This post was originally published on this site

It’s been another terrifying time for U.S. stock-market investors — the S&P 500

SPX,

suffered its worst first-half for any year since 1970. Where do we go from here?

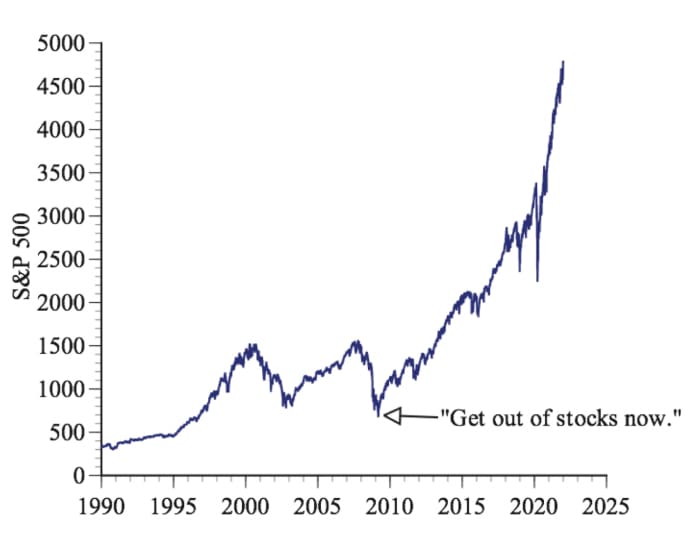

I remember the 2007-2008 crash when the S&P 500 fell 41% from its high and financial guru Zvi Bodie famously advised, “Unless you have the heart of a high stakes gambler, get out of stocks now.” Unfortunately he gave this advice in March 2009, which happened to be the bottom of the crash. When an interviewer asked Bodie, “Wouldn’t leaving the stock market right now be locking in your losses?,” Bodie replied, with no evident irony, “That is exactly right. You want to make sure you don’t lose more.”

My point is not to pick on Bodie. We’ve all made mistakes. My point is that reflexively selling after the market has gone down is seldom a good idea. Instead, we should take a deep breath, calm down, and, instead of thinking about whether stock prices are higher or lower than they were in the past, consider whether stock prices are high or low relative to their intrinsic values. For value investors, predicting ups and downs, tops and bottoms, is not the goal. The question is whether stocks are cheap or expensive.

Having lived through 1929’s Great Crash, John Burr Williams wrote his classic treatise, The Theory of Investment Value, arguing that the intrinsic, long-term value of a stock (or any asset) is the present value of the future cash an investor expects to receive, discounted by the investor’s “personal rate of interest.”

Instead of trying to guess whether a stock’s price will be higher or lower a few days, weeks or months from now, we should think about how much we would be willing to pay for the cash we expect to receive if we were to hold the stock forever. Not that we literally plan to hold any stock forever, but thinking this way forces us to stop wasting our time making ill-informed guesses about short-term fluctuations in stock prices.

Let’s make some back-of-the-envelope calculations for the S&P 500, using Williams’ dividend-discount model. With the simplifying assumption of a single required return and constant dividend growth, Williams derived this well-known valuation equation: V = D / R – g — where D is the value of the next dividend, R is the investor’s required rate of return, and g is the dividend growth rate.

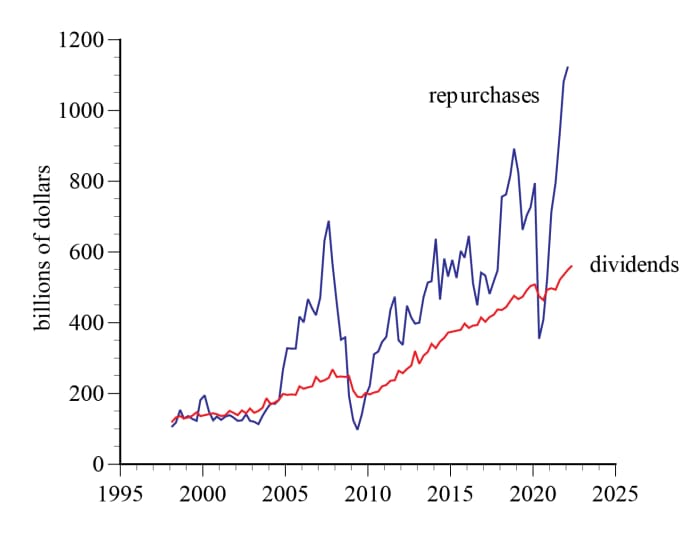

The total amount of cash flowing from a corporation to its shareholders consists of the dividends plus share repurchases. (The easiest way to confirm this logic is to imagine that a corporation has only one shareholder — the total cash flow is clearly dividends plus repurchases.) In recent years, corporate disbursements to shareholders have increasingly been in the form of repurchases—which makes sense because of their favorable tax treatment.

Interpreting D in the constant-growth dividend-discount model as the annual dividends plus buybacks, and adjusting for the way the S&P 500 Index is calculated, the current value of D for the S&P 500 is 194.

Allowing for 2021 to be an aberration, I will use a conservative value of 150. For a required rate of return, the current rates on U.S. Treasury bonds are 2.883.01% on 10-year bonds

TMUBMUSD10Y,

and 3.1120% on 30-year bonds

TMUBMUSD30Y,

I will use an 8% required return — which seems conservative to me — but you can use your own number.

The last input we need is the future rate of growth of S&P 500 dividends plus repurchases. Since 1998 (the earliest data I have), the annual growth rates have been about 6% for dividends and 10% for repurchases. For the sum, dividends plus buybacks, I am going to use the seemingly conservative value of 5%, which is a little lower than the long-run growth of U.S. GDP.

With these cautious assumptions, Williams’ valuation equation gives an intrinsic value of V= $150 / (0.08 – 0.05) = 4500 — which is 15% above the S&P 500’s July 7 close at 3,902.62.

How confident should we be that stocks are cheap? Benjamin Graham, who, like Williams, experienced the Great Crash firsthand, was another founding father of value investing. He advised investors to pay no more for a stock than a price that allows a margin of safety, “rendering unnecessary an accurate estimate of the future.”

Warren Buffett explained it this way: “You have to have the knowledge to enable you to make a very general estimate about the value of the underlying business. But you do not cut it close. That is what Ben Graham meant by having a margin of safety. You don’t try to buy businesses worth $83 million for $80 million. You leave yourself an enormous margin. When you build a bridge, you insist it can carry 30,000 pounds, but you only drive 10,000 pound trucks across it. And that same principle works in investing.”

Here, the most consequential uncertainty is the growth rate of dividends and share repurchases. We can assess the robustness of our calculations by trying some alternative growth-rate values, such as 4% or 6%, which give intrinsic values of 3750 and 7500, respectively.

Instead of either/or values, we can quantify our uncertainty by putting probabilities on our assumptions. For example, we might say that our beliefs about the long-run growth rate of dividends plus repurchases can be described by a normal distribution with a mean of 5% and a standard deviation of 0.5%, but ruling out values below 3% or above 7%. With these assumptions, our valuation beliefs can be summarized by the probability distribution shown below:

This probability distribution is slightly skewed to the right with a mean of 5151.48 and a median of 4999.69. There is approximately a 4% probability that the intrinsic value of the S&P 500 is less than 3902.62, its value on July 7.

We can interpret this 4% probability by saying that our assumptions imply that if we buy the S&P 500 for $3902.62, we believe that there is only a 4% chance that we will have paid too much. This is a simple quantification of Graham’s margin of safety.

What’s the proverbial bottom line? Nobody knows where stock prices will be next week, next month, or at the end of the year. But a range of plausible, conservative assumptions about the future cash flow from stocks indicates that it is highly likely that the intrinsic value of the S&P 500 is currently above its market price. Stocks are cheap.

Gary N. Smith is the Fletcher Jones Professor of Economics at Pomona College. He is the author of “The AI Delusion,“(Oxford, 2018), co-author (with Jay Cordes) of “The 9 Pitfalls of Data Science” (Oxford 2019), and author of “The Phantom Pattern Problem” (Oxford 2020).

More: One of Wall Street’s biggest bulls lowers S&P 500 target — still sees 25% upside by year-end