This post was originally published on this site

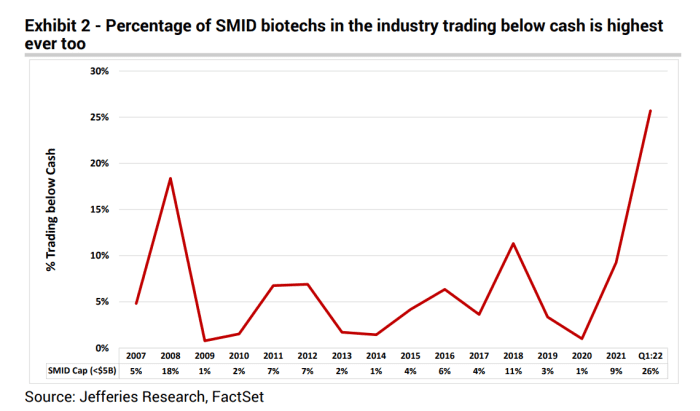

If you want to know how much investors hate the biotech sector right now, consider this simple statistic: More than 25% of small biotech companies have stock-market capitalizations that are smaller than how much they have in cash.

“The market is saying a quarter of these companies are literally worth nothing,” says Jefferies biotech analyst Michael Yee, who recently published this insight.

That’s remarkable. That 25% is the highest in 15 years — higher than even during the agonizingly long bear market of the 2008 financial crisis.

Back then, 18% traded below cash. From 2010 to 2020, the number bounced between 3% and 11%, according to Yee and his team. He’s referring to small- and medium-cap (smidcap) companies, those with a market cap of less than $5 billion. These are the ones that tend to have no earnings and have early-stage therapies in testing.

“This is the worst drawdown we have seen in our careers,” says biotech analyst Charmaine Chan with the Cambiar Opportunity Fund

CAMOX,

“No one has seen anything worse unless they have done this for over 20 years.”

For contrarians, this kind of extreme signal suggest only one thing. The sector is a buy. While it’s tough to find any biotech experts who are bullish on the group (even Yee is cautious), I’m not the only one looking at this as a contrarian opportunity.

Category 5 storm in biotech

The macro analyst Larry McDonald at The Bear Traps report has a similar view. To spot contrarian buy signals, McDonald tracks a collection of capitulation markers he developed during the 2008 crisis. They tell him when a sector is so despised that it is worth buying, in the contrarian sense. It’s a “blood in the streets” indicator, to borrow from the old Wall Street adage that says we should buy stocks when there’s blood in the streets. His capitulation gauge tracks several technical signals, among other things.

“The capitulation model for biotech is a Category 5 storm, the same as energy in 2020,” says McDonald. “The risk-reward is fantastic, at least for a countertrend bounce.”

Look at how the SPDR S&P Oil & Gas Exploration & Production exchange-traded fund

XOP,

is up over 170% from its 2020 midpoint.

McDonald suggests the SPDR S&P Biotech

XBI,

and iShares Biotechnology

IBB,

ETFs. I suggest six individual stocks below with help from Yee and Chan. McDonald thinks the XBI could go up 20% to $83 in a shorter-term countertrend rally, and possibly rise 30% to $90 or more a year from now. Those targets are the 50- and 100-day moving averages.

Biotech experts disagree

People who know the space better than myself and McDonald aren’t on board. Yee, who has been cautious since last summer ahead of the big decline, thinks biotech will remain challenged for the year. “It will take a lot of time to heal these wounds,” he says.

There’s nothing broken about the underlying science being developed in biotech, or the prospects for innovation, he says. It’s just that stocks can stay cheap for longer than you expect. “Why would someone wake up tomorrow and say ‘I need to buy all the smidcap biotech stocks down 50%?’ It’s always tough to be the first one in the swamp.”

“I think it a little bit too early to be bullish,” agrees Cambiar’s Chan. “You need catalysts to change the narrative.”

Look for progress on these fronts.

1. More biotech mergers and acquisitions

“M&A would change the narrative, but it’s not happening,” says Chan.

There is a good case for it, though. “Big pharma has so much cash they could basically buy the whole smidcap universe,” notes Yee. Their cumulative cash balance has now risen to more than $300 billion.

“The CFOs of big pharma are looking at this carnage, and they are just licking their chops,” says McDonald. “You are probably going to see substantially more transactions down here.”

Yee expects M&A to pick up gradually, but he’s less optimistic than McDonald. “M&A is tough when markets are falling fast,” he says.

2. The FDA gets its act together

From baby formula shortages to drug-approval delays and terribly mixed signals on approval paths, the Food & Drug Administration has been a big source of problems and confusion for everyone from parents to biotech investors. “The FDA has become more unpredictable,” says Chan.

OK, it has had the distraction of the pandemic and the need to focus on vaccines and therapies. But now with COVID-19 winding down (hopefully), perhaps the FDA can refocus on drug approvals.

3. Broader market conditions improve

Investors continue to panic about inflation and recession, because they know the Fed can’t come to the rescue with the proverbial “Fed put” (stimulus to counter stock-market declines).

Since the Fed has taken the training wheels away from investors, they have to think through inflation and GDP growth on their own. So far, they’re doing a poor job since it seems clear inflation has peaked and we aren’t going into recession. Hopefully, they get up to the task soon.

Stocks to consider … or avoid

Chan singles out UCB

UCBJY,

UCB,

a Belgian biotech company. Its shares got hit hard in mid-May when the FDA dinged its request for approval of its bimekizumab therapy for the treatment of a chronic inflammatory disease called plaque psoriasis because of some manufacturing inspection issues.

Now it has to reapply, but the data supporting bimekizumab seem sound. It has already been approved in Europe, Japan, Canada and Australia.

She also likes the prospects for two other UCB therapies in late-stage testing for neurological disorders: zilucoplan and rozanolixizumab. Expect more data readouts and applications for approval in the second half of this year, possible catalysts.

Yee singles out Vertex Pharmaceuticals

VRTX,

Fate Therapeutics

FATE,

and Ventyx Biosciences

VTYX,

Vertex has been posting strong revenue growth for its cystic fibrosis treatment trikafta (up 48% in the first quarter to $1.76 billion). It’s also showing good progress on pipeline therapies for cystic fibrosis, sickle cell disease, kidney disease, diabetes and pain. Its stock is down 14% from April highs of $292.75.

Fate Therapeutics stock has slumped 77% since August, even though there have been no negative developments, says Yee. Fate continues to show progress developing its natural killer cell immunotherapies for cancer. Fate doesn’t need to raise capital soon. It has a partnership with Johnson & Johnson

JNJ,

to develop cancer therapies.

Ventyx Biosciences develops therapies for inflammatory diseases like psoriasis, arthritis, Crohn’s disease and colitis. It expects key Phase I trial data on two of them over the next four months.

The companies trading ‘for free’

Yee cautions against thinking companies trading below cash might get bought out simply because their science can technically be purchased for free. “They likely suffered from negative events,” he says. But he does have buy ratings on Olema Pharmaceuticals

OLMA,

which has around $7 per share in cash vs. a recent stock price of $2.10, and LianBio

LIAN,

($3.76 in cash vs. $2.47 stock price).

Olema is conducting early-stage studies of therapies for breast cancer. LianBio helps partners study and develop their therapies in China. It has a deal with Bristol-Myers Squibb

BMY,

for example, to develop a cardiovascular therapy there called mavacamten, approved in the U.S. Yee thinks this China angle alone is worth $13 a share for LianBio. It’s partnering with other companies to develop therapies for inflammation, respiratory and eye disorders.

“We appreciate sentiment may continue to be challenging on China stocks, but the company has plenty of cash to execute on the pipeline and ongoing trials including the lead mavacamten asset,” says Yee.

Note that these are tiny sub-$300 million market cap companies which can be quite risky in biotech.

Vaccine stocks

Moderna

MRNA,

Pfizer

PFE,

and Novavax

NVAX,

are way off the highs seen in the thick of the pandemic. But Yee cautions against getting too bullish on them. The reason: It seems like the pandemic is receding, and large vaccine buyers around the world have been opting out of purchase options and deferring shipments.

Michael Brush is a columnist for MarketWatch. He owns VRTX and FATE and has suggested VRTX, FATE, PFE, NVAX and OLMA in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.