This post was originally published on this site

It’s a cool breeze during a hot moment, but it’s not the summer weather.

As record-breaking numbers of Americans pack their cars and travel to Fourth of July barbecues that will cost them more than last year, they’ll fill up at gas stations where they are likely to be paying just a little less at the pump.

Believe it or not, national gas price averages recently have been declining. Slightly.

On Friday, the average edged down again to $4.84, down from the record high of $5.01 set in mid-June, AAA said. A gallon still costs over 20 cents more than it did a month ago and $1.74 more than a year ago.

Drivers have been through two straight weeks of declining average prices and the downward trend is poised to continue a third week, according to Patrick De Haan, head of petroleum analysis at GasBuddy. Gas prices notched a record-high $5.03 on June 16 and the average price is down to $4.84, according to the gas price aggregator.

The price-easing trend “doesn’t look like it’s going to be brief,” De Haan said. The welcome trend could possibly continue for a fourth and fifth week too, he said. From that point on, he said, it’s too far out to venture a guess on what the future holds. There are various factors that could push the price right back up, like a hurricane toppling supply chains, De Haan has noted.

Make no mistake, gas prices are still exceptionally high and could even get to $6 per gallon as of late summer, according to some forecasts.

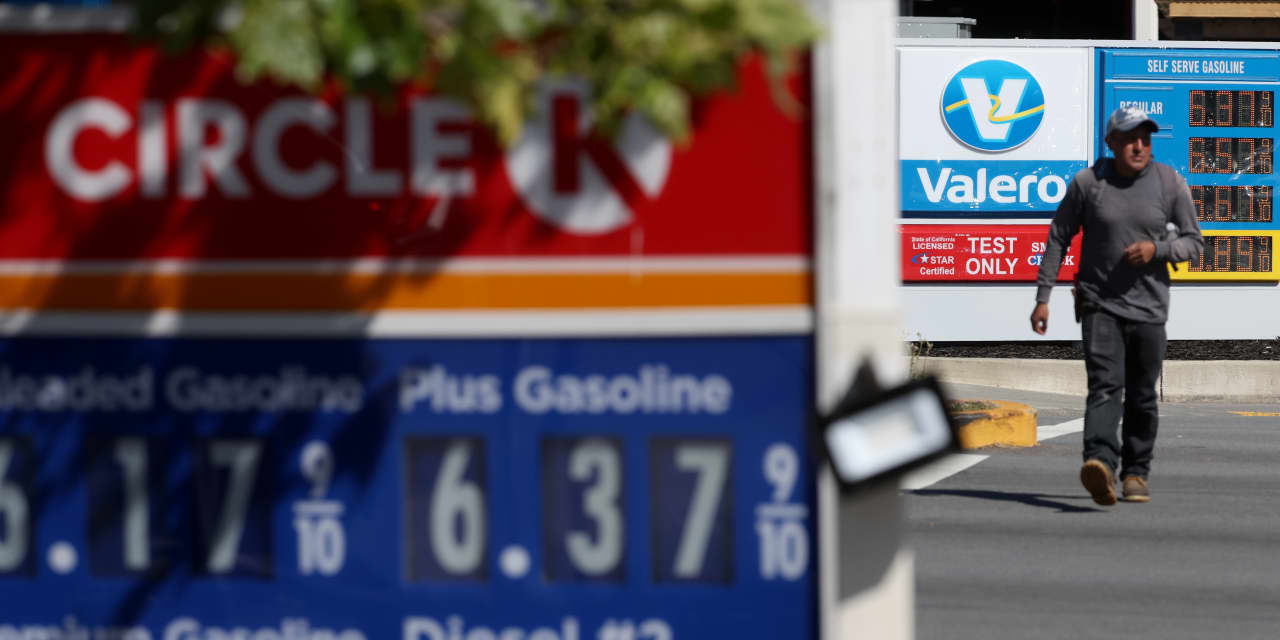

Millions of drivers are paying prices far beyond the average, starting in California. There, drivers — who are now in line to get “inflation relief” checks from the state — were paying $6.27 per gallon ***on Friday, according to AAA and GasBuddy.***

At a time when inflation stays hot and Russia’s war in Ukraine shows no signs of cooling, what’s creating the slight drop in gas prices? And how long could the trend continue as the summer driving season starts?

It’s a mix of more supply, softening demand and macro-level recession anxiety rattling oil investors, observers say.

For De Haan, the big reason is more supply through more refining action. America’s refineries worked at 95% of their “operable capacity” in the week ending June 24, according to U.S. Energy Information Administration data. That’s the highest read in 30 years, according to a note from Phil Flynn, senior market analyst at The Price Futures Group.

A month ago, the operable capacity rate was 92.6% and two months ago, it was 90.3%, De Haan said. America can benefit from more refining capacity, but the numbers show that the refineries that are working are doing it briskly, he said.

“The supply part of the equation is improving, and the demand side is holding,” said De Haan, adding that higher prices have only crimped demand to a certain extent for now.

One demand gauge is the U.S. Energy Information Administration’s estimated daily amount of product supplied, according to AAA spokesman Devin Gladden. For the week ending June 24, it was 8.93 million barrels daily. The prior week, it was 8.943 million barrels.

“People just can’t afford high prices,” Gladden said. It’s a theme that’s played out in some surveys, including a poll from Cars.com showing many drivers opting for closer destinations to save on gas.

High prices seldom scare away consumers and puncture demand on a large scale, said a Wednesday note from RBC Capital Markets. In three decades, there were 39 months where prices popped 30% year-over-year, analysts wrote. When that happened, there were only 12 months were demand fell at least 2%, they noted.

Five occurred in 2008, but a comparison to now didn’t work because, analysts said, consumers were in better financial condition.

“Despite record pump prices, current [consumer] expenditure as a percentage of total spend remains below historical averages,” the note said. “As such, when push comes to shove, there is discretionary spending that could be pared back before core items like gasoline are truly impacted.”

It’s possible demand increases for the holiday travel, bringing prices with it, Gladden said. “After that, prices could continue on that downward trajectory,” he said.

Oil prices are softening as investors consider what demand will be if a recession occurs, Gladden said. “The downward trajectory is certainly being passed on to consumers.”

Just don’t kid yourself, he cautioned. So long as the price of crude oil — the main component of gas prices — stays above $100/barrel, any real relief isn’t in sight. On Thursday, West Texas Intermediate crude for August delivery fell to by $4.01 to $105.77.

Oil futures rose again Friday, with the prices on West Texas Intermediate climbing $1.81, or 1.71%, to $107.57 a barrel. One analyst said markets are caught in a “push-pull” between worries about economic worries in the future and the oil market’s strength now.

The pause on state-level gas taxes may also be nipping at prices. That’s even if skeptics call the move a gimmick.

For example, Georgia’s halt on its gas tax has shaved away between 16.8 cents and 18.8 per gallon, according to researchers at the Penn Wharton Budget Model. Connecticut’s gas tax halt will end on June and drivers have saved between 17.9 cents and 21.7 cents per gallon.

President Joe Biden wants lawmakers to pause the federal 18.4 cent gas tax during the summer, but analysts doubt that will happen.

This story was updated on July 1.