This post was originally published on this site

The Value Gap is a MarketWatch Q&A series with business leaders, academics, policymakers and activists on reducing racial and social inequalities.

Baby bonds — or providing every American child with a federally funded savings account at birth — have been hailed as a promising way to narrow a racial wealth gap that has only widened in recent decades.

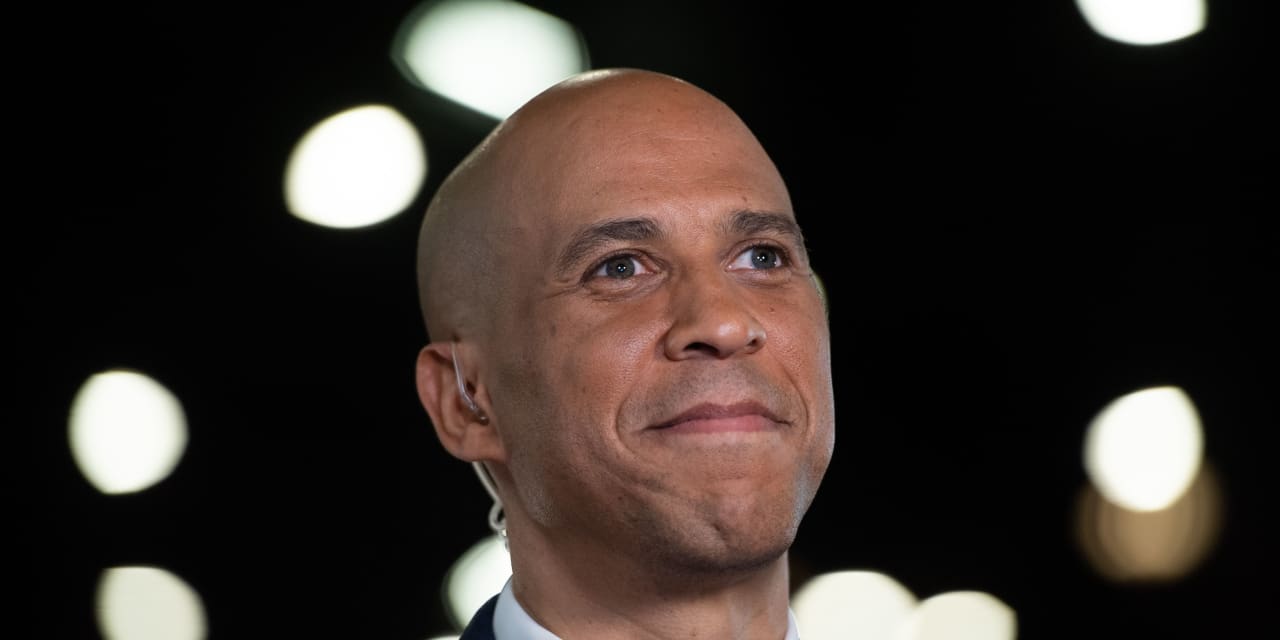

Yet at least on the federal level, they haven’t become a reality, despite years-long efforts from lawmakers like Sen. Cory Booker, a New Jersey Democrat, and advocacy from economists like Darrick Hamilton.

Still, Booker, who pushed baby bonds legislation back in 2018 and made the policy central to his presidential campaign the following year, reintroduced the American Opportunity Accounts Act in February 2021 alongside Rep. Ayanna Pressley, a Democrat from Massachusetts. The plan: Create and seed interest-bearing savings accounts of $1,000 for every child, depositing up to $2,000 each year depending on their household income.

Once the child turned 18, they could access the account to pay for specific expenses related to education, homeownership or starting a business. On average, they’d hold a balance of nearly $21,000, according to estimates from the nonpartisan watchdog Committee for a Responsible Federal Budget, and kids who grew up below the poverty line would have more than twice as much.

Adults between the ages of 18 and 34 otherwise have an average of $8,330.50 in their savings accounts, according to a 2019 NerdWallet survey. And that’s if they have a savings account at all.

Read more: Want to solve the retirement crisis? Two words: Baby bonds

The baby bonds program, Booker said last year in a press release, would cost approximately $60 billion annually, or “less than 10 percent of what we currently spend to subsidize wealth-building through the tax code.” Senate Majority Leader Chuck Schumer was among the bill’s 15 Senate co-sponsors, up from only one Senate co-sponsor a year earlier, according to a separate release from Booker’s office.

“We’re using the tax code to help people with wealth create even more wealth, to the tune of hundreds of billions of dollars,” Booker told MarketWatch in an interview. “We do not use our tax code to help people without wealth to create wealth.”

Republicans, however, appear unlikely to support the measure. Ryan Bourne of the libertarian Cato Institute argued in a commentary piece that Booker’s proposal would “do nothing to change behaviors,” saying conservatives should instead back tax-free universal savings accounts. And when New Jersey Gov. Phil Murphy, a Democrat, wanted to try out baby bonds in his state, Republicans expressed concerns about the cost. The state’s effort ultimately fizzled out.

The reintroduction of the American Opportunity Accounts Act came several months after legislators and business interests had pledged to address the country’s historically unequal economic and justice systems in the wake of racial-justice protests nationwide.

Naomi Zewde, then a postdoctoral researcher at Columbia University, found in a 2018 study that without baby bonds, median wealth among young white people is about 16 times greater than the wealth of young Black Americans: White people hold $46,000, while Black people have $2,900. With baby bonds, that disparity narrows considerably: Young white adults would see their median wealth increase to $79,159, and young Black Americans would have a newfound median wealth of $57,845.

MarketWatch spoke with Booker ahead of Juneteenth, which commemorates the end of slavery in the U.S. and has also become a rallying point for concrete policies to address historical inequities like the racial wealth gap, about his interest in baby bonds and what he thinks they’d be able to accomplish. The interview has been edited for length and clarity:

MarketWatch: You’ve been an advocate for baby bonds for years now. What is it that you like about them?

Booker: I think it is a powerful way to deal with the wealth inequalities in our country by also empowering our economy overall. This is a plan that actually creates an expansion of the U.S. economy, expansion of GDP, and addresses the reality that we have a real wealth gap in our country. … Decades ago, in the ’60s, the average family at the top of the income scale had six times the wealth of the families in the middle, and now it’s more than doubled. We’re just seeing this massive wealth disparity, and it really addresses that.

MarketWatch: Have your views changed on how this sort of program might work — or why this sort of program might be necessary — since the onset of the pandemic and racial-justice protests of 2020?

Booker: I have seen around me my entire career deeply unfair realities, driven often by government, that have created these stratifications of wealth. I live in a majority-minority city, and I think that I’m the only senator that lives in a majority-Black neighborhood that’s below the poverty line. Obviously the issues of the day are pressing upon me, but this issue has been around for more than my lifetime. And over my lifetime — I’m 53 — it’s gotten worse.

The Great Recession of ’08, ’09 wiped out all of the gains we made from the ’60s to the early 2000s in shrinking the racial wealth gap. They are now back to where they were before I was born. … This has been a pressing purpose in my public life, and my professional life, for its entirety.

MarketWatch: Is this a policy proposal that’s gaining any traction in Congress? What happened after the reintroduction of the American Opportunity Accounts Act last year?

Booker: Well, we’re picking up more cosponsors in the Senate. I’m really excited. I mean, when we first started, I think we had one or two; now we have 16 total, including me. And with Ayanna Pressley leading, we’ve got some really great momentum in the House of Representatives. And this is the story often of big legislation in the Congress: It starts slow, but it slowly gains momentum and, eventually, its time comes.

And I do think, to your earlier question, that a lot of the consciousness-raising that happened after George Floyd — when suddenly you saw the bestsellers on everything from Amazon

AMZN,

to New York Times

NYT,

all being about America’s history of using laws to drive racial inequities, including economic inequities — I just saw more people stepping forward and wanting to be a part of legislation that was in, a sense, race-neutral, but had the impact, as Columbia University said, of virtually eviscerating the racial wealth gap when it comes to young people.

“‘Baby bonds is not exclusive. I do not think this is the sort of magic switch that if we flip it, it will end all the economic crises in our country.’”

MarketWatch: I have to ask as well: Where does the opposition lie? Is there a universe where baby bonds can have cross-aisle appeal?

Booker: I remind Schumer all the time, to his joy, that the earliest versions of this bill were bipartisan. It was him and another Republican senator who put forward a bill about child savings accounts. … As many politicians on both sides of the aisle celebrate a capitalist system, the reality is, Americans, as their birthright, should have some capital that they can invest in things that create more capital, that are proven.

And so that idea is something I could talk about in front of the Manhattan Institute or AEI, the American Enterprise Institute, as well as the NAACP or the CAP [Center for American Progress]. So I just think that this is very hopeful, in a partisan, sometimes even tribal environment, that we can have a breakthrough with people on the right.

MarketWatch: How much will it cost?

Booker: It would cost $60 billion, which is about 10% of the money we already used in our tax code to help people with wealth create more wealth.

MarketWatch: Have you spoken to President Biden about your desire for baby bonds, and could the policy make its way into the Democrats’ economic agenda before the midterms?

Booker: Well, I don’t know if you remember this, but I ran for president. And during that time, I had some really robust conversations with the now-president about policy. And he told me during one of the presidential debates during the commercial break, or before — I can’t remember exactly which one — he told out of the blue how much he loved the baby bonds proposal. So I haven’t talked to him specifically about it in recent months. But I know it’s something that some of his policy team likes. And I know it’s something that he expressed affection for during the presidential primaries.

MarketWatch: Apart from baby bonds, some folks might say, “Well, what can we do to help people who are suffering right now? People who are experiencing a higher cost of living, an increase in housing costs?” What do you say to that?

Booker: Baby bonds is not exclusive. I do not think this is the sort of magic switch that if we flip it, it will end all the economic crises in our country. Clearly, this would help generations with putting down payments on houses, or getting into a higher income bracket by investing in higher education or skills training. But there are other things that are urgently needed.

And perhaps the one that I thought we had great momentum on, and the data is very compelling, is the expansion in the earned income tax credit and the child tax credit, both of which brought more resources to working-class Americans that really did help alleviate some of the burden of rising housing prices, and actually lifting people out of poverty completely.

In addition to that, one of the big things that we’ve proposed is, in the same way that we have a wealth transfer in this country with the mortgage interest deduction — which overwhelmingly goes to the wealthiest quintile of the country — we should have the same kind of deduction available for renters. I believe that if we have renters that are paying more than a third of their income [toward rent], based upon the area median rents and communities, they should be able to deduct from their taxes what is above a third of their income that they’re paying. To me, that’s an issue of fairness for renters, and it would be a big help in driving housing security at a time when there’s way too much housing insecurity.

“‘There’s a lot of things driving the cost increases for Americans, from COVID, to the shipping crisis, to corporate consolidation, to price gouging. People on the lower end of our economic income scale, their earnings are not driving inflation.’”

MarketWatch: What do you say to folks who might be more wary of something like a baby bonds proposal, and more wary of government spending, amid rising inflation?

Booker: We clearly have a problem with inflation. Economists are saying that the problem that’s driving that has a lot more to do with the shocks to the supply chain we’ve seen globally, costs going up because of a lot of corporate gouging. I mean, you look at the S&P 500,

SPX,

the most profitable year for the S&P 500s over the last 50 years was last year. Corporations are making incredible profits. So there’s a lot of things driving the cost increases for Americans, from COVID, to the shipping crisis, to corporate consolidation, to price gouging. People on the lower end of our economic income scale, their earnings are not driving inflation.

Clearly, there’s a lot of money out there, but it’s chasing too few goods because of the challenges we’re having in supply chains and more. And so I’m not worried about this. In fact, the entirety of Build Back Better — people were concerned about it, but you had top economists, I think at places like Moody’s, saying that it actually would not drive inflation.

MarketWatch: Former Stockton Mayor Michael Tubbs, a champion of guaranteed income, has started to make basic income a reality by starting small in city halls across the country. Now, his new nonprofit is turning its sights on wealth-creation measures like baby bonds. Have you spoken with the former mayor, and is there a scenario where baby bonds successfully start small and work their way up to the federal level?

Booker: Well, you’re not just talking to a senator, you’re talking to a former mayor — and us mayors, we kind of like, love each other. So I definitely know Tubbs, have talked to him throughout his career, and he’s an extraordinary innovator. And that’s where you often see some of the best innovations — starting at the mayoral level — that often end up rising to become national policy issues. Cities are incubators of great ideas of the future. And so I welcome a lot of these experiments and our ability to study them as a way to inform policy at the national level.

MarketWatch: The economist Darrick Hamilton has said he views baby bonds and reparations as “complements, not substitutes” to each other, and Sandy Darity from Duke argues baby bonds wouldn’t go far enough in closing the racial wealth gap. Do you see baby bonds as a supplement to reparations to come, or would baby bonds be the reparations themselves?

Booker: No, I don’t see baby bonds as a form of reparations. I see baby bonds-dependent policy that would create more economic growth, economic fairness, and it would have the collateral effect of dealing with the persistent racial wealth gap in our country. But I’m the lead sponsor in the Senate of what is House Bill 40, that wants to really set up a commission to better study reparations and better understand how we might approach the issue in the United States.

MarketWatch: Do you favor the approach [promoted by some civil-rights groups and activist leaders] of pushing the president to sign an executive order to establish this commission so its recommendations can be implemented during his term?

Booker: I want to see the commission get established; I would like to see it be done through legislation. Clearly the president has the ability to get it done or something similar done. I think that the legislation we have has a lot of strength in it, because it would involve Congress moving together and be much more invested in it.