This post was originally published on this site

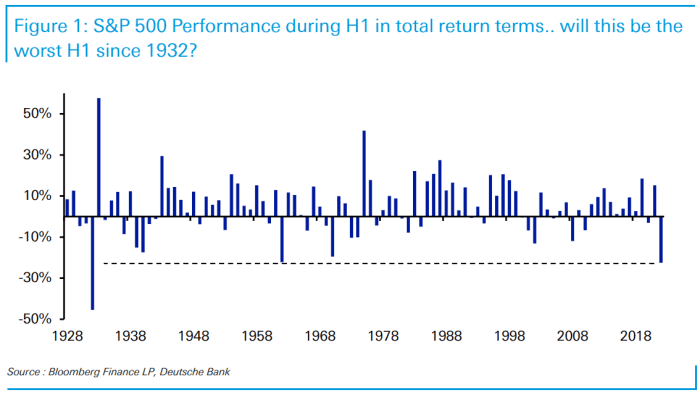

The S&P 500 officially hit bear market territory last week and, according to Deutsche Bank, is currently on track for its worst half-year performance since the Great Depression.

With the large-cap benchmark

SPX,

having shed around 22.3% so far in 2022 — the biggest drop since 1932 (see chart below) — strategists at the bank see the remainder of the year hinging on whether or not the economy avoids falling into recession.

SOURCE: BLOOMBERG FINANCE LP, DEUTSCHE BANK

“If we don’t see a recession materialize over that period it might be tough for markets to continue to be as bearish as they have been, and a bounce back resembling history might be possible,” strategist Jim Reid said in a client note on Tuesday. “However, it’s hard to see markets recovering if we see firm evidence of the recession.”

See: Stock market is not fully pricing in a looming recession, say Morgan Stanley and Goldman Sachs

Though the bank sees a recession beginning in 2023, “the risk of an earlier move is clearly building with declining financial conditions, and consumer and business confidence plummeting,” Reid said.

The dismal stock-market performance combined with a rout in the bond market is making for one of the worst years on record for financial markets overall, Reid said. The yield on the 10-year U.S. Treasury note

TMUBMUSD10Y,

jumped 5.7 basis points to 3.291% on Tuesday. Treasury yields, which move opposite to price, have surged to multiyear highs in the first half as major central banks around the world have moved to tighten monetary policy in response to the rising inflation concerns.

Read: Why stock-market investors are ‘nervous’ that an earnings recession may be looming

That’s made for a rough year so far for investors with a traditional 60/40 portfolio, meaning a combination of 60% stocks and 40% bonds, since 10-year Treasurys are on track for their worst first half since 1788. Reid said.

Barron’s: The 60/40 Stock and Bond Strategy’s Time Has Come Again

U.S. stocks rose on Tuesday as markets reopened after the Juneteenth holiday weekend. The Federal Reserve last week raised its benchmark rate by 75 basis points, or three-quarter of a percentage point, its largest move since 1994 as policy makers attempt to get a grip on persistent inflation.

The Dow Jones Industrial Average

DJIA,

was up nearly 600 points, or 2%, in afternoon trade, while the S&P 500 rose 2.5% after stocks last week suffered their biggest weekly losses since 2020.