This post was originally published on this site

The current high inflation environment is often compared to the 1970s. But perhaps a more apt comparison would be to the 1870s.

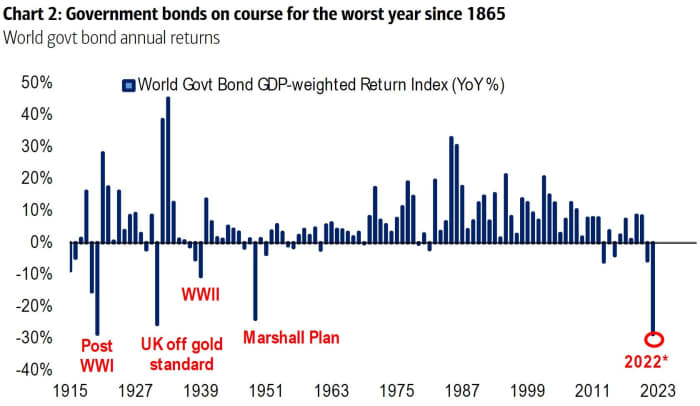

According to Bank of America, government bonds are on track for their worst year since 1865, the year the U.S. Civil War ended.

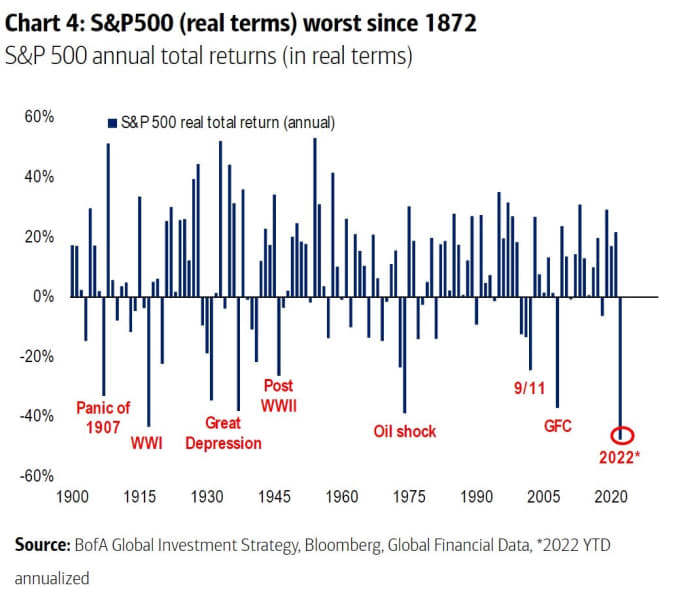

Meanwhile, the stock market, when adjusted for inflation, is on track for its worst year since 1872, again according to Bank of America calculations.

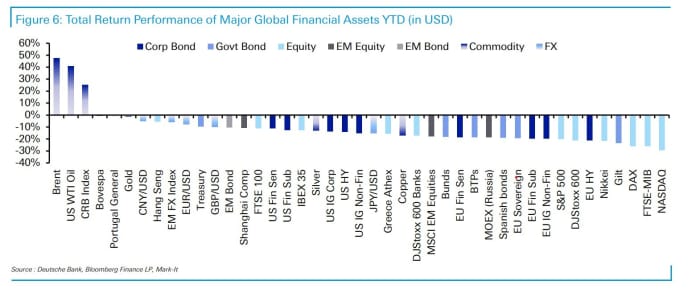

Deutsche Bank presents a chart showing a wide variety of asset performance during the first half. Only energy and commodities made any sort of headway in the first half.

The official tally, in nominal terms, is that the S&P 500

SPX,

dropped 20.6% in the first half of the year, and the Nasdaq Composite

COMP,

dropped 29.5%.