This post was originally published on this site

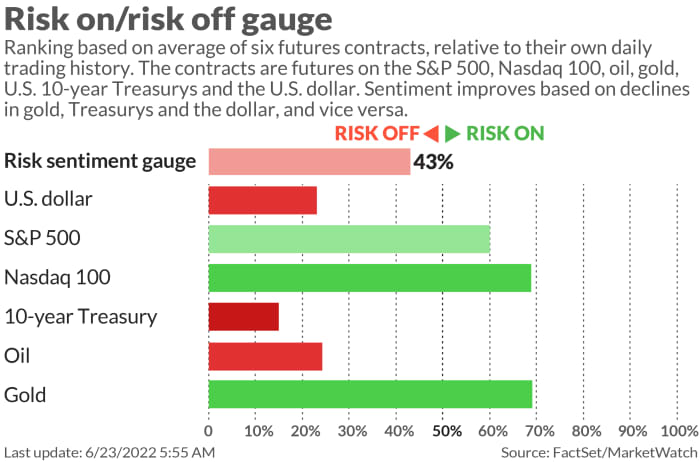

Stocks are on the rebound again, at least that’s the vibe from futures.

That’s a day after Federal Reserve Chair Jerome Powell confirmed to lawmakers, what markets already knew — that a soft economic landing might be tricky while taming the inflation beast.

Along with average investors, hedge funds have had a rough start to this year. Managers were down about -0.56% in May, outperforming the Nasdaq by 1.49%, but trailing the S&P 500

SPX,

by 0.57%, according to the Eurekahedge Report.

But one manager has clawed out some gains this year. That’s AQR Capital Management’s founder Cliff Asness, whose Equity Market Neutral Global Value strategy is up 48% so far this year, while his absolute return strategy has gained 35%, according to CNBC, which interviewed him late Wednesday.

In our call of the day, Asness offers up a couple of stock picks from his quant process and challenges the meme crowd over his AMC Entertainment

AMC,

short position. Firstly, the star manager touched on broader markets and how he is feeling about hard-hit bonds these days.

“We don’t dislike them quite as much as six months ago,” Asness told CNBC. “If you forced me, I would say we’re negative on bonds, also in the trend-following world that doesn’t really look at value and in the managed futures world, we’re certainly short bonds.”

“I don’t think I can say bonds are a value play,” he said, and that’s opposed to a couple of tech names that he reluctantly shared. “This doesn’t mean if we enter a recession, there won’t be a big bond rally, but in terms of the things we compare yields to, bonds are considerably less disastrous. But that is damning with faint praise.”

Would his value plays be in trouble if a recession arrives? Asness said his strategists aren’t that sensitive to macro factors, partly because they don’t take big industry bets. “I don’t think we have a very direct bet on recession versus non-recession.”

He said they are sticking with some value plays in the portfolio because they always like to have that exposure and especially “when it looks very, very cheap.” While there has been a pullback for value in June, highs are so high they’re tied with the tech bubble when it comes to relative prices between value and growth, he said.

CNBC

As for value-play stocks that fall into his playbook — cheap, profitable, low risk and with good momentum — Asness pointed to tech giants Meta Platforms

META,

and Amazon

AMZN,

down 53% and 34% year-to-date.

“Both Meta and Amazon are generally liked by our process now. They’re cheap versus their peers…we do industry comparisons and they’re not always perfect — Meta is social media and Amazon is internet retail…but they both look good on a combination of value, profitability and low risk investing…Amazon is good on all three,” he said.

In his broader interview with CNBC, Asness also laid down a challenge to the memes, announcing a new short position AMC Entertainment. “It’s terrible on everything we care about,” Asness reportedly said. “It is super expensive, super unprofitable and super high beta and volatility.”

“I dare all the meme stock maniacs to try to hurt us,” he jabbed.

Judging by the Twitter reaction so far, it looks like the meme crowd isn’t backing down, while AMC is up 1.5% in premarket.

The buzz

“Gigantic money furnaces.” That’s how Tesla

TSLA,

CEO Elon Musk describes the electric-vehicle maker’s two newest factories.

EV group Polestar will debut on the Nasdaq Friday after its deal with special-purpose acquisition company Gores Guggenheim

GGPI,

was approved.

Stock in Darden Restaurants

DRI,

is up after its board OK’d $1 billion in share buybacks.

Accenture stock

ACN,

is falling on an earnings miss for the consulting company.

Warren Buffett’s Berkshire Hathaway

BRK.A,

BRK.B,

disclosed buying another 9.6 million shares of Occidental Petroleum

OXY,

Those shares are up.

JPMorgan says investors have more cash tucked away now, than during early days of the COVID-19 pandemic.

Powell heads for his second day of testimony on Capitol Hill, kicking off at 10 a.m. Eastern. Weekly jobless claims came in slightly higher than consensus, with S&P Global’s U.S. manufacturing and services purchasing managers indexes still to come.

The markets

Stock futures

ES00,

NQ00,

have turned higher, with bond yields

TMUBMUSD10Y,

TMUBMUSD02Y,

easing back, while oil

CL.1,

BRN00,

keeps falling, a day after settling at a six-week low. Bitcoin

BTCUSD,

continues to hover around the $20,000 mark.

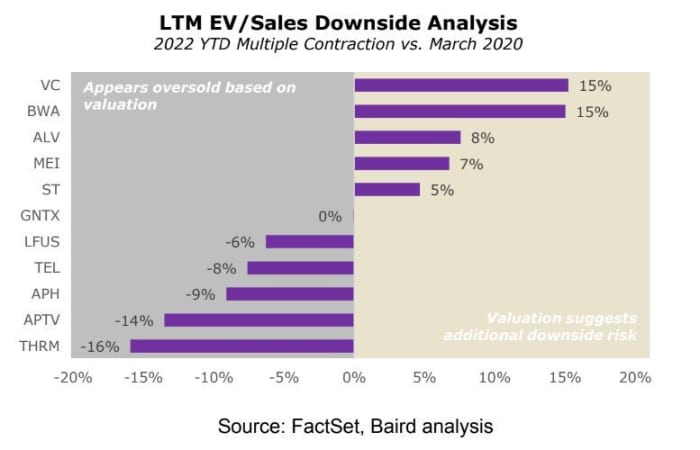

The chart

Auto supplier stocks have largely priced in an economic recession, and have “still vibrant tailwinds,” says Luke Junk, research analyst at Baird. He says investors looking for “already washed-out sectors.” should feast their eyes on companies dealing with electrification, active safety, in-vehicle technology. Gentherm

THRM,

and Aptiv

APTV,

are two oversold names that stand out for Junk.

FactSet, Baird

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

NIO, |

NIO |

|

REV, |

Revlon |

|

AAPL, |

Apple |

|

MULN, |

Mullen Automotive |

|

AMZN, |

Amazon |

|

RDBX, |

Redbox Entertainment |

|

BOXD, |

Boxed |

Random reads

Six of the world’s most livable cities are in Europe.

Transgender kids’ parents drain their savings to flee conservative states.

A quick-thinking coach saved the life of swimmer Anita Alvarez at an international competition on Wednesday:

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.