This post was originally published on this site

The U.S. initial-public-offering market is staring down another slow week, with just one small deal on tap, capping a period of little to no activity as investors eye volatile secondary markets amid high inflation, supply-chain snags and a raging war in Europe.

There were just seven IPOs in May that raised an aggregate $1.1 billion to mark the slowest month for new deals in more than five years, according to Bill Smith, co-founder and chief executive of Renaissance Capital, a provider of IPO-focused ETFs and institutional research.

The typical flurry of deals that tend to come after the Memorial Day weekend failed to materialize, with just Hong Kong–based online brokerage Zhong Yang Financial Group

TOP,

coming to market last week. That deal priced at the low end of its range to raise $25 million at a valuation of $175 million.

“The big macro overhang is rising interest rates, which are really poison for growth stocks,” Josef Schuster, founder of IPOX Schuster LLC and chief architect of the IPOX indexes, told MarketWatch.

“You can see today that the market tried to hang in, but then yields went up, and that’s the big overhang that needs to be resolved. That won’t happen until the Fed is done taking action.”

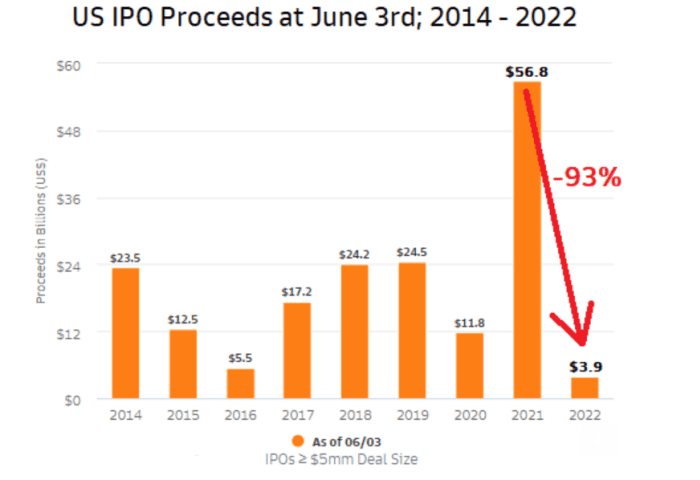

Source: Renaissance Capital

Don’t miss: New York Stock Exchange vice chairman says the IPO market may revive after Labor Day

The IPO market is also being hurt by the poor returns stemming from last year’s bumper crop of deals, said Shuster. More than 1,000 new companies listed shares on U.S. exchanges in 2021 to raise $315 billion, according to data from Dealogic.

Many of those deals are now foundering, causing investors to lose money and shy away from new offerings.

From the archive: You bought. They sold. Meet some of the insiders who unloaded $35 billion in stock amid the tech IPO bonanza before it tanked.

The pre-IPO market, meanwhile, has swept up billions of dollars that’s now stuck as valuations are being questioned amid the wealth destruction in the technology sector. (The pre-IPO market allows employees and accredited investors to trade shares of privately held companies that are preparing to go public.)

See now: Dow transports selloff may be warning of something more than just a macro speed bump

“The pre-IPO market didn’t exist 10, or 20 or 30 years ago, but a lot of investors are now stuck in markets that can’t be valued because sponsors have not been updating,” said Schuster.

Hedge funds are also hitting a wall, he said. Tiger Global Management, for example, is reported to have lost more than 50% of its value in 2022 after betting big on tech names including Snowflake Inc.

SNOW,

Sea Ltd.

SE,

and Carvana Co.

CVNA,

as CNBC reported last week.

One positive sign is that those companies that have braved the market in 2022 are performing well, said Schuster. Examples include oilfield-services company ProFrac Holding Corp.

PFHC,

which is up about 10% since it went public in early May, and Excelerate Energy Inc.

EE,

which is up about 5% from its April debut.

“There’s a vintage of deals that are getting cheaper and doing well, and that may be a light at the end of the tunnel,” Schuster said. “Founders are being more selective, and investors are being more selective, so things are becoming more rational, which may mean a turnaround later this year.”

One IPO vehicle that is currently struggling is the special-purpose acquisition corporation, or SPAC, model that became highly popular during the pandemic. SPACs, also called blank-check companies, are shells that list on exchanges and then have up to two years to acquire a business or businesses, which then become public companies.

Last week, Forbes and SeatGeek were forced to abandon SPAC deals, joining a growing roster of companies that had to cancel plans.

“A listing is simply not worth it if the result is steep fees, little funding, low liquidity, and reputational harm from poor returns,” said Smith from Renaissance.

IPOX’s Schuster noted that many SPACs are close to 2 years old, and if they haven’t consummated a deal they may be forced to liquidate and return the money to investors. The majority of SPACs underperform traditional IPOS, “and are just bad deals,” he said.

Both Goldman Sachs

GS,

and Citigroup Inc.

C,

recently said they would no longer work on SPAC deals, he said, while Bank of America said it would reduce its exposure. Schuster compared the phenomenon to the 2000 dot-com period, when bulge-bracket banks couldn’t get enough tech startup IPO businesses — until the crash, at which point they all pulled away.

“Solid companies that want growth financing will always find the IPO route is best,” he said.

This week’s sole deal, that of Phoenix Motor Inc.

PEV,

was downsized late Tuesday and priced below the midpoint of the range.

A spinoff of SPI Energy Co. Ltd., the company designs, assembles and integrates electric drive systems and light- and medium-duty electric vehicles, such as forklifts, and markets and sells electric chargers.

Phoenix offered just 2.1 million shares, priced at $7.50 to raise $15.75 million at a valuation of $150 million. The original plan was to offer 2.5 million shares priced at $7 to $9 a pop.

The company has applied to list on Nasdaq under the ticker symbol “PEV.” As of year-end, Phoenix had delivered 104 electric shuttle buses and work trucks.

“Phoenix Motor is highly unprofitable and has yet to generate significant revenues,” said Renaissance’s Smith.

The company had a net loss of $2.32 million in the quarter ending March 31, wider than the loss of $1.91 million posted in the year-earlier period, according to its prospectus. Revenue rose to $671,000 from $473,000 a year ago.

See now: Piano maker Steinway is going public again: 5 things to know ahead of its IPO