This post was originally published on this site

The housing market may be slowing down, but owning a home is still a costly proposition. Two charts reveal exactly how expensive it is.

Just over a year ago, the monthly cost of owning and renting were practically identical, according to a blog post from John Burns Real Estate Consulting. “Now, owning a home costs $839 more per month than renting. This differential is almost $200 higher than at any time since the turn of the century,” Danielle Nguyen, senior research manager at John Burns wrote.

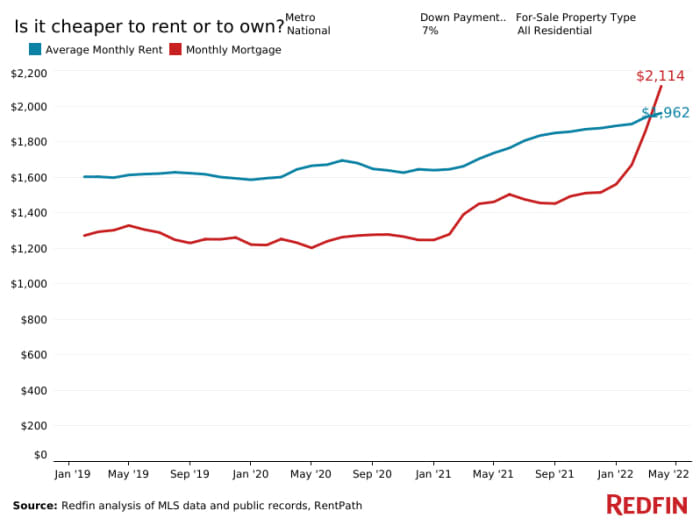

Across residential properties, renting a home would set one back roughly $1,962 a month, according to data from Redfin, as of April 2022. But if a homeowner had put down a 7% down payment for a home, they’d be stuck with a mortgage that would set them back $2,114 a month — $152 more.

“With demand now shifting toward renting, home builders who were once reluctant to sell to rental home investors are now soliciting offers from investors,” Nguyen added. “Strong demand from investors will provide additional support to today’s home prices.”

The historical gap between owning and renting can be seen in the chart below:

Looking ahead, however, Nguyen told MarketWatch, “High home prices and rising interest rates may impact home buyers.” Fewer people can now qualify for homes, she said. Indeed, first-time buyers are increasingly priced out of the country’s hottest real-estate markets.

This homebuyer penalty hits harder in some spots in the country, according to John Burns. In places where home prices accelerated the most, like Raleigh-Durham, Nashville, Denver, Tampa, and Phoenix, owning a home was much more expensive than renting.

John Burns Consulting assumed the purchase of a home at 80% of the current median price. They also assume that the buyer put down a 5% down payment with a 30-year fixed-rate mortgage.

To put that in context: A year ago, renting would have set you back $1,705 a month, as compared to a monthly mortgage payment of $1,451, the National Association of Realtors stated in a blog post in January.

The cost to own a home went up because home prices have been soaring since the start of the COVID-19 pandemic, as people moved out of crowded cities helped by their ability to work remotely. Rising building costs and the shortage of inventory also helped to push up prices.

The typical value of a home as of May 31 was nearly $350,000, according to Zillow

Z,

In January 2020, right before the pandemic began to spread across the country, the typical home was valued at $251,000.

In March 2022, the median home constitutes about 38.6% of someone who is earning the median income of $68,000 a year, up from 30.2% in March 2021, according to the Atlanta Federal Reserve.

The Dow Jones Industrial Average

DJIA,

tech-heavy Nasdaq Composite

COMP,

and S&P 500

SPX,

closed lower on Thursday after rising on Wednesday on the back of the U.S. Federal Reserve’s 75-basis-point rate hike.

Got thoughts on the housing market? Write to MarketWatch reporter Aarthi Swaminathan at aarthi@marketwatch.com.