This post was originally published on this site

It’s tight quarters in Wall Street’s bear sleuth these days.

Goldman Sachs just downgraded their 2022 U.S. growth forecast (to 2.4% from 2.6%) and 2023 (to 1.6% from 2.2%), as senior chairman Lloyd Blankfein warned of “very, very high” risks for a U.S. recession.

“If I were running a big company, I would be very prepared for it. If I was a consumer, I’d be prepared for it,” he said over the weekend.

Also one of the most bullish banks on Wall Street headed into this year, Goldman cut its end-2022 S&P 500 target to 4,300. Their new baseline forecast assumes no recession, but if that happens, expect a drop to 3,600, they say.

“Although S&P 500 firms posted much better-than-expected 1Q EPS growth of 11%, investors have been mauled by a 18% near-bear market plunge since the index peaked on January 3rd,” said chief U.S. equity strategist David Kostin, in a note.

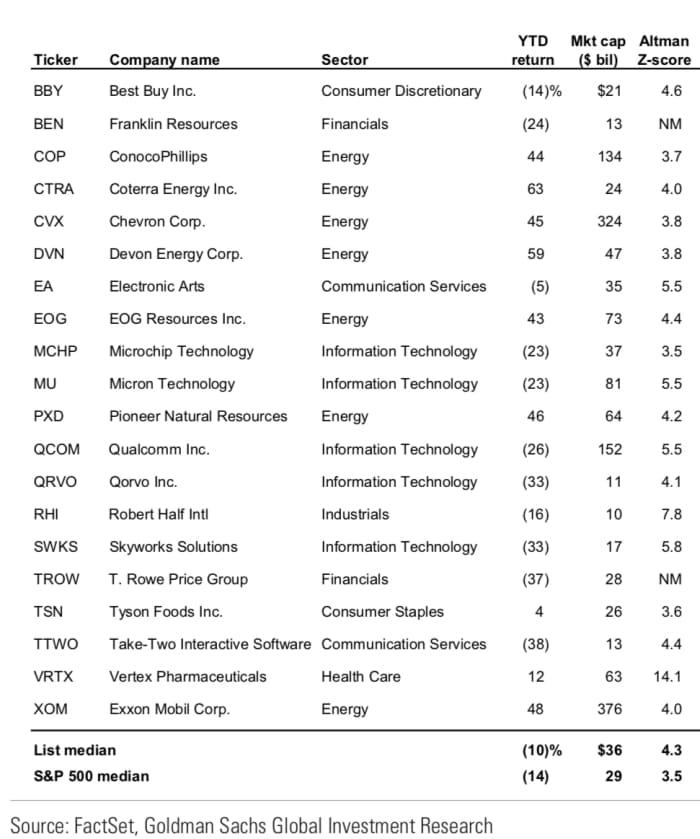

Their consolation prize and our call of the day is a list of 20 stocks with valuations below previous bear market lows.

Those companies also have size and liquidity — an above-average market cap is needed for uncertain times — and balance sheet strength, meaning they are typically less sensitive to an economic slowdown because they can withstand a fall in credit market liquidity, said Kostin and the team.

As for that attractive valuation, the metric is explained like this: the price/earnings multiple after a 20% haircut to expected 2023 earnings is below the forward p/e at the bottom of either or both of the March 2009 and March 2020 bear markets.

“Importantly, given the different real interest rate environments, the highlighted stocks are more attractively valued today on a yield gap basis relative to the rest of the index than they were in either 2009 or 2020,” said Kostin and the team.

And the stocks on this list, after a potential 20% reduction in 2023 EPS, would still have 2021-2023E compound annual growth earnings per share growth rate of 4% compared with -2% for the median S&P 500 company.

Uncredited

Read: ‘Nowhere to hide?’ What’s next as stocks slump toward bear market amid stagflation fears

The buzz

It’s da svidanya to Russia for McDonald’s

MCD,

as the fast-food giant announced plans to exit from the country and sell its business there, which could cost it up to $1.4 billion. McDonald’s also wants to secure jobs for its 62,000 workers there.

Tesla’s

TSLA,

Elon Musk said Twitter’s

TWTR,

legal team has accused him of breaking a nondisclosure agreement over bots, following his Friday announcement that a $44 billion deal for the social media group is on hold.

Stringent COVID lockdowns triggered slumping retail sales and industrial production in China, both data sets the weakest since March 2020, points out Deutsche Bank.

It’s a big week for retailer results, with Walmart

WMT,

(see preview), Home Depot

HD,

and Target

TGT,

on tap. Take-Two Interatcive

TTWO,

will report results after Monday’s close.

The Empire State Manufacturing index for May is ahead. The week’s other big data will be Tuesday’s release of retail sales for April.

The markets

Uncredited

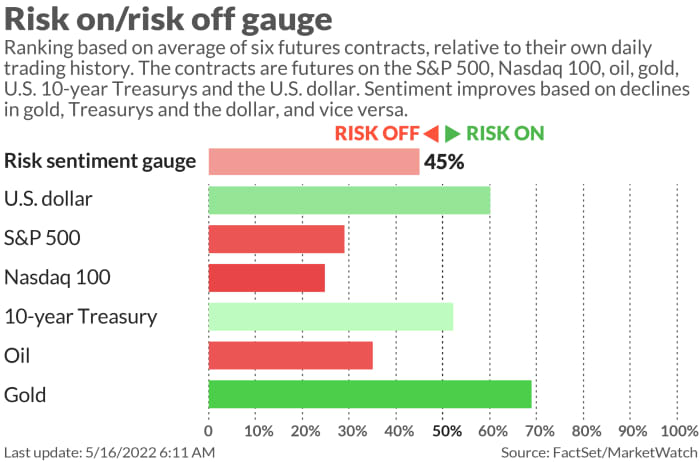

U.S. stock futures

ES00,

NQ00,

are down after that China data, oil prices

CL00,

BRN00,

are down, while Treasury yields

TMUBMUSD10Y,

TMUBMUSD02Y,

are flat to weaker. The dollar

DXY,

and gold

GC00,

are lower, and bitcoin

BTCUSD,

is weaker, trading just under $30,000 with most cryptocurrencies under modest pressure.

Read: Crypto investor Barry Silbert offers sympathy and advice to those who have lost fortunes last week

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern Time:

Random reads

Goldman Sachs’ senior bankers have been told to take all the vacation they want

A Thai beach cove made famous by Leonardo di Caprio is reopening. But you may not be visiting anytime soon.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.