This post was originally published on this site

Stocks are settling in for more choppy action, as investors continue to consider the Federal Reserve minutes and after Nvidia dropped a warning late Wednesday.

But we’re switching away from Wall Street’s tug of war to focus on cryptocurrencies, and a call from the president of macroeconomic research firm Lamoureux & Co., Yves Lamoureux, who has made some prescient predictions on crypto (not to mention equities).

He said the so-called winter for bitcoin

BTCUSD,

is over for now, with a forecast for the No. 1 cryptocurrency to reach $100,000 by later 2023, in a run higher that could last up to 2025.

“I’m not giving a major buy signal, I’m just saying, yes, you can start to buy a little bit,” Lamoureux told MarketWatch in a recent interview. Hovering at $30,000 and off more than 55% from a record high of $68,990 in November 2021, bitcoin meets much of his critiera to exit a bear market, he said.

But the crux of his call is based on an eclipse-like event expected in 2024 (he predicts around March), when rewards for bitcoin miners will be chopped in half. The so-called halving event occurs every four years, and is aimed at controlling the number of coins in circulation and support prices. The last one was May 11, 2020.

“One of the main things that drives bitcoin is supply,” he said. “There’s less supply, so there’s less coming to the market …that historically has always driven prices higher. What I’m saying is that it’s out of the narrative now.”

Lamoureux has shifted from advice earlier this year that investors should not chase bitcoin, but he said he always expected a brief bear market. Among his past calls, he warned clients about a skyscraper bitcoin top in November, just as it reached that record high, as well as predictions that panned out in early 2017 and mid-2020.

As well, sentiment for bitcoin is “super low,” he noted, which has been seen at other major bottoms.

But he advised investors buy a bit at a time, rather than make big bets as the road ahead won’t be straight up. “It’s always the same way. It goes up before the halving, kind of pauses, and then shoots up, so there’s two phases to it,” said Lamoureux.

Bitcoin reaching $100,000 will bring in a new wave of investors and attention, he said. But he is a classic market timer, doing well with bitcoin because he has bought and sold at the right moments. “When there’s euphoria, I get out, and when I see a lot of despair, negativity, like now, then I re-enter,” he said.

The investment community has soured a bit on the crypto sector thanks to the stablecoin debacle, fears of more regulation to come, and general bearish attitudes for assets such as stocks.

Read: Guggenheim’s Minerd sees a more brutal washout for bitcoin taking it to $8,000

Lamoureux is only interested in bitcoin, and doesn’t “trust any of these stablecoin projects.”

“I’m interested in Bitcoin because it is the king and that’s where institutional money will flow first. So always stick with the best. Everybody wants to be bitcoin, but they’re not …don’t make it complicated, stick with bitcoin,” he said.

Don’t miss a new, deep dive on the sector from MarketWatch’s Frances Yue, who digs into where analysts think bitcoin and other cryptocurrencies are now headed.

The buzz

Chip group Broadcom

AVGO,

has reached a $61 billion deal to buy cloud-computing group VMware

VMW,

Apple

AAPL,

is lifting hourly pay for U.S. workers to $22 an hour, up 45% from 2018 to try to compete in a tight labor market and amid pushes by employees to unionize. Bloomberg reports Apple is also keeping production levels flat for its iPhone this year, due to industry constraints.

The spring swoon continues for tech stocks, with Nvidia

NVDA,

shares tumbling after the chip maker gave a weaker outlook due to China’s COVID-19 shutdowns and the Russia-Ukraine war. Cloud computing group Nutanix

NTNX,

is off 14% and software group Snowflake

SNOW,

is down 30% for similarly downbeat forecasts.

Tesla CEO

TSLA,

Elon Musk will lean on equity to finance his $44 billion Twitter deal, and not a margin loan backed by Tesla shares, down about a third since he struck a deal with Twitter in late April.

Russia cut its key interest rate for a third time since early April. And facing criticism over fueling a global food crisis, Russia has promised to open a safe corridor for foreign ships to leave Black Sea ports in Ukraine, a key agriculture exporter. U.S. wheat futures

W00,

are down over 2%.

A day ahead of an update on the Fed’s favorite inflation gauge, we have weekly jobless claims and revisions to first-quarter gross domestic product before the market open, followed by pending home sales.

Read: Bernanke says he thinks inflation will come down later this year

The markets

U.S. stock futures

ES00,

NQ00,

are up, as Treasury yields

TMUBMUSD10Y,

TMUBMUSD02Y,

pull back. Gold

GC00,

is steady, while oil

CL00,

is inching up. The dollar is steady, but a little weaker against the ruble after that rate cut.

The chart

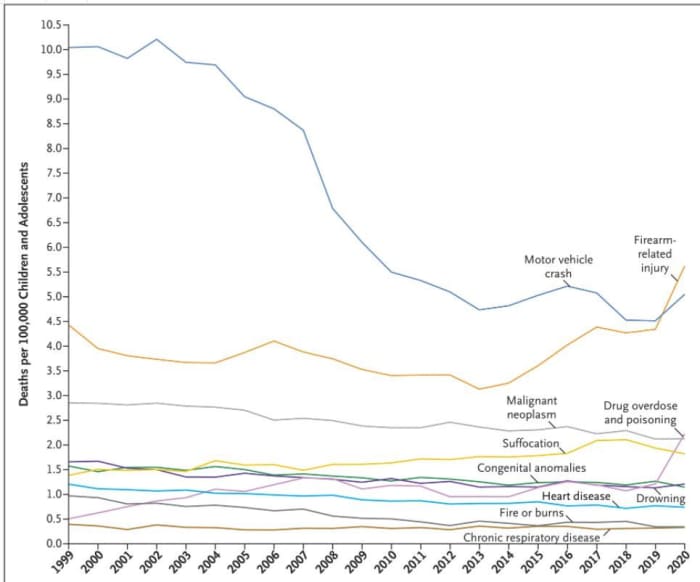

The U.S. continues to mourn a mass shooting that left 19 children and two adults dead at the hands of an 18-year old gunman at a Texas elementary school.

Worth repeating is this chart from the Centers for Disease Control and Prevention that shows guns were the biggest cause of death among U.S. children between 1999 and 2000:

CDC, New England Journal of Medicine.

Random reads

New Zealand’s biggest king salmon producer is shutting some farms as warming seas are causing masses of fish to die.

Dear boyfriends, girlfriends, parents. Millennials love their dogs more than you.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.