This post was originally published on this site

The price is not right.

That’s the verdict from strategists at Morgan Stanley and Goldman Sachs, who each warned as a new week kicked off that the stock market wasn’t fully pricing in a recession. And that’s as U.S. equities

SPX,

were off to a solid start as trading resumed after Monday’s Juneteenth holiday.

“With our view for lower multiples and earnings now more consensus, the markets are more fairly priced. However, it does not price the risk of a recession, in our view, which is 15-20% lower, or roughly 3000,” said Mike Wilson, Morgan Stanley’s chief U.S. equity strategist and one of most bearish voices on Wall Street this year, in a note Tuesday. “The Bear market will not be over until recession arrives or the risk of one is extinguished.”

Read: Elon Musk joins a chorus of Wall Street forecasters in predicting a U.S. recession

Wilson sees much of Wall Street still assuming much higher price-to-earnings ratios for year-end S&P 500 target prices. His bank was “very out of consensus” coming into 2022 with a forecast for a 20%-plus fall in valuations — they’re now down 28% year-to-date. But Morgan Stanley

MS,

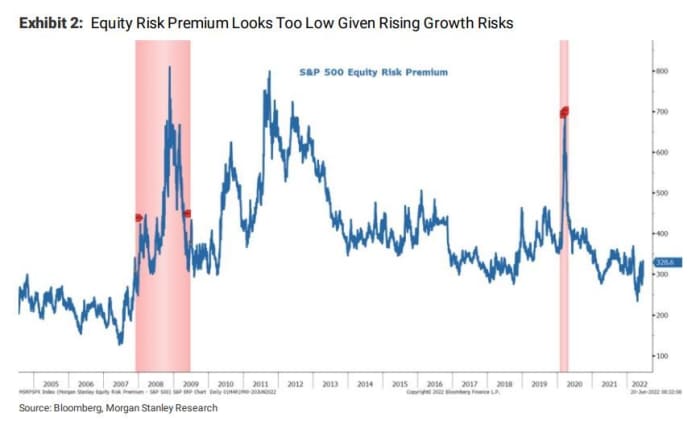

analysts have kept dropping their valuation call as bond yields rise, with the current 15.3 P/E ratio incorporating an equity risk premium (ERP) of 330 basis points, too low in his opinion.

Wilson would like to see the ERP at 370 basis points, which would leave the S&P 500’s P/E ratio falling to 14 times, as long as bond yields

TMUBMUSD10Y,

and earnings estimates are stable. ERP represents the extra return investors expect on riskier stocks over risk-free bonds.

MORGAN STANLEY RESEARCH REPORT DATED JUNE 21, 2022

Echoing some of Wilson’s thoughts was Goldman Sachs’s chief global equity strategist, Peter Oppenheimer, who sees the market pricing in the risk of just a mild recession, rather than an average or deep contraction. He sees the current bear market as a cyclical one, and a function of the economic cycle, according to a Goldman Sachs

GS,

research note Tuesday.

“Most bear markets end when economic conditions are still poor, but there is a sense that they are no longer deteriorating at the same rate,” Oppenheimer told clients in the note. “Even if eventually yields do not rise a lot further, it seems likely that the markets would at least price the risk that they will before we can see a genuine recovery.”

U.S. financial conditions aren’t really that tight based on historical standards, so either rates need to rise further or markets need to reprice risk, which would serve as tightening anyway, he said.

GOLDMAN SACHS RESEARCH NOTE DATED JUNE 21, 2022

The S&P 500 tends to lose one-third of its value, on average, around a recession, according to RBC Capital Markets.

“The average drop has been 32%,” RBC analysts, led by U.S. equity strategy head Lori Calvasina, said in a note Tuesday. “That kind of drop would take the S&P 500 to 3,262 this time around.”

The median peak-to-trough decline for the S&P 500 around a recession is 27%, which would drag the S&P 500 down to 3,501, the note shows.

“The 3500 area is a big support and stress test for a secular bull market defined by the rising 200-week” moving average and the 50% retracement of the rally seen from March 2020 to January 2022, according to a market analysis note from BofA Global Research that’s dated June 20.

The U.S. stock market was trading sharply higher Tuesday afternoon, with the S&P 500 up 2.8% at around 3,777, according to FactSet data, at last check. The index has tumbled about 21% this year based on Tuesday afternoon trading.

“Last week we were on the road speaking with investors in two different regions in the U.S.,” the RBC analysts said. “Most had moved away from debating whether a recession is coming and were thinking about when one would start, how long it would last, how deep it would go, and conditions on the other side.”

The meetings were primarily with “long-only institutional investors that we’d consider to be longer duration and focused on fundamental stock pricing,” according to their note.

Several of the investors told RBC that they had already “trimmed around the edges and were sticking with higher quality names that they like for the long term,” the analysts said. “Several also told us they were already sitting on cash balances that were much higher than usual.”