This post was originally published on this site

This year has been inescapably awful for investors, as this chart on first-half performance shows.

So in an environment where every short-term move seems to be a bad one, it might be worth getting a longer-term perspective.

Monish Pabrai, the founder of both the Pabrai Investment Funds and the Dhando Funds and an author on investing, gave an interesting interview earlier this month on what he has learned from legendary investors Warren Buffett and Charlie Munger.

As the dot-com bubble at the turn of the century became apparent, he decided to invest in very basic businesses, like funeral homes and steel mills, at two and three times earnings. “I saw the dot-com crash, I didn’t see the severity of the financial crisis coming until it was well into it,” he said.

Right now, he sees bubbles in crypto and in meme stocks like GameStop

GME,

and AMC

AMC,

In the tech sector, he’s not sure if it has corrected fully or not. “I don’t have bets in that area so it’s not very relevant.”

“I think what investors would be better off doing is not fixating on these things, and just try to focus on things that they are able to understand really well,” he said. TJ Maxx

TJX,

he says, is an example of a company that has done well for a long period of time, buying excess inventory at discounts and reselling them.

Funeral businesses he says are another example. “I don’t know who’s going to die in St. Louis next year, but I know how many are going to die ,” he says. The funeral service business isn’t hugely price competitive, as people don’t look for the lowest price to bury their loved ones. “Twenty-two year-olds don’t aspire to go into the funeral business so it has limited competition,” he adds.

Pabrai talks about the advantage of being unoriginal. “Munger actually endorses cloning quite a bit. In investing, no one is smart enough to figure it all out themselves, so one of the things that is a huge advantage in investing is if you can look at what other people you admire and trust have already put their money into.”

He advises against using leverage, because you may not get to play out your hand because of the gyrations in markets.

He regrets being too price sensitive and not getting back into compounders in 2009. “I’m not really interested in making an investment where I can double my money, what I’m really interested is, can I hold something for 10 or 20 years, and can we get 30, 50, 100 times of what we put in.”

Pobrai talked of Warren Buffett’s investment in Japanese trading houses — that Berkshire Hathaway

BRK.B,

funded by borrowing in yen at a low rate, and getting dividend yields of around 7% to 8%.

“He is able to show the world that, hey look, there’s something that was sitting there where I could put a lot of money in it but I go to $6-$7 billion without any risk really, and I’m going to make several billion on it.” But the real benefit is that it uses Buffett’s brainpower, just as playing bridge is a use of gray matter from the world’s most famous investor.

The buzz

Key manufacturing data is ahead, with expectations the June Institute for Supply Management index will slow to a reading of 54.3%. Any reading above 50% indicates improving conditions. The May construction spending report also is due for release. Eurozone consumer prices rose to a record high of 8.6% in June.

Micron Technology

MU,

shares fell 4% in premarket trade after the microchip maker beat expectations on fiscal third-quarter earnings but projected current quarter results well below analyst estimates.

Pabrai said Micron is his largest holding. “For the longest time, the memory business was a terrible business,” he said in an earlier interview. But now with just three major players, and with about 30% of the cost of data centers going to memory chips, memory is a tax on all the streaming and e-commerce, he says.

Kohl’s

KSS,

shares plunged after the retailer said talks to be bought by Franchise Group

FRG,

have ended. Kohl’s also lowered its outlook for sales, now expecting second-quarter revenue to be down by a high single-digit percentage.

The market

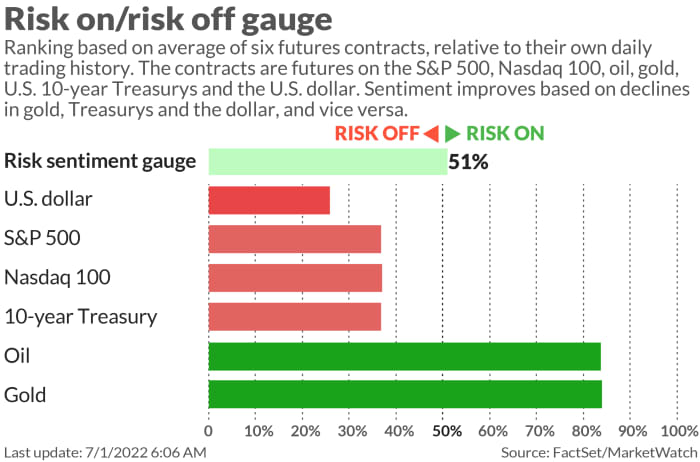

U.S. stock futures

ES00,

NQ00,

pointed to a sluggish start to the third quarter, though futures were well off their early morning lows. Oil futures

CL.1,

rose, while the yield on the 10-year Treasury

TMUBMUSD10Y,

was below 3%.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

NIO, |

Nio |

|

MULN, |

Mullen Automotive |

|

AAPL, |

Apple |

|

AMZN, |

Amazon.com |

|

EVFM, |

Evofem Biosciences |

|

NVDA, |

Nvidida |

|

AMD, |

Advanced Micro Devices |

Random reads

The missing cryptoqueen has been added to the FBI’s ten most wanted list.

On one hour-long flight, Delta Air Lines

DAL,

offered $10,000 to passengers to get bumped.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.