This post was originally published on this site

The slumping stock market may soon get a seasonal boost, at least that is what history shows, according to Bespoke Investment Group.

“There’s not much for investors to get excited about when it comes to the equity market these days, but in our search for silver linings, the calendar is one trend that is starting to work in the market’s favor,” Bespoke said in an emailed note Monday.

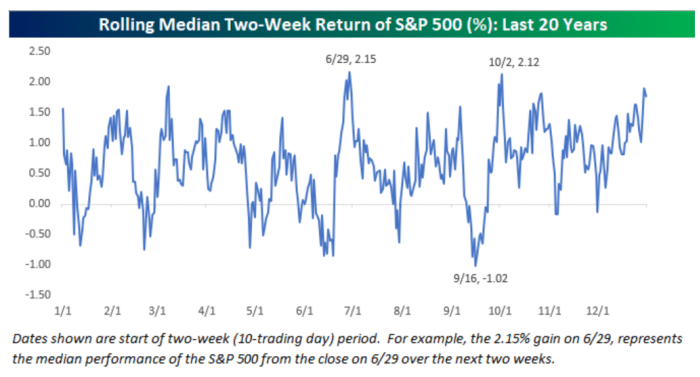

The S&P 500 historically performs well during the two weeks following the close on June 29, with its 2.15% gain over that stretch being “the best of any other day on the calendar over the last 20 years,” the note shows. The trend is captured in this chart below.

BESPOKE INVESTMENT GROUP

The chart shows that Oct. 2 is the second-best day based on returns seen over the subsequent two weeks. And “the period from the close on 9/16 has been the weakest two-week period on the calendar with the S&P 500 declining by a median of 1.02% over the last 20 years.”

“Seasonal patterns should never be a primary basis for any investment decision, but it certainly helps to know what the seasonal tendencies are at different times of the year and therefore is a topic we pay attention to,” Bespoke wrote. “If there’s ever a time that investors could use a seasonal pick-me-up, it would be as we close out the worst first half for the market in over 50 years!”

The S&P 500

SPX,

has sunk around 18% this year based on Monday afternoon trading, while the Dow Jones Industrial Average

DJIA,

has dropped more than 13% and the Nasdaq Composite

COMP,

has tumbled around 26%, according to FactSet data, at last check.