This post was originally published on this site

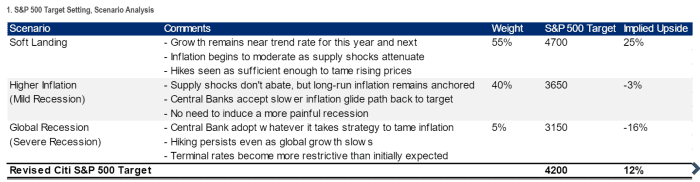

Citigroup analysts have cut their S&P 500 target for this year by 500 points to 4,200, after stubbornly high inflation spurred the Federal Reserve to aggressively raise interest rates.

“Fed hawkishness and the rising real rate impact on valuations has been a defining feature” of the stock market drawdown in the first half of 2022, Citigroup analysts said in a research note on U.S. equity strategy after the market’s close Friday. Their revised target is above the S&P 500’s

SPX,

trading level early afternoon Monday of around 3,915, according to FactSet data, at last check.

The U.S. stock market has slumped in 2022, with the S&P 500 falling into a bear market amid investor fears that the Fed risks pushing the economy into a recession as it battles the hottest inflation in about 40 years. Bearish positioning combined with “better than feared earnings and signs of peaking rates,” sets up a “positive” second half of the year, according to the Citi note.

“Our base 4700 target in place since early March accounted for geopolitical overhang on valuations but with an economic soft landing,” the Citi analysts said. Their revised S&P 500 target for 2022 was determined by blending their “soft landing” and recession scenarios.

CITI RESEARCH NOTE DATED JUNE 24, 2022

Citi economists now peg odds of a global recession at 50%, according to the note.

“We suspect that recession timing is skewed toward mid-’23,” the bank’s analysts said. “Lingering inflation and risk of stagflation have not been resolved,” they said, adding that “earnings risk is a bigger issue for next year.”

Last week Morgan Stanley’s chief U.S. equity strategist Mike Wilson warned that the stock market was not pricing in the risk of recession, which could send the S&P 500 to around 3,000.

Read: Recession is challenging inflation as top fear among stock and bond investors

U.S. stocks opened modestly higher Monday after fresh economic data showed new orders for durable goods in May were stronger than forecast. The S&P 500 was struggling for direction in early afternoon trading Monday, while the Dow Jones Industrial Average

DJIA,

was up 0.1% and the Nasdaq Composite

COMP,

was down 0.4%, FactSet data show, at last check.

Meanwhile, the Citi analysts said that “a series of macro indicators continue to support an 8% top down earnings growth picture for this year.” They wrote that “earnings resiliency as valuations have largely rightsized” has set the stage for their latest call for the S&P 500.

“We admittedly have been overly optimistic regarding U.S. equities thus far this year,” the Citi analysts said. “We expect a U.S. equities rebound” during the second half of 2022, “which will only lessen the full year drawdown.”

The S&P 500 has dropped almost 18% in 2022 based on early afternoon trading Monday, according to FactSet data.