This post was originally published on this site

Investors have stocked away more cash now than they did in the early days of the coronavirus pandemic, according to an analysis from JPMorgan.

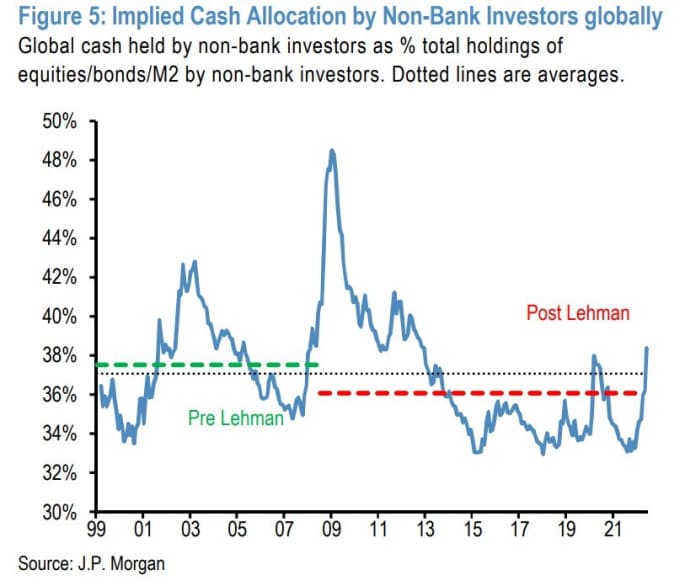

The implied cash allocation by non-bank investors, based on the stock of the money supply measure known as M2 to the stock of financial assets, has risen sharply in recent weeks.

“With investors currently very overweight cash, both equities and bonds should find support into the second half of the year,” said Nikolaos Panigirtzoglou, a London-based strategist at JPMorgan.

That should be a help after what’s been a rough year for both asset classes. The S&P 500

SPX,

has dropped 21% this year, and the S&P U.S. government bond index has dropped 9%.

Leveraged investors appear to have retrenched abruptly last week, said Panigirtzoglou, judging by its estimate for S&P 500 index mini futures positions. “Our S&P 500 futures position proxy suggests that almost all of the previous post-pandemic position build up in S&P 500 futures has been unwound this year,” he said.

Panigirtzoglou also examined the performance of stocks and earnings during the past 11 recessions. The median price decline peak-to-trough in the S&P 500 is 22%, and the earnings per share decline is 17%. In what he calls mild recessions — based on whether earnings fell by more or less than the median in the past 11 U.S. recessions — the S&P 500 price decline peak-to-trough is 18% and the EPS decline is 9%, compared to the 33% price drop and 24% earnings fall in deep recessions.

“While a mild recession seems to be already embedded in this year’s equity market declines, a deep recession is not yet in the price,” he said.