This post was originally published on this site

As earnings season kicks into high gear, there is one major question that could determine where stocks and inflation will head from here: Will companies continue to raise prices or cut costs in an attempt to maintain the record profit margins of 2021?

As this column discussed three months ago, the S&P 500 index’s

SPX,

record profit margin in 2021 was a historical anomaly, topping 12% when it had never before hit 11%. Wall Street analysts at the time expected record margins to continue through this year and into 2023 and 2024, and those expectations are actually increasing. Profit margins are now expected to top 13% in 2023 and 2024, with the estimate for next year growing from 12.93% to 13.25% in the past three months.

The more companies chase those record profit margins by increasing prices, the higher inflation could go. Inflation continued to increase in June, with the consumer price index once again hitting its highest increase in more than 40 years.

Don’t miss: With inflation rising and fears of recession, watch out for these 3 key numbers in company earnings reports

For an idea of what this looks like in an individual earnings report, take a look at one of the first reports of the season, PepsiCo Inc.

PEP,

The maker of soft drinks and snacks reported that overall sales volume increased just 1% from last year, but the company reported net revenue growth of 7% and organic revenue growth of 13%. The reason: Effective net pricing increased 12% from the year before.

Pepsi executives sounded like they were going to be more careful about price increases in the future, however, because of concerns about retailers and lower-income consumers.

“We obviously have to pass some of these costs to the consumer, [but] how do we do it in a way that doesn’t impact volume and it continues to generate growth for [retailers] and growth for us, and those are the type of conversations we’re having,” Chief Executive Ramon Laguarta said when asked by an analyst about pricing in a conference call Tuesday.

“Obviously, we’re all concerned in a way about the high inflation and how that’s going to impact, especially as we look at the full consumer universe, the lower part of the income pyramid, that’s where we’re all looking more

carefully and we’re making decisions on entry point in the categories and how do we continue to have that particular consumer engage in our categories,” he said.

Despite the price increases, Pepsi’s net profit margin did decline in the second quarter, to 7.1% from 12.3% a year ago, though executives promised to increase operating margin.

Net profit margins overall appear to be declining, especially in tech and many consumer-focused categories. FactSet Senior Earnings Analyst John Butters said Friday that expectations for the quarter have already fallen as actual results were blended in, with analyst’s expectations for a 12.7% net margin at the beginning of the quarter declining to 12.4% so far this quarter, even with the bulk of reports still ahead.

Even if executives in sectors such as consumer discretionary and tech decide not to chase the record net margins of 2021, they could stay high overall due to expected windfall profit from oil companies.

Exxon Mobil Corp.

XOM,

already disclosed expectations for billions in additional second-quarter profit due to oil and gas prices spiking as Russian oil was diverted to other markets due to the invasion of Ukraine, and energy-sector margin expectations for 2022 have surged to 13.15% from 9.39% at the end of 2021.

Read: When will inflation peak? Consumers and economists see light at the end of a long tunnel

The second quarter a year ago was the peak for net profit margins so far with the S&P 500 index, reaching 13%. While analysts still expect they will grow in the years ahead, the true path depends on what executives decide to do, with the numbers, forecasts and executives’ statements arriving in the next few weeks acting as our best guide as to what is to come.

In the week ahead, we will hear from several industries that have contributed to the rise in consumer prices, such as airlines, with United Airlines Holdings Inc.

UAL,

American Airlines Group Inc.

AAL,

and Alaska Air Group Inc.

ALK,

expected to report.

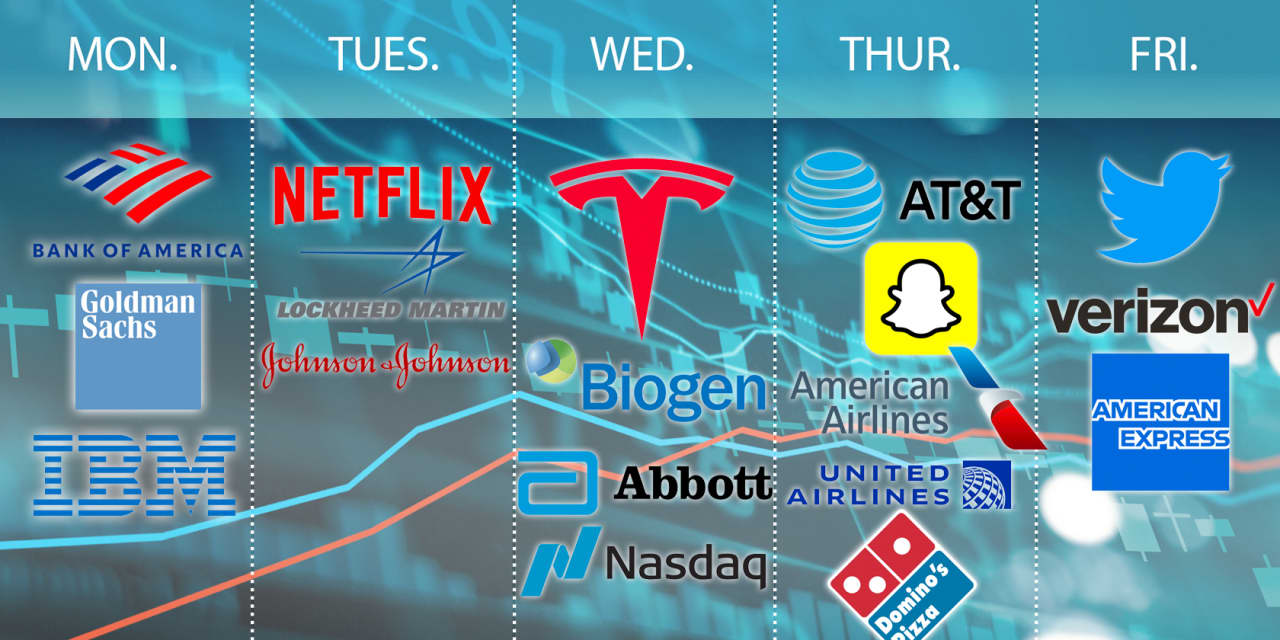

This week in earnings

More than 70 S&P 500 companies are expected to report earnings this week, with seven of the 30 Dow Jones Industrial Average

DJIA,

components on the schedule — International Business Machines Corp.

IBM,

and Goldman Sachs Group Inc.

GS,

on Monday; Johnson & Johnson

JNJ,

on Tuesday; Dow Inc.

DOW,

and Travelers Cos. Inc.

TRV,

on Thursday; and Verizon Communications Inc.

VZ,

and American Express Co.

AXP,

on Friday.

Here are some of the reports to watch out for.

The calls to put on your calendar

Tesla Inc.

TSLA,

: Tesla earnings calls are always unpredictable, especially when Elon Musk shows up. If Musk shows up this week, however, it will be a surprise, because he has plenty else to worry about — A judge plans the first hearing Tuesday in his legal battle with Twitter Inc.

TWTR,

which will report its second-quarter results early Friday morning without a conference call. Tesla will report Wednesday afternoon after the electric-car maker said deliveries declined 18% sequentially in the second quarter, with Musk’s appearance in the earnings call afterward still a question mark.

Earnings preview: Wall Street braces for ‘difficult’ second quarter from Tesla

Snap Inc.

SNAP,

: Doubts about the online-advertising industry have been increasing, and Snap will be the first major barometer on Thursday afternoon, hours ahead of Twitter’s numbers hitting. The color from Chief Executive Evan Spiegel dealing with demand, pricing and the continuing effects of changes to Apple Inc.’s

AAPL,

approach to sharing data will contain clues to expectations for some much bigger reports the next week from rivals Meta Platforms Inc.

META,

and Alphabet Inc.

GOOGL,

For more: Twitter has more to worry about than Elon Musk as doubts about online-ad industry persist

The numbers to watch

Netflix Inc.

NFLX,

subscribers: Netflix said three months ago that it expected to lose 2 million subscribers in the second quarter, but then the streaming service split the fourth season of its megahit “Stranger Things” over the second and third quarters, which may have saved it from a decline. Even if Netflix managed to keep those customers around into July, however, it may just push the decline into the third quarter, so watch for the forecast as well.

Earnings preview: Netflix is pulling out all the stops to reverse a slide in subscribers