This post was originally published on this site

The latest bull market for U.S. stocks remains on the brink of expiring, with the benchmark S&P 500 just shy of the threshold that marks bear territory.

The S&P 500

SPX,

finished 0.1% lower at 3,930.08 on Wednesday, after falling as far as 3,858.87 at its session low. That was the index’s lowest close since March 25, 2021, and left it 18.1% below its record finish from early January. A close below 3,837.25 would mark a 20% fall, according to Dow Jones Market Data, meeting the widely used technical definition of a bear market.

The S&P 500 entered correction territory — a fall of 10% from a recent peak — last month, its second such foray this year. A tough April for stocks has been followed by an ugly May, with equities suffering as investors continue to dump megacap tech stocks and other highflying pandemic darlings amid investor jitters over inflation that continues to run historically hot and a Federal Reserve that is moving to quickly raise interest rates and otherwise tighten monetary policy in an effort to get those price pressures under control.

Hopes that an eagerly awaited reading on April consumer price inflation on Wednesday would show inflation had peaked and help steady the ship offered little solace to jittery investors. While the annual pace of inflation slowed to 8.3% from 8.5% in March, it was still hotter than the 8.1% reading expected by economists. Moreover, a core CPI reading, which strips out food and energy, showed an unexpected monthly rise.

Read: What’s next for stocks and bonds after inflation data fails to provide ‘watershed moment’

Through Thursday, the S&P 500 was down 4.9% in May, while the tech-heavy Nasdaq Composite

COMP,

which entered a bear market earlier this year, had dropped 7.8% and the blue-chip Dow Jones Industrial Average

DJIA,

was down around 3.8%.

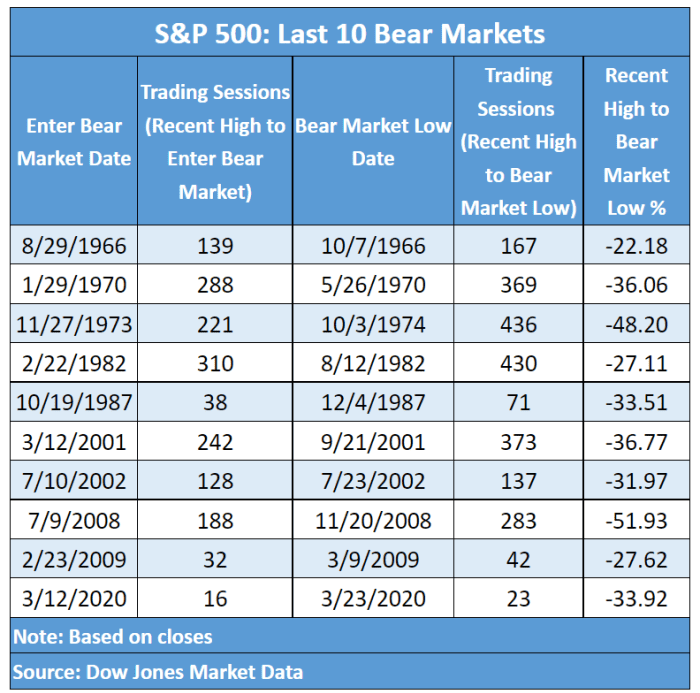

Dow Jones Market Data

The S&P 500 ended its last bull market on March 12, 2020, as the outbreak of the COVID-19 pandemic sent stocks tumbling. The bottom of the pandemic-inspired bear market came on March 23, 2020, with the S&P 500 marking a 33.9% fall from its bull market peak on Feb. 19, 2020.

Based on figures going back to 1929, the average bear market sees a peak to bear-market low decline of 33.5%, and a median fall of 33.2%, according to Dow Jones Market Data. On average, it has taken 80 trading days for the S&P 500 to hit its low after entering a bear market — and a median 52 trading days, the data showed.