This post was originally published on this site

Wall Street investors specialized in buying risky forms of corporate debt to slice-and-dice into securities have added an estimated $2 billion in high-yield, or “junk bonds,” to their funds already this year, according to an analysis by BofA Global.

Funds managed by the Carlyle Group Inc.

CG,

KKR & Co. Inc.

KKR,

and Ares Management Corp.

ARES,

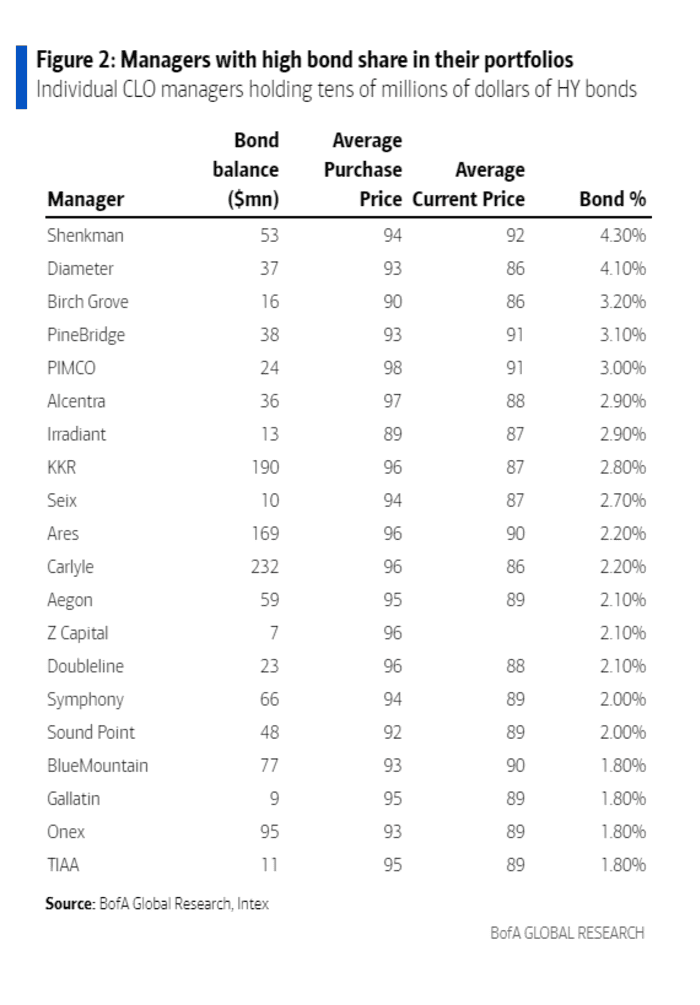

— some of the world’s biggest names in debt — were among a group of investors (see chart) that BofA Global pegged as adding “tens of millions of dollars” in junk bonds to their so-called “collateralized loan obligations” (CLOs), funds created mainly to invest in leveraged loans.

Big names in debt adding junk bonds to funds

BofA Global, Index

Like junk bonds, leveraged loans have emerged in recent decades as a key way for companies with an elevated risk of default to obtain financing from Wall Street, including to help fund their buyouts. Thus, the “junk” ratings.

After the Global Financial Crisis, rules were passed to help limit what CLOs can hold in an attempt to avoid another CDO-style implosion at banks, but were loosened in 2020. Most now can keep up to 5% of their holdings in bonds.

CLOs essentially work like this: They are managed funds that can top $1 billion in size. Mostly, they hold slices of loans to companies in various industries, with the aim of diversifying the fund’s risk. Investors can buy bonds sold by the fund with AAA (perceived as a safe-haven assets) to BB (a higher default risk) credit ratings.

The increased allocation by debt funds to corporate bonds comes during a tough stretch for investors, with the S&P 500

SPX,

falling into a bear market and bonds also failing to hold up.

The first-half of 2022 saw historic losses in financial markets as the Federal Reserve began to aggressively raise interest rates and shrink its balance sheet in a bid to fight inflation near a 40-year high. Mounting fears of a U.S. recession have led some investors to brace for worse days ahead, particularly if companies with weaker finances and higher borrowing costs end up hard-hit.

See: This segment of the corporate bond market is flashing a warning that investors shouldn’t ignore

With that backdrop, investors have pulled some $40 billion from funds that invest in U.S. high-yield bonds already this year, roughly 11% of the sector’s assets under management at the beginning of January, according to Goldman Sachs data. Major exchange-traded funds in the sector also have been jolted by sharply negative returns.

The carnage, however, appears to be attracting a powerful type of niche investor, with a long history in distressed debt.

“CLOs emerged as a new investor in HY over the past year, lured by deep price discounts and better quality,” Oleg Melentyev’s high-yield credit research team wrote, in a Friday note. “We estimate HY bonds have increased by $2bn YTD in CLOs. Interestingly, some managers have also picked up IG bonds at discount prices (around $90pts) with CLO portfolios now holding Apple

AAPL,

and Microsoft

MSFT,

bonds.”

The flood of deeply discounted corporate bonds is part of a trend that MarketWatch has been tracking this year.

BofA pegged total returns for U.S. high-yield bonds at roughly -13%, with a pace of losses “similar to 2008″ when the sector ended the year at -26%.

Despite their distressed prices, high-yield bonds have benefited from having a high exposure to the energy and commodities complex this year, particularly with U.S. oil prices

CL00,

CLQ22,

settling near $108 a barrel on Friday.

Carlyle, KKR and Ares did not immediately respond to requests for comment.