorter and shallower than normal,” agrees Bank of America, citing relatively strong corporate and consumer balance sheets. The kinds of leverage excesses that caused the last few severe recessions are not apparent. And the severity of COVID appears to be on the wane.

The upshot: Loome thinks the corporate bond default rate will come in at 4% in the medium term vs. a long-term average and market expectations of 5%. Bank of America puts the default rate over the next 12 months at 3.4%.

3. Inflation is rolling over

If so, this would suggest fears that the Fed will tip the economy into recession are exaggerated. That may be the case. The prices for most commodities — from oil, copper and lumber to agricultural goods — are all down sharply from peaks earlier this year. A recent New York Fed survey showed prices paid, prices received and supply-chain constraints are easing at companies. The price tags on used cars, bedding and furniture, and durable goods like big appliances are all down.

At some point, this has to start showing up in the official inflation numbers, says Ed Yardeni, of Yardeni Research.

“It seems like inflation is starting to course correct,” says Loome. That’s what he hears from managers at companies he analyzes. “Talking with companies, it feels like we were at peak of pain a few months ago, and it is now starting to abate.”

The bond market is saying the same thing, given that 10-year Treasury yields have fallen. “Break-even” rates on bonds suggest lower inflation ahead. This is the difference between the yields on Treasurys and Treasury inflation-protected securities with comparable maturities.

“The bond market is very efficient. The bond market is saying ‘We don’t think inflation is going to stay high,’” says Loome.

But in a way, inflation can actually help companies issuing debt, points out Bank of America. That’s because inflation can boost revenue and cash flow, while interest payments are typically fixed. Because of inflation, B of A predicts corporate cash flow will fall only 10% in any recession in the coming year, compared with much bigger 25%-40% declines in downturns over the past 35 years.

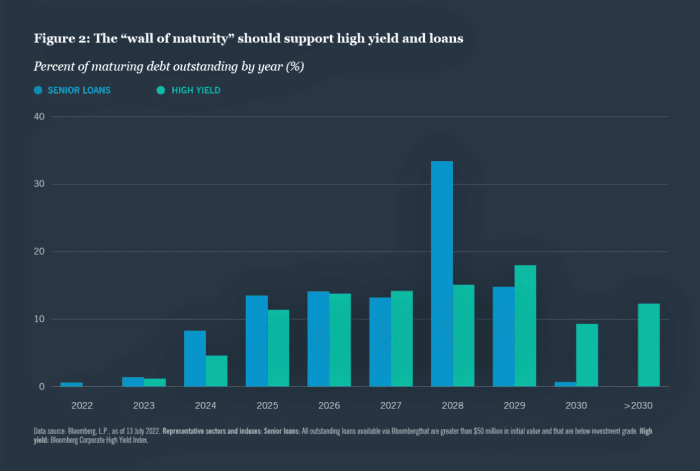

4. Riskier companies recently refinanced at low rates, pushing out the ‘maturity wall’

Companies took advantage of low interest rates in the past few years to refinance debt. This locked in lower interest rates that are attractive now as rates rise.

It also pushed out the time frame for debt maturity, called the “maturity wall.” This chart from Nuveen shows that 75% of high-yield debt and loans mature after 2025.

Nuveen

“This not only mutes the impact of any increase in interest expense, but also helps companies avoid large principal payments,” says Saira Malik, Nuveen’s chief investment officer. “We don’t expect defaults to rise materially, even in a recession, as debt burdens aren’t excessive and low financing rates have been locked in.”

5. Liquidity is bad, but it may ease

One reason high-yield debt has been hit is that markets are thin. Brokerage only make markets in high-yield debt if they’re issuing new junk bonds. That is not the case now; the new issue calendar is shut down.

“Brokerage provision of liquidity is worse by multiple times compared to 2008,” says Loome. “Their provision of liquidity is nonexistent.”

Liquidity issues are particularly bad in CCC-rated bonds. That’s one reason their prices have fallen so much and why Loome is overweight this part of the junk bond market.

What could go right

This liquidity problem would ease if the new issue market opens back up — because recession fears ease, inflation abates, and the Fed eases up on rate increases.

But the problem for investors is that by the time these changes signal it’s time to jump back in to high-yield debt, most of the move up in junk-bond prices will have happened.

Michael Brush is a columnist for MarketWatch. At the time of publication, he had no positions in any stocks mentioned in this column. Brush is the author of the stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.