This post was originally published on this site

The outlook for the semiconductor sector is moving from bad to worse, and investors appear to be moving their money into the software sector as a result.

Pessimism about the future of the chip sector has been growing after a mixed round of forecasts in the second quarter, with analysts signaling that the pandemic-driven boost in sales amid supply problems may dry up. They fear that customers overbought during the supply-chain frenzy, which would lead them to halt purchases because they already have inventory, and are beginning to see signs that is happening.

Don’t miss: Why semiconductor stocks are ‘almost uninvestable’ despite record earnings amid a global shortage

Mizuho analyst Jordan Klein and Bernstein analyst Stacy Rasgon checked in this week with notes outlining their doubts that the boom in chip sales will continue into next year.

“It feels worse that it has been across buy-side all year,” Klein wrote in a note Friday. “Everyone super negative and cautious based on checks out of Asia suggesting memory pricing falling, smartphone and PC supply chains downticking as inventories rise and demand/orders slow.”

“While data center/server and auto supply chains sound good, few seem to want to buy/add to these semi stocks fearing weakness elsewhere will hurt all semi sentiment and valuations,” Klein said. “And if cloud capex spend gets cut, it could be game over for some of the liked and owned semi names like Marvell Technology Inc.

MRVL,

Advanced Micro Devices Inc.

AMD,

Nvidia Corp.

NVDA,

that target the data center.”

Rasgon wrote on Tuesday that “it feels like investors are waiting for somebody to blink,” as Wall Street expects confirmation from some chip makers in the coming earnings season that sales will suffer from overbought inventory.

“The ‘peak cycle’ vs ‘stronger for longer’ debate is no longer a debate with multiples collapsing amid double ordering worries, consumer weakness, inflation, macro, and new headwinds (Shanghai, Ukraine etc.), and investors are now actively seeking estimate cuts,” Rasgon said.

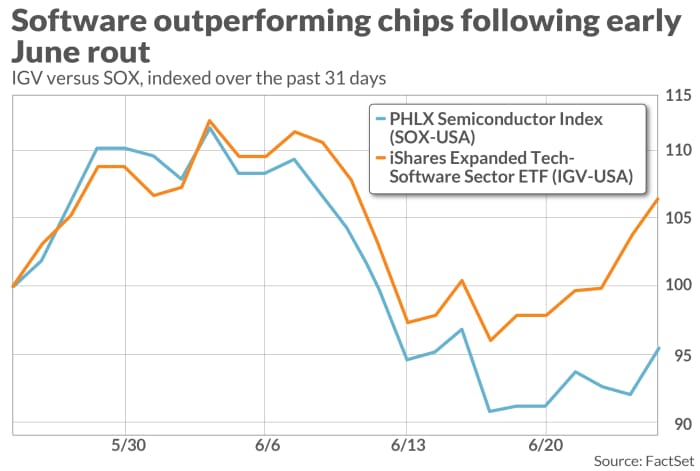

Klein tracked the disinvestment from chips into the software sector, noting that software stocks have bounced back considerably better than chip stocks from the broad selloff in the first half of June. Klein said he’s seeing a “major rotation” out of chip stocks, following a rotation out of energy and materials stocks.

Over the past 31 days, the iShares Expanded Tech-Software Sector ETF

IGV,

is up more than 6%, while the PHLX Semiconductor Index

SOX,

is down more than 4% over the same period. Year-to-date, the IGV is down 28% and the SOX index is down more than 31%.

In comparison, the Energy Select Sector SPDR ETF

XLE,

is down nearly 15% over the past 31 days, even though it’s the only State Street SPDR sector ETF that’s in positive territory for the year, with a 30% gain. Similarly, the Materials Select Sector SPDR ETF

XLB,

is down 9% over the past 31 days, but unlike energy, the materials ETF is down nearly 17% for the year.

“How much of this is really true buying remains in question,” Klein noted. “Feels much more squeezy as interest rates have pulled back and growth factor working vs the inflation winners.”

Mizuho’s cash equity desk, however, saw a key trend on Thursday of “real size selling” of energy stocks, and some “real buying in high growth software.”

“Not sure if this is money coming into software fearing a sustained move higher in sector or just more dumping semis expecting poor guides and confirmation that demand/orders are slowing,” Klein wrote, adding that recent conversations over the past week indicate that investors are becoming even more negative about chip stocks.

On Tuesday, Morgan Stanley resumed coverage of AMD with an overweight rating, now that the investment firm is done advising Xilinx following its acquisition by AMD, but that optimism didn’t extend as much to other chip makers. For its part, at AMD’s analyst day two weeks ago, the chip maker stuck to its outlook issued in May, and said it expects average annual growth of about 20% over the next three to four years.

This past earnings season Intel Corp.

INTC,

doubled down on its bullish 2022 outlook even though the current quarter shows signs of weakness. And on Wednesday, Intel delayed its groundbreaking ceremony for its Ohio fab as enthusiasm in Congress to support the chip industry appears to have waned.

Read: Intel wins latest race in chip uses for the cloud, says KeyBanc Capital Markets

Qualcomm Inc.’s

QCOM,

outlook was bullish, but analysts could see support in the short term given strength in its handset business. Nvidia cut its outlook because of China shutdowns and lost Russia revenue because of the war in Ukraine, and Wall Street took that as the long-awaited “cut” for the stock. Cisco also issued a poor outlook because of the China shutdowns and shares saw their worst day in more than a decade.

Chip-equipment suppliers were less optimistic because of continuing supply chain problems holding them back. That was the case with Applied Materials Inc.’s

AMAT,

ASML Holding NV

ASML,

Lam Research Corp.

LRCX,

and KLA Corp.

KLAC,