This post was originally published on this site

Shares of Nike Inc. took a tumble Tuesday toward a two-year low after multiple Wall Street analysts cut their price targets, as the sporting apparel and accessories giant’s disappointing gross margin guidance offset fiscal fourth-quarter profit and revenue beats.

The stock

NKE,

dropped $5.94, or 5.4%, in midday trading, enough to pace the Dow Jones Industrial Average’s

DJIA,

decliners, and to put it on track for the lowest close since Aug. 7, 2020. The stock’s price decline cut about 39 points off the Dow’s price, while the Dow fell 195 points, or 0.6%.

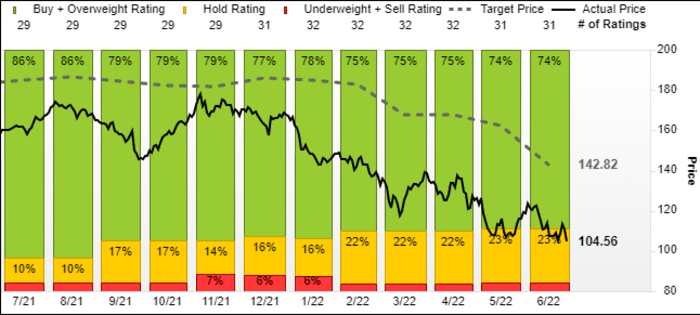

Of the 31 analysts surveyed by FactSet, no less than 14 lowered their price targets. That lowered the average price target to $142.82 from $162.29 at the end of May.

But Wall Street remained overwhelmingly bullish on Nike, as 23 analysts had the equivalent of buy ratings on the stock, and the new target implied about 37% upside from current levels.

FactSet

Nike reported late Monday net income for the quarter to May 31 that slipped to $1.44 billion, or 90 cents a share, from $1.51 billion, or 93 cents a share, in the same period a year ago, and above the FactSet consensus of 80 cents a share.

Revenue slipped 0.9% to $12.23 billion, but beat the FactSet consensus of $12.06 billion.

Meanwhile, cost of sales rose 0.6% to $6.73 billion and gross margin contracted to 45.0% from 45.8%, as higher inventory obsolescence reserves in China and increased freight and logistics costs offset higher selling prices and favorable currency moves.

And on the post-earnings conference call with analysts, Chief Financial Officer Matthew Friend said fiscal 2023 gross margins are expected to be flat to down 50 basis points (0.50 percentage points) from the prior year, citing continued elevated freight and product costs.

Stifel Nicolaus analyst Jim Duffy reiterated the buy rating he’s had on Nike for at least the past four years, but dropped his stock price target to $135 from $150. Duffy said not only did fourth-quarter margin miss his forecast for an improvement to 47.0%, the full-year guidance was also “light.”

Duffy said by his calculation Nike’s margin guidance implied fiscal 2023 earnings per share of $3.25 to $4.00, which is below his EPS estimate at the time of $4.48.

Wedbush’s Tom Nikic also remained bullish on the stock but trimmed his target to $130 from $139, citing a “noisy” quarterly report and full-year outlook that was “more conservative than expected.”

Nikic said the company’s outlook showed that COVID-19-related lockdowns in China hit the company hard, and led to “lingering” margin issues.

“While trends in this market have slowly improved amid reopening, there’s now excess supply in the marketplace, which is likely to cause a highly promotional environment in the near term,” Nikic wrote in a note to clients.

Nikic suggested Nike’s margin guidance implies an EPS range of $3.25 to $3.85.

The stock has plunged 37.2% so far this year, which currently makes it the worst year-to-date performer among Dow components. In comparison, the Dow has lost 14.0% this year.